As legislators indicated, in connection with the introduction of a fee to compensate for damage caused by heavy vehicles to public roads of federal significance, the financial burden on the owners of such vehicles has increased significantly. After all, these persons must pay two mandatory payments to the consolidated budget of the Russian Federation for the financing of public roads: a fee for compensation of damage and a transport tax. They decided to correct this “injustice” (though not for long). Let's find out how.

The answer is contained in Federal Law No. 249-FZ dated July 3, 2016, which amended Part II of the Tax Code of the Russian Federation. This law came into force on July 3, 2016, but the effect of the articles of the Tax Code of the Russian Federation amended by it is determined in a special manner. Let's start with the order in which organizations that own heavy vehicles must now calculate transport tax.

Tax deduction for transport tax from an organization

If a transport company, to which a vehicle is registered, having a permissible maximum weight of over 12 tons and included in the register of vehicles of the toll collection system (the so-called “Platon” system), pays a fee to compensate for the damage caused to federal roads by the specified vehicle, it has the opportunity reduce your transport tax liability.

The relevant provisions on this are included in paragraph 2 of Art. 362 of the Tax Code of the Russian Federation (new additional paragraphs 12 – 14). The basic rule goes like this.

The amount of tax calculated at the end of the tax period by taxpayer organizations in relation to each vehicle with a maximum permitted weight of over 12 tons registered in the register is reduced by the amount of the fee paid in respect of such a vehicle in a given tax period.

Thus, reducing the financial burden on organizations that own heavy vehicles is realized through the use of tax deductions.

It must be taken into account that the amount of the fee transferred during the tax period (that is, the calendar year) for a specific heavy-duty vehicle reduces the amount of the transport tax calculated based on the results of the specified period for this particular vehicle.

It is possible that the amount of the fee paid exceeds the amount of transport tax calculated at the end of the year. When applying a tax deduction, this essentially means that the amount of tax payable to the budget takes on a negative value. So, in this case, the amount of transport tax should be considered equal to zero (paragraph 13, paragraph 2, article 362 of the Tax Code of the Russian Federation).

You should also pay attention to the new paragraph (paragraph 2) in paragraph 2 of Art. 363 Tax Code of the Russian Federation.

Taxpayers-organizations do not pay calculated advance tax payments in relation to a vehicle with a permissible maximum weight of over 12 tons, registered in the register.

Let us remind you that, as a general rule, during the tax period, taxpayers-organizations must pay advance payments for transport tax, unless otherwise provided by the laws of the constituent entities of the Russian Federation. Taking into account the innovation, advance payments in any case (regardless of what is determined by the law of the subject of the Russian Federation) do not need to be paid for heavy vehicles included in the vehicle register of the toll collection system (but they need to be calculated, why, it will become clear later). For other taxable vehicles, advance payments are calculated and transferred, except for situations where otherwise established by the law of a constituent entity of the Russian Federation.

System value

The Platon system ensures fair collection of funds for road repairs. The fact is that heavy vehicles weighing more than 12 tons cause serious damage to state highways. To estimate the amount of damage caused to the road by one heavyweight, it is enough to refer to statistics: the movement of one heavyweight is comparable to the movement of 25 thousand cars along the highway.

“Platon” was created to ensure that owners of heavy vehicles independently compensate for the damage caused. These contributions are a kind of compensation for the destructive impact on public roads.

Funds collected through the service are sent to the Federal Budget of the Russian Federation. From the budget they are allocated for the repair of public road surfaces, as well as the development of roadside infrastructure. For this reason, the sections of roads discussed are called federal highways.

The system allows authorities to collect accurate information on the movement of vehicles weighing more than 12 tons. Platon also ensures reliable storage of received information and can automatically transmit it. Moreover, this algorithm applies to all federal roads.

The significance of “Plato” lies in monitoring and improving the operational condition of roads in the Russian Federation. It is worth noting the operator of this system. The entire process of creating “Plato” and regulating its work is the merit of RTITS.

Transport tax benefit for individuals

Individuals (including those registered as individual entrepreneurs) on the basis of the new Art.

