How is tax calculated?

The base tax rate is calculated by local authorities based on the income of the population. Therefore, taxes in Moscow and Orenburg differ several times.

The tax amount also depends on the age of the car - the older the car, the lower the tax. The Federal Tax Service website has a calculator for calculating transport tax. To calculate the approximate tax, select the region, year of manufacture of the car, time of ownership, type of car and engine power.

If a car costs more than 3 million rubles, the owner pays luxury tax. For example, behind the Audi Q7 with 245 hp. With. in Perm you will have to pay 17,928 rubles. Here are the increasing coefficients for luxury cars:

1.1 - passenger cars worth from 3 to 5 million rubles inclusive, not older than 3 years;

2 - passenger cars worth from 5 to 10 million rubles, not older than 5 years;

3 - passenger cars worth from 10 to 15 million rubles, not older than 10 years;

3 - passenger cars costing over 15 million rubles, not older than 20 years.

Why is the transport tax different in the regions - Motorist's Handbook

The amount of transport tax is set by regional authorities taking into account the current basic tariffs established at the federal level.

The municipality can adjust the tax rate, but not increase it more than 10 times. Let's consider what transport tax applies in different regions of the country.

Why is it different in different subjects of the federation?

Regional authorities received the right to independently adjust transport tax tariffs.

They can change the following indicators:

- rates, linking their changes depending on the power of the vehicle, damage to the environment, and the age of the car;

- benefits for certain categories of citizens;

- terms and procedure for payment of transport tax.

Each region has adopted the right to adjust base rates in its own way, so there are significant differences in different regions of the country.

Also, regional authorities have the right to periodically make changes to the calculation of transport tax. Current rates can be seen on the Federal Tax Service website, where information is regularly updated.

Regional authorities can either increase or decrease tax rates. The main thing is that the new value does not exceed the basic tariffs by ten times.

Once formed, rates are subject to evaluation by federal authorities. If they approve the changes, a new document is drawn up.

The new rates come into effect on January 1. If, for example, changes were made in March 2021, then taxes will be paid only for 2021, and the payment will arrive in 2021.

You can calculate the amount of transport tax yourself. To do this, the rate is multiplied by the number of horsepower in the car. The amount received is the transport tax.

But it is not necessary to know the calculation system and make calculations yourself, since taxpayers receive a receipt with the amount already indicated for payment.

What does the size depend on?

When determining tariffs, several parameters are taken into account:

- vehicle category;

- engine power;

- age;

- tenure period.

Responsibility for paying the tax rests with all vehicle owners. Payment is made equally for regularly used and not used vehicles at all.

When calculating the tax rate, regional authorities take into account the standard of living in the region and the average salary. For example, in Moscow car owners pay significantly more than in Saratov.

The transport tax rate is determined primarily by the vehicle's power. The more horsepower under the hood, the higher the tax.

It is generally accepted that powerful cars cause more damage than small cars with power up to 100 hp.

The amount of tax is also affected by the cost of the car. If the vehicle was purchased for a price of 3 million rubles. or more, then an increased coefficient is applied. This is the so-called luxury tax and the overpayment can be significant.

Calculating the amount of tax depending on the power of the car encourages the use of low-power and compact cars.

The authorities are considering options for replacing or completely abolishing the transport tax. For example, it is proposed to introduce payment based on environmental class. The more a vehicle harms the environment, the higher the payment. This proposal is currently under consideration.

The second proposal is to abolish the tax and include it in the cost of fuel. For several years now, politicians have been introducing this way of solving the transport tax issue. But so far the President of the Russian Federation has not approved this initiative.

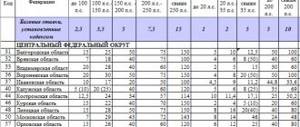

Transport tax table 2021 by region

The current transport tax rate by region for 2019 can be found on the Federal Tax Service website.

Let’s look at what tariffs are in effect in the regions this year for cars of category “B”:

| Region | With car power up to 100 hp. | Car power from 100 to 150 hp. | Car power from 150 to 200 hp. |

| Republic of Adygea | 10 | 20 | 40 |

| Amur region | 15 | 21 | 30 |

| Belgorod region | 15 | 25 | 50 |

| Vladimir region | 20 | 39 | 40 |

| Ivanovo region | 10 | 20 | 35 |

| Kaliningrad region | 2,5 | 15 | 35 |

| Nizhny Novgorod Region | 22,5 | 31,5 | 45 |

| Moscow region | 10 | 34 | 49 |

| Leningrad region | 18 | 35 | 50 |

For trucks, transport tax is calculated at a different rate:

For 2021, the truck tax rate has been significantly reduced. The changes affected primarily heavy vehicles weighing more than 12 tons.

