What is transport tax?

Transport tax is a tax levied on vehicle owners. Transport means are: cars, motorcycles, scooters, buses, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, jet skis, motor boats and other water and air vehicles.

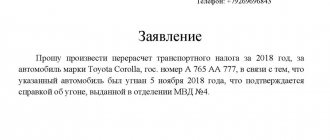

Not all vehicles are subject to taxation. For example, the following exceptions exist: - rowing boats, as well as motor boats with an engine power of no more than 5 horsepower - vehicles that are wanted, subject to confirmation of the fact of their theft (theft) by a document issued by an authorized body. The full list of exceptions is indicated in Article 358 of the Tax Code of the Russian Federation.

Payers of transport tax are both individuals and legal entities.

Why are pickups considered trucks?

Most owners of these SUVs have a category B driver's license, so by law they are considered to be driving a passenger car. This is how category “B” is described in paragraph 1 of Art. 25 of Federal Law No. 196 of December 10, 1995 “On Road Safety :

- In the Russian Federation, the following categories and their subcategories of vehicles are established, for which a special right to drive is granted (hereinafter referred to as the right to drive vehicles):

category “B” - cars (except for vehicles of category “A”), the permissible maximum weight of which does not exceed 3,500 kilograms and the number of seats, in addition to the driver’s seat, does not exceed eight; cars of category “B” coupled to a trailer, the maximum permitted weight of which does not exceed 750 kilograms; cars of category “B” coupled to a trailer, the permissible maximum weight of which exceeds 750 kilograms, but does not exceed the unladen weight of the vehicle, provided that the total permissible maximum weight of such a combination of vehicles does not exceed 3500 kilograms.

However, it is correct to determine the type of car not by the driver’s license, but by the vehicle passport (PTS). Most pickup trucks have a title that specifies the type “truck, flatbed,” which means it is legitimate to consider it a truck . The make and model of the car is encrypted in a numerical and alphabetic code, which can be viewed in the second line of the passport. If the second digit in the code is 3, then this indicates a cargo type of car or pickup truck.

If the tax authority classifies a pickup truck with a certain engine power as a truck, it means that the transport tax on it will be calculated at different rates than for passenger cars with the same horsepower. Sometimes such rates can be higher, which is fair, because trucks cause more damage to the road surface than cars. But in some regions, on the contrary, it is more profitable to have a heavy truck than a passenger car due to lower rates.

How to calculate the tax amount?

The amount of transport tax is calculated based on the following parameters: — Tax rate

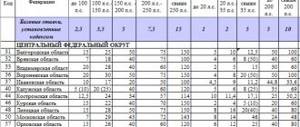

The tax rate is established by the laws of the constituent entities of the Russian Federation per one horsepower of engine power.

Depends on power, gross capacity, vehicle category and year of manufacture of the vehicle. Tax rates can be increased or decreased by the laws of the constituent entities of the Russian Federation by no more than 10 times the rate specified in the Tax Code of the Russian Federation. — Tax base

This parameter is set depending on the type of vehicle.

For cars, motorcycles and other vehicles with an engine, this is the engine power in horsepower - Ownership period

The number of complete months of ownership of the vehicle during the year.

— Increasing coefficient

For passenger cars with an average cost of 3 million rubles. a multiplying factor is applied. The list of such cars is available on the website of the Ministry of Industry and Trade of the Russian Federation.

Understanding car taxes

If the vehicle is registered in the middle of the year, you need to use a more detailed formula: multiply the rate by the engine power and the number of months of ownership remaining until the end of the year, divided by the total number of months in the year. If the same 123-horsepower Rio was purchased in May, the tax for the past year will be: 123 * 25 * 8/12 = 2050 rubles.

Russia is still far from the United States with its manic attitude towards taxes, but non-payment of car taxes will not go unpunished for long either. If the required amount does not appear in the accounts of the Federal Tax Service by December 1, then first a penalty will be charged for each calendar day of delay. The formula for calculating the penalty is as follows: the tax amount is multiplied by 1/300 of the refinancing rate of the Central Bank of the Russian Federation (today it is 7.25%) and by the number of days of delay.

Check the notification. The amount of transport tax payable is indicated in the tax notice. If there is a personal account, it will only be sent there. If you do not have a personal account, the notification will be sent by mail. One month before the payment deadline, everyone must receive documents with charges and details.

The tax notice is sent to the taxpayer by mail or through a personal account on the website nalog.ru. You just need to pay the amount indicated there, and you don’t have to count anything. But this applies only to individuals: the company calculates the transport tax itself, pays it more often than once a year, and also submits a declaration.

In Crimea, the year of manufacture affects not only the auto tax for cars and trucks, but also for buses, motorcycles, snowmobiles and other vehicles. As a rule, here the tax on a new car (less than 10 years have passed since its release) is 2 times higher than on an old one (more than 20 years). Thus, the tax on a new passenger car (with a power of more than 250 hp) is calculated at a rate of 50 rubles. for each horsepower, and for the old one - only 25 rubles.

We recommend reading: Mitigation of punishment under Article 228.1 in 2021

Despite the fact that a tax on old cars has not been introduced in Russia, in some regions of the country the size of the vehicle tax depends on the year the car was manufactured. This happens for the reason that the Tax Code allows the constituent entities of the Russian Federation to differentiate rates depending on the age of the vehicle.

Who is entitled to transport tax benefits?