361.1 of the Tax Code of the Russian Federation are exempt from transport tax in relation to a heavy vehicle if the amount of the “Platonovsky” fee transferred during the tax period exceeds or equals the amount of the calculated tax for this period. If the amount of the calculated transport tax exceeds the amount of the fee, a tax benefit is provided in the amount of the fee. Accordingly, the difference is paid to the budget. In order to take advantage of the announced tax benefit, an individual must submit to the tax authority:

- application for benefits;

- documents confirming the right to receive it.

It should be taken into account that the use of benefits in relation to heavy vehicles is the right (not the obligation) of an individual – a transport tax payer. Therefore, if the choice made is not declared (by submitting the relevant documents to the tax authority), the exemption will not apply. Let us recall that the calculation of the amount of transport tax to be transferred to the budget by individual taxpayers is carried out by the tax authority on the basis of information provided by the authorities carrying out state registration of vehicles (clause 1 of Article 362 of the Tax Code of the Russian Federation).

The calculation looks like this:

3.73 rub./km x 0.41 x 4,975.311 km = 7,608.51 rub.

In this case, the calculation takes into account the amounts for canceled route cards and adjustments made to charges for on-board devices.

Such a report is generated automatically from the state toll collection system “Platon”. A similar document is prepared by the operator of the state toll collection system, RTITS LLC, acting on the basis of the Order of the Government of the Russian Federation of August 29, 2014 No. 1662, the Decree of the Government of the Russian Federation of June 14, 2013 No. 504, of May 18, 2015 No. 474, dated 03.11.2015 No. 1191.

The extract is necessary to track the status of settlements on the “Platonic” fee.

It does not contain information about the dates of movement, numbers of heavy trucks.

To do this, you need to order details of transactions by travel date through the company’s personal account.

Detailed operations by travel date.

Accounting for fees when calculating corporate income tax

The amount of the “Platonovsky” fee used as a tax deduction for transport tax is not taken into account when calculating profit tax by the transport company.

On this score in Art. 270 of the Tax Code of the Russian Federation now has a special norm - clause 48.21. Based on the results of reporting periods, the amount of payment not taken into account when determining the tax base for income tax is determined based on the amount of advance payments calculated in accordance with Chapter. 28 of the Tax Code of the Russian Federation in relation to heavy vehicles. But the difference (if the amount of the transferred fee exceeds the amount of the transport tax) is included in tax expenses on the basis of paragraphs. 49 clause 1 art. 264 of the Tax Code of the Russian Federation (other expenses associated with production and sales). (Subparagraph 1 does not work, since, as financiers indicated in Letter No. 03-05-06-04/77196 dated December 29, 2015, payment for compensation for damage caused to public roads of federal significance by heavy vehicles does not apply to taxes and fees regulated by the Tax Code.) Serve as supporting documents in relation to expenses in the form of “Platonic” fees (letters of the Ministry of Finance of the Russian Federation dated January 11, 2016 No. 03-03-RZ/64, dated December 28, 2015 No. 03-03-06/1 /76740):

- operator’s report, which indicates the route of the vehicle with reference to the time (date) of the start and end of the vehicle’s movement;

- primary accounting documents drawn up by the taxpayer himself, justifying the use of the named vehicle on the corresponding route.

Transfer of an advance payment to the Platon system operator

Regulatory regulation

For all vehicles registered in the Platon system, it is necessary to transfer a fee to compensate for damage caused by the vehicle to federal roads. Payments are transferred by the owner (holder) of the vehicle to the operator of the Platon system (Article 31.1 of the Federal Law of November 8, 2007 N 257-FZ). The amount and procedure for depositing amounts is determined by Decree of the Government of the Russian Federation of June 14, 2013 N 504.

Payments to Platon can be advance or deferred (postpayment). To obtain a deferment, the Organization must write an application to the system operator (clauses 6-9 of the Decree of the Government of the Russian Federation of June 14, 2013 N 504).

The transferred amount of the advance payment is not an expense, but is taken into account as part of advances issued (clause 3, 16 of PBU 10/99).

Payments to the operator of the Platon system are reflected according to Dt 76.09 “Other settlements with various debtors and creditors” (1C chart of accounts), since payments to the Platon system are non-tax payments.

Accounting in 1C

The transfer of payment to the operator of the Platon system is formalized by the document Write-off from the current account, type of operation Other settlements with counterparties in the Bank and cash desk section - Bank - Bank statements - Write-off button.

