More information about the penalty

When purchasing insurance, you and the company enter into an agreement, which becomes the basis of your cooperation. Each party agrees to comply with certain requirements. For example, in order for a driver to be entitled to receive compensation, he must promptly report the accident to the insurer. For its part, the company must make a payment or send your vehicle for repairs within a clearly defined time frame. According to the law, after accepting a claim from a driver, the insurer must consider the case within 20 days, making a payment to the victim or providing a justified refusal.

If the insurer does not comply with this, then the driver has the right to demand compensation for a penalty. Legally, this is enshrined in the Federal Law (Federal Law on OSAGO penalties No. 40). Additionally, this is supported by Law No. 4015-I, which substantiates such concepts as “legal penalty” and “penalty”, as well as Federal Law No. 223 on the rules and procedure for calculation. These laws are the basis for forming a claim against the insurance company.

What is the maximum amount of compensation?

The amount that the injured party receives is calculated using a unified methodology based on the damage received. If an additional payment is required, a penalty will be charged on the amount of the additional payment.

Let’s assume that the insurance company paid you 25 thousand rubles, and with the help of an independent examination you achieved a payment of 55 thousand rubles. Accordingly, the penalty can only be recovered for the underpaid 30 thousand rubles.

In addition to the cost of repairs, the amount of the penalty may include other expenses:

- evacuation of a car from the scene of an accident

- car parking

- restoration of damaged signs

- other expenses incurred due to the accident

According to Art. 16.1 of the Law “On Compulsory Motor Liability Insurance” the maximum amount of the penalty is 400 thousand rubles if the vehicle is damaged and 500 thousand rubles if harm is caused to human health (each victim separately).

Circumstances for payment

Dear readers!

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please contact the online consultant form

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

+7 (495) 980-97-90(ext.589) Moscow,

Moscow region

+8 (812) 449-45-96(ext.928) St. Petersburg,

Leningrad region

+8 (800) 700-99-56 (ext. 590) Regions

(free call for all regions of Russia)

You can receive compensation for a penalty in three main cases:

What else to read:

- My car was scratched in the yard, what should I do?

- Europrotocol 2021

- How to get money instead of repairs under compulsory motor liability insurance: a detailed review

- the lines for sending a damaged vehicle to a service center for repairs were violated;

- failure to pay funds within the specified period or transfer only part, which is also an offense;

- for untimely written refusal to pay.

Also, in rare cases, drivers can demand compensation from the Russian Union of Automobile Insurers (RUA) if violations were discovered on its part. If the insurer sent the car for repairs on time, but it was done poorly or not done at all, then this increases the repair period due to the fault of the insurer, which becomes an additional reason to demand the recovery of a penalty under compulsory motor liability insurance.

Amount of penalty DDU

The exact formula for calculating the penalty under the DDU is in Article 6 of the Federal Law of December 30, 2004 No. 214-FZ. Separate formulas are presented for different categories of shareholders:

- citizens;

- individual entrepreneurs, legal entities.

When calculating the penalty, the main factor is who the shareholder is. It is believed that individuals and citizens buy housing for personal purposes that do not involve entrepreneurship. For this category of citizens, the amount of the penalty doubles. It is assumed that additional protection is not required for legal entities, since they conduct business activities and must take into account possible risks and losses.

Charges for legal entities and individuals

When a development company violates the deadlines for the transfer of real estate, the shareholder has the right to file a claim, on the basis of which the construction company is obliged to pay a penalty. Its size is calculated according to the formula defined by Federal Law of the Russian Federation No. 214-FZ. For individuals the amount will be higher.

The courts do not always satisfy the shareholder's claim in full. If the amount is very large, the court has the right to reduce it. Thus, the enrichment of the shareholder at the expense of the developer is excluded.

Penalty for DDU in case of bankruptcy

In the event of bankruptcy of the development company, shareholders have the right to choose:

- refund;

- real estate.

Participants in shared construction independently determine whether to make a financial claim or insist on putting the property into operation.

Important! In addition to repayment of the debt, the shareholder has the right to demand compensation for moral damage.

It is extremely important to calculate the amount of the penalty as accurately as possible, since a mathematical error can cause the claim to be rejected. To correctly calculate the penalty under a shared construction agreement, it is better to contact a law firm.

Participants in the DDU are classified as third-priority creditors. Thus, after the sale of property and assets of a bankrupt company, payment of funds to all victims may not be enough. To collect penalties, it makes sense to contact experienced lawyers.

Collection of penalties under DDU without prepayment

In most cases, defrauded shareholders are in a difficult financial situation, as they are forced to look for housing and pay for the services of a lawyer. Collection of a penalty under a shared construction agreement without prepayment will not require any expenses from the applicant until the amount is collected from the developer.

The procedure looks like this:

- the applicant enters into an agreement with a lawyer;

- the lawyer studies the case materials, collects information about the developer, and forms an evidence base;

- Legal services are paid only after a positive court decision is made.

Important! Courts of general jurisdiction often decide to reduce the amount of the fine. Lawyers recommend turning to arbitration.

Pre-trial demand for payment of penalties

If the insurer violated the points described above, you did not receive the amount of compensation or the repaired car on time, you can safely demand not only money under compulsory motor liability insurance, but also a penalty. First of all, of course, it is necessary to resolve the issue pre-trial. To do this, the driver must write a statement and submit it to the insurance company. At the same time, the paper indicates the method in which the victim wants to receive funds: in cash or by bank transfer, indicating the details. This is sufficient information for the policyholder. If agents ask for other documents, write a complaint about securing a penalty.

The submitted claim must also include the following:

- applicant's details (full name, residential address, contact details);

- name and address of the insurer;

- a detailed description of your situation;

- date of document execution,

- applicant's signature with transcript.