At the federal level, the following categories of citizens are exempt from paying transport tax:

- Heroes of the Soviet Union, heroes of the Russian Federation, citizens awarded Orders of Glory of three degrees - for one vehicle;

- veterans of the Great Patriotic War, disabled people of the Great Patriotic War - for one vehicle;

- combat veterans, disabled combat veterans - for one vehicle;

- disabled people of groups I and II - for one vehicle;

- former minor prisoners of concentration camps, ghettos, and other places of forced detention created by the Nazis and their allies during the Second World War - for one vehicle;

- one of the parents (adoptive parents), guardian, trustee of a disabled child - for one vehicle;

- owners of passenger cars with an engine power of up to 70 horsepower (up to 51.49 kilowatts) inclusive - for one such vehicle;

- one of the parents (adoptive parents) in a large family - for one vehicle;

- owners of vehicles belonging to other preferential categories.

In addition to the federal list of preferential categories of citizens, there are regional benefits. For example, in some regions of the Russian Federation, pensioners pay only 50% of transport tax, or are completely exempt from it. The situation varies greatly depending on the region. For example, in Moscow there are no benefits for pensioners, and in St. Petersburg pensioners are completely exempt from paying transport tax for a domestically produced car with an engine power of up to 150 horsepower.

You can find out the availability of regional benefits on the tax service website, in the “electronic services” section. On this page you must select a subject of the Russian Federation, municipality (city), type of tax and year. After this, you will receive complete information about all types of transport tax benefits for individuals.

It is important to know that the tax authority does not have the right to provide a transport tax benefit based solely on age information. Benefits are of a declarative nature, as a result of which it is necessary to submit to the Federal Tax Service the taxpayer’s application in the prescribed form, which indicates the basis for providing the benefit (reaching retirement age).

Calculation of transport tax on cars older than 10 years

Transport tax is an integral state duty paid by both legal entities and individuals in the Russian Federation. The volume of a specific payment depends on a huge variety of different factors, but the main ones include the power of the car, in horsepower, and also the age of the car. In view of the fact that the described duty may vary from region to region, the age of the car also affects significantly, but in its own way, in each region.

A similar proposal, which replenishes the country’s budget at the expense of socially vulnerable segments of the population, such as pensioners and young people, who cannot buy a newer car due to meager pensions and salaries - a transport tax on a car over 10 years old - has only come into force today of the year. In total, the transport tax on cars older than 10 years in 2021 is calculated as follows:

In Russia, for car owners there are no advantages from the tax on old cars ; in this case, only the state benefits. The federal budget is significantly replenished from organizations that have expensive vintage cars on their balance sheets or from wealthy Russians who can afford to have an expensive used car in their garage and pay higher taxes for it. We talked about transport tax for organizations here.

As RIA Novosti reported (https://ria.ru/20181205/1543479059.html), an initiative letter was sent to the Ministry of Industrial Trade. According to the deputy, calculating transport tax based on engine power is “not entirely fair”, since the cost of two cars with the same power, but different years of production, differs greatly. The procedure for calculating transport tax, formulas and examples are given here.

The older and more expensive the vehicle, the greater the burden falls on the shoulders of the owner of the unit. For example, if the car is more than 25 years old, the tax for the use of such a unit will be focused on technical inspection data and compliance with environmental standards.

The transport tax on cars over 25 years old in 2021 applies only to expensive vehicles, however, this novelty may affect every fan of rare transport, since such units adversely affect the environmental situation in the country and violate the norms of the relevant branch of law.

Today, owners of old cars pay the same sales taxes as owners of new vehicles. But a bill is being developed that could completely ban the sale of used cars from hand to hand. The fact is that in this way many sellers evade paying tax. The innovation will allow us to bring the market out of the shadows and regulate it. Experience will be adopted from Japan, where there are special auction sites designed for such transport. Direct sales are prohibited there, only through official dealers. The buyer who offers the best price wins, and since it will be known to the fiscal authority, it will not be possible to avoid paying the tax.

We recommend reading: Calculate low-income households 2021

The legislation of our country does not exempt owners who decide to sell them from paying taxes on cars older than 10 years. Even if they have been owned for several years, they will still have to pay a mandatory fee to the treasury. To do this, the tax authority must provide information about the original cost and sale price. You will need to contribute 13% of the income received. You can find out more about the procedure on the official website of the fiscal authority.

How to calculate the number of complete months of car ownership?

If a vehicle is delivered or deregistered during the year, then the transport tax is calculated with a certain coefficient. This coefficient is defined as the ratio of the number of complete months during which a given vehicle was registered to the number of calendar months in a year (12).

The procedure for determining the number of full months of car ownership is calculated in accordance with paragraph 3 of Art. 362 of the Tax Code of the Russian Federation. Month of registration

It is considered complete if the vehicle

is registered

before the 15th day inclusive.

The month of deregistration is considered complete if the car is deregistered

after the 15th day. For example, if a car was registered after the 15th, then this month is not complete and is not taken into account when calculating the car tax.

Tax on a car over 30 years old

Local legislators work very heterogeneously, and sometimes show excessive severity, imposing a transport tax on everyone and everything. The corresponding norms must be sought in regional regulatory documents, in particular, the “Law on Transport”, and they practically cannot be generalized.

The evaluation system will not be simple. Judging by the data published by the Kommersant newspaper, the machine will be checked for compliance with GOST by experts accredited by the sports federation. The originality of the parts and the level of restoration will be assessed. Moreover, they plan to award penalty points for each non-original part.

May 04, 2021 klasterlaw 157

Share this post

- Related Posts

- What is expected of large families in 2021 with four children in Dagestan

- Should I Pay Utilities If I Don’t Live in the Apartment? The Owner Filed a Lawsuit

- Letter of Guarantee for an Apartment for LLC

- Improving living conditions for large families in Volgograd