Let's consider the features of filling out the document Write-off from a current account :

- The recipient is the operator of the Platon system;

- Agreement - the basis for settlements with the operator of the Platon system, Type of agreement Other; PDF

- Settlement account - 76.09 “Other settlements with various debtors and creditors.”

Postings according to the document

The document generates the posting:

- Dt 76.09 Kt - advance payment transferred to the operator of the Platon system.

Payment as an expense for the “simplified”

If a transport company (IP) applies the simplified tax system with income selected as the object of taxation, reduced by the amount of expenses, it has the opportunity to act in accordance with a procedure similar to that established for income tax payers.

To be more precise: in tax expenses, “simplified” workers can include the amount of excess of the payment paid during the tax period for damages over the amount of transport tax calculated for the tax period (new paragraph 37 in paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation). When calculating advance payments for tax paid in connection with the application of the simplified tax system, expenses take into account the amount of the “Platonov” fee actually paid for the reporting period, reduced by the amount of calculated advance payments for transport tax. The same applies to Unified Agricultural Tax payers - a new clause talks about this. 45 in paragraph 2 of Art. 346.5 Tax Code of the Russian Federation.

For your information

Previously, “simplified” people were deprived of the opportunity to include the “Platonov” fee in tax expenses (letters of the Ministry of Finance of the Russian Federation dated January 18, 2016 No. 031106/2/1319, dated October 6, 2015 No. 03‑11‑11/57133).

Note.

Accounting entries are provided for heavy cargo vehicles for which the “Platonov” fee is transferred. For other vehicles, advance payments are still made (if the Law of the subject of the Russian Federation provides for such a procedure), which are reflected quarterly in the accounting accounts (in the last month of the reporting quarter).

It should be noted that the company determines the procedure for accounting for fares independently and enshrines it in its accounting policy (clause 4 and clause 7 of the Accounting Regulations PBU 1/2008 “Accounting Policy of the Organization”, approved by Order of the Ministry of Finance of the Russian Federation dated 06.10.2008 No. 106n).

Therefore, the company may use a different accounting record scheme.

Validity period of innovations

The possibility of applying tax deductions for transport tax by organizations applies to legal relations that arose from 01/01/2016, and is valid until 12/31/2018 inclusive.

During the same period, accordingly, tax expenses (when applying a regular or simplified taxation system) are formed taking into account the amount of the “Platonic” fee offset against the transport tax reduction (it is not taken into account as expenses). From 01/01/2019, tax deductions will no longer be applicable, but the possibility of including the amount of compensation for damages in tax expenses will remain. Individuals can use the tax benefit (exemption from taxation) for transport tax in relation to legal relations that arose starting from 01/01/2015. The benefit will cease to apply from 01/01/2019.

It should be especially emphasized that a tax deduction (benefit) for transport tax is provided to taxpayers of transport tax in connection with their payment of compensation for damage in respect of vehicles with a maximum permitted weight of over 12 tons. Therefore, if, for example, in relation to heavy vehicles registered to the lessor, the “Platonic” fee is paid by the lessee, then the lessor has no right to reduce the transport tax by the amount of the fee paid by the lessee to compensate for damage (Letter of the Ministry of Finance of the Russian Federation dated July 18, 2016 No. 03‑ 05‑04‑04/41940).

Operating principles of the system

"Plato" is an online system that allows users to track the status of payments without having to visit offices and sit in queues. The owner of a heavy-duty vehicle will be able to perform operations after registering on the site and gaining access to his personal account.

After this step, the motorist will also receive information about the bank details, which will allow him to transfer funds for driving on federal roads to a car whose weight exceeds 12 tons. Transfer of funds is based on advances. The scheme works as follows: the car owner deposits a certain amount into the system, after which the operator gradually debits the amount required for payment from the account account.

Some heavy-duty vehicles do not incur road damage charges.

These heavy trucks include:

- Cars carrying passengers. The rule applies to all such vehicles, except cargo-passenger vans.

- Special services vehicles: ambulance, police, fire, emergency rescue. Moreover, such vehicles must be equipped with special identification marks: a flashing light and sound devices.