This is due to the fact that owners of “heavy cargo” are required to pay tax through the “Platon” system and the reduction in the rate is an avoidance of double taxation.

In 2021, the transport tax has several features:

- Transport tax is paid once, in the whole amount by individuals and quarterly by legal organizations.

- Taxpayers no longer need to calculate their taxes themselves. This was the case before, but now, if there is no receipt, you need to contact the territorial branch of the Federal Tax Service to obtain a duplicate. Previously, it was possible to independently calculate and pay the tax.

- Payment must be made according to a receipt, which arrives at the place of registration of the car owner. The payment document indicates the number that is entered during online payment to simplify the procedure.

- Regional authorities may exempt or provide a tax discount for certain categories of beneficiaries. These could be pensioners, parents of disabled children, a mother or father from a large family, etc.

- You must declare your right to the benefit yourself and regularly confirm your social status to maintain the benefit.

In general, the procedure for calculating and paying transport tax is well established and is carried out according to a certain scheme. But many car owners still have questions.

Which regions have the lowest and highest

For many, transport tax is a heavy financial burden, which is taxing on the budget from year to year. This often leads to car owners simply stopping paying taxes, dooming themselves to administrative liability.

Many even decide to register a car in a foreign region so as not to overpay for taxes. This, of course, causes a number of difficulties, but for some categories of citizens it is the best option.

However, it is worth considering that transport tax is calculated not at the place of registration of the car, but at the place of registration of the owner.

And in order to pay tax at a reduced rate, you will have to not only register your car in the chosen region, but also settle in this area yourself.

In general, the law does not establish restrictions on car registration. You can register in any region, regardless of where you live and where you buy the car.

Let's look at where the lowest tax rate is for cars up to 100 hp:

| Region | Rate, rub. |

| Sverdlovsk region | 2,5 |

| Kaliningrad region | 2,5 |

| Krasnoyarsk region | 5 |

| Republic of Crimea | 5 |

| Sevastopol | 5 |

And now a list of regions where the rate is the highest:

| Region | Rate in rub. |

| Republic of Tatarstan | 25 |

| Voronezh region | 25 |

| Perm region | 25 |

| Mari El Republic | 25 |

| Vologda Region | 25 |

It turns out that in Moscow and St. Petersburg tax rates are not the highest in the country. Of course, they cannot be classified as low, but there are still larger indicators.

In which federal subjects do they not pay?

It is immediately worth noting that the obligation to pay transport tax rests with all vehicle owners. Exceptions are citizens of preferential categories who are exempt from paying tax.

But in some regions, transport tax is not paid for vehicles with a power of less than 100 hp.

These include:

- German Autonomous Region;

- Orenburg region.

But the calculation of the tax depends, first of all, on the make of the car and its value. So, if a car was purchased for 3 million or more, then you will have to pay tax.

There are several legal ways to reduce your tax:

- Change the engine to a less powerful one or change the car. Some regions provide tax exemptions for cars.

Power less than 70 hp Also for vehicles with power up to 100 hp. paying a low rate. And if there is an opportunity to carry out reconstruction, then it is worth taking advantage of it. After replacing the engine, you will need to contact the traffic police department and provide documents. In the next billing period you will have to pay less. - Take advantage of the benefits. It is worth studying the list of beneficiaries in your region who are exempt from paying transport tax. These include disabled people, veterans, and in some areas, parents from large families and pensioners.

- Don't buy an expensive car. If the cost of the vehicle is more than 3 million rubles, then you will have to pay at least 10% more.

- Temporarily deregister the vehicle. You will have to travel with transit plates for a certain period of time, but you will not have to pay tax during this period. You just need to take into account that law enforcement agencies have an increased interest in such cars. And already at the first check of documents you will need to indicate the reason for the lack of registration of the vehicle.

- Register the car to a person who is registered in a region where there is a low tax rate. Operating such a vehicle is not prohibited by law. The main thing is that the driver has an MTPL insurance policy with him.

- Re-register the car to a beneficiary. For example, the region provides tax exemption for pensioners. By re-registering the car to a loved one who is a pensioner, you can forget about paying transport tax. You only need to write an application to the Federal Tax Service for the provision of benefits.

Source: https://askupka.ru/pochemu-transportnyy-nalog-raznyy-v-regionah/

Where do they pay the most?

| Moscow | Moscow region | Petersburg | Mari El | Tatarstan | |

| Lada Granta (87 hp) | 1044 | 870 | 2088 | 2175 | 870 |

| Hyundai Solaris (123 hp) | 3075 | 4182 | 4305 | 2305 | 4305 |

| Skoda Octavia (150 hp) | 5250 | 5100 | 5250 | 5250 | 5250 |

| Toyota Camry (181 hp) | 9050 | 8869 | 9050 | 9050 | 9050 |

| Audi A6 (245 hp) | 18 375 | 18 375 | 18 375 | 18 375 | 18 375 |

| Mercedes G63 AMG (585 hp) | 87 750 | 87 750 | 87 750 | 87 750 | 87 750 |

Where do they pay the least?

| Ingushetia | Transbaikalia | Crimea | Ugra | Magadan | |

| Lada Granta (87 hp) | 435 | 609 | 435 | 435 | 609 |

| Skoda Octavia (150 hp) | 1050 | 1500 | 1050 | 1050 | 1500 |

| Toyota Camry (181 hp) | 1810 | 3260 | 5430 | 7240 | 2715 |

| Audi A6 (245 hp) | 7350 | 8085 | 18 375 | 14 700 | 5635 |

| Mercedes G63 AMG (585 hp) | 23 400 | 38 025 | 50 500 | 70 200 | 26 325 |

Where you don't have to pay

In the Orenburg region, owners of cars with a capacity of up to 100 hp. With. transport tax is not paid.

Owners of cars with an electric motor are also exempt from tax in the following regions: Kaluga, Kemerovo, Lipetsk, Amur, Kaliningrad, Tyumen, Irkutsk regions, Kabardino-Balkarian Republic, Moscow and Moscow region, St. Petersburg.

The condition for tax exemption is power not exceeding 150 hp. With.

Do you think the tax on your car is fair? Write in our public.

Source: Autonews

Comparison of transport tax rates in different regions

It must be said that the most profitable region for the taxpayer in terms of transport tax is Crimea. The lowest rates apply there. The Orenburg region is also beneficial for motorists whose car does not exceed 100 horsepower. The most expensive region is St. Petersburg, which, even in comparison with Moscow, has a base tariff that is 2 times higher. For example, in the same capital the rate is 12 rubles per 1 horsepower, and in St. Petersburg it is already 24 rubles per 1 horsepower.

There is no point in presenting a complete list of regions with all rates, since it is huge. This can be clarified with the Federal Tax Service. Let's present the lowest and highest rates, taking into account the breakdown of vehicles into three categories, depending on power (tax rate (rubles) per unit of horsepower).

| Region | Power up to 100 hp | 101 - 150 hp | More than 250 hp |

| Orenburg region | 0 | 15 | 150 |

| Republic of Crimea | 2.5 - 5 (depending on year of manufacture) | 3.5 - 7 (depending on year of manufacture) | 25 – 50 (depending on year of manufacture) |

| The Republic of Ingushetia | 5 | 7 | 40 |

| Sevastopol | 5 | 7 | 100 |

| Tomsk region | 6 | 10 | 85 |

| The Republic of Khakassia | 6 | 15 | 100 |

| Magadan region | 7 | 10 | 45 |

| Transbaikal region | 7 | 10 | 65 |

| Jewish Autonomous Region | 6 (up to 80 hp)8 (80 - 100 hp) | 14 | 110 |

| Tyva Republic | 7 | 11 | 98 |

| Chechen Republic | 7 | 11 | 91 |

| The Republic of Dagestan | 8 | 10 | 105 |

| Moscow | 12 | 25 | 150 |

| Saint Petersburg | 24 | 35 | 150 |

It is worth noting that the difference between transport tax rates for cars up to 150 hp. forces is more significant than the difference for cars over 250 hp. With. This can be seen in the examples of Moscow and St. Petersburg.

You can find out what rate is valid in your region on the Federal Tax Service website. It must also be indicated when providing a notice and receipt for payment of transport tax, which is received by the taxpayer every year before November 1. Moreover, the tax itself will be paid next year, after the reporting year.