The insurer has only 5 days to review the application (excluding holidays and weekends). In most situations, the insurance company tries to avoid litigation. This is an expensive and exhausting process that does not have the best effect on the company’s reputation. The driver is only required to verify that the insurance company actually received the application. Send the documents by registered mail with a delivery report, or personally hand over the application to an authorized employee against signature.

If you initially plan to demand a penalty through the court, then in the application you only need to write about the demand for compensation for unpaid funds or car repairs. You can directly claim the penalty after sending the application through a lawsuit.

Decoding the concept

A penalty is a fine or penalty that one party to a civil law relationship must pay to the other if it fails to comply with its obligations.

This concept also exists in the auto insurance industry. According to Federal Law No. 40-FZ of April 25, 2002, a penalty under compulsory motor liability insurance is a financial obligation arising from non-compliance with the terms of the contract. But only one party bears them - the insurer.

Depending on what terms of the contract were violated, the recipient of the penalty under compulsory motor liability insurance may be:

- policyholder,

- victim in an accident.

The Federal Law “On Compulsory Motor Liability Insurance” does not speak about the right of an insurance company client to demand a penalty, but about the insurer’s obligation to pay it if there are grounds.

Contacting the Central Bank

This method is an alternative to filing a claim with the insurance company. The bank, for its part, is responsible for the activities of all financial companies, including various insurance companies. The bank allows you to resolve issues of non-payment of compensation, but in most cases such an appeal does not allow you to resolve the issue of a penny. If you decide to use the help of the Central Bank of the Russian Federation, you need to prepare a corresponding application, indicating:

- Applicant's full name and contact details;

- information about the insurer against whom you have a claim;

- description of the insurer’s violations, calculation of penalties;

- contract or policy data;

- your insurance case number.

Be sure to include a copy of the complaint. The application can be sent either by mail or via the Internet by filling out a form on the website of the Central Bank of the Russian Federation. As practice shows, complaints to the bank are processed quickly, in less than one week.

Court

If the insurance company has not taken action to pay after the application, then you can file a lawsuit. Be sure to support all documents that confirm that you are the victim in relations with the insurance company. As a rule, to consider the case, you will need a contract, a certificate from the State Traffic Inspectorate about the accident, an expert assessment of the amount of damage, as well as a document that confirms your appeal to the insurance company as part of the pre-trial proceedings.

A frequent practice is to reduce the amount of the penalty. Please note that, according to Article 333 of the Civil Code of the Russian Federation, the court can indeed reduce the amount of the penalty, but only when the defendant (insurance company) has filed an appropriate application and after providing relevant evidence that the required amount is not commensurate with the damage received. If the defendant did not submit an application, did not provide evidence of the disproportionality of the payment, and there were no discussions on this issue, then the court itself does not have the right to reduce the amount of the penalty under compulsory motor liability insurance. In fact, in such a situation, the court accepts one of the parties (the defendant), which is already a violation of the law.

The statement of claim can be submitted on the Internet. The document states:

- name of the court and insurance company with address;

- your complete details;

- why you are filing this claim;

- regulations that serve as the basis for meeting your requirements;

- indication of the exact amount of the penalty with the given calculation.

Through an application, the plaintiff (driver) can and should ask the court for assistance in obtaining the relevant documents in the case that are in the insurance company. We recommend that you use the help of lawyers to ensure that you receive the requested amount.

In court proceedings you will need the following documents:

- Copies of documents for the car: PTS.

- COP.

- OSAGO policy.

- Passport (copy).

- Conclusion of the appraisal examination.

- Violation protocol.

Penalty under compulsory motor liability insurance judicial practice

NOTE!

The court DOES NOT have the RIGHT to independently reduce the amount of the penalty! Only at the request of the defendant.

Even if the court reduces the amount of the penalty, it will be an insignificant amount and in the event of an appeal to a higher authority, you will defend your money.

Below is a court decision in which the plaintiff did not draw the court’s attention to the practice of the Supreme Court of the Russian Federation under Art. 333 Civil Code of the Russian Federation. as a result, the court reduced the penalty under compulsory motor liability insurance by 40% .

Of the claimed 40,000 rubles, only 25,000 rubles were recovered.

How to calculate

Let's move on to the most interesting issue - the calculation of penalties under compulsory motor liability insurance. The amount may vary significantly, but there are minimum and maximum amount limits. The penalty is calculated using the following formula:

C*Х*D, where:

C - the amount of payment to the victim, which is announced by the appraiser after inspecting the damage;

X - the amount of the penalty for each overdue day - for payment is 1%, for delayed repairs - 0.5%, for no refusal - 0.05%;

D - the number of days by which the insurer was late in payment.

Additionally, the amount of the penalty includes related expenses that the driver incurred during a traffic accident. This includes expenses for:

- emergency commissioner;

- evacuation and parking of a broken car;

- transporting the victim to the hospital;

- repair of road signs and other objects damaged in the accident.

Accordingly, if you do not trust the appraiser from the insurance company, you can contact an independent expert. The delay begins on the day following the 20-day period given by the insurance company to consider your application. If the penalty is collected through a lawsuit, then the last day is considered the date of filing the claim. Subsequently, it is replaced with a later one, since the defendant can pay the amount during the trial. If the insurer has not made payment even after the trial, an additional claim should be filed, where the period of penalty will include the time spent on the trial.

The total amount of compensation for the penalty cannot exceed the amount of the insurance payment; accordingly, the maximum amount of the penalty under compulsory motor liability insurance will be up to 400,000 rubles for damage to the car and up to 500,000 for damage to health. Even if, because of the interest, you calculate a penalty of 650,000, but only the car is damaged, then the court will order the maximum payment for this case - 400,000. If the penalty is collected on part of the unpaid amount, then the formula takes