- Vehicles intended for transportation of military equipment.

All other cars not included in the listed categories must replenish their balance in a timely manner to pay for travel on federal highways.

How are you charged?

Payment for travel of heavy trucks is carried out using a set tariff of 1.9 rubles/km. This value meets the requirements of the Resolution adopted on March 24, 2017. Ordinary citizens can find information about the current tariff on the official Platon website.

The dimension of the tariff directly indicates the principle of collecting payments: the value of the tariff is multiplied by the number of kilometers traveled. It is not difficult for tax authorities to track the movement of heavy cargo. Information about the number of kilometers is taken using satellite navigation equipment designed for this purpose.

The information support center is provided with a special device that allows you to determine the coordinates of the vehicle. Processing and sending data from the on-board device to the Data Processing Center is carried out automatically.

The funds of the user of the Platon system are also written off automatically. If there is no stationary tracking frame, mobile tracking will be provided. Owners of heavy trucks pay for travel on federal highways on a fair basis.

Principles for withdrawing funds from a motorist in the Platon system:

- payment is made only for the distance traveled;

- funds are collected continuously;

- monitoring is carried out using satellite systems (GPS and GLONASS);

- control of heavy trucks is regular through the use of stationary and mobile control.

Thus, owners of vehicles weighing more than 12 tons are exempt from inconvenience when compensating for the damage caused by heavy trucks to the road surface. Almost the entire process occurs automatically.

When can the tax amount not be reduced?

If Plato is paid by the same person as the 2019 transport tax, then the benefits will not apply. This rule also applies to those vehicles that are leased.

In this situation, it will not be possible to take into account the amount of paid amounts under Plato in the form of a deduction for the car owner.

In addition, organizations that have benefits are exempt from paying advance contributions for transport tax.

In addition, taxpayers who have been transferred to the simplified taxation system (STS) or the unified agricultural tax can make payments under “Plato” in the expense column.

The law has retroactive effect because it improves the situation of tax payers. The law came into force on January 1, 2015.

This means that individuals can recalculate taxes from this date and return any overpayments.

Taxpayers under the simplified taxation system and the unified agricultural tax can recalculate tax amounts from January 1, 2021.

Who can use it

All users of the Platon system can take advantage of the benefit.

According to the innovations, users of the Platon program can now take advantage of benefits when paying transport tax, i.e. the Platon system reduces transport tax.

Payments under the program can be deducted from the amount of transport tax for the corresponding tax period. This benefit applies to both legal entities and individuals.

If the amount of payments under the Platon system is greater than or equal to the transport tax, then you do not need to pay the transport tax.

Individuals, as well as individual entrepreneurs, can request benefits from the tax service when submitting an application and verification documentation (the documents are the same as when calculating personal income tax).

Legal entities must claim the benefit through a tax return.

In the tax report, in the expenses column, the amount that is obtained when transport tax is deducted from the total amount of payments to the Platon system is recorded. If payments are greater than the tax amount, then you need to enter 0.

For example, the tax for the year was 15,000 rubles, and the amount of payments to Platon was 10,000 rubles. You must write 5,000 rubles in expenses, but payments are not subject to accounting.

If the tax was 4,000 rubles, and the payment to “Plato” was 7,000 rubles, then 3,000 rubles are included in expenses, and the tax amount is not taken into account.

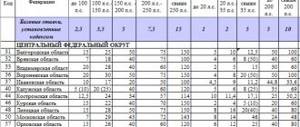

This report provides the following data:

Account number, balance, number of heavy loads and then details of transactions by date and heavy load.

| Movement date | GRZ | Type of transaction | Path along the federation routes, km | Enrollment | Write-off |

| 30.12.2016 | E285VA174 | Charging (BC) | 75.129 km | RUB 114.88 | |

| 30.12.2016 | E275MA174 | Charging (BC) | 74.03 km | 115.22 rub. |

At the end of the year, you can confirm your right to deduct transport tax using the report “Information on motor vehicles with a permissible maximum weight of over 12 tons, as well as information on payment of payment for compensation for damage caused to federal highways,” which is generated for each heavy load (Letter of the Federal Tax Service of the Russian Federation dated August 26, 2016 No. BS-4-11/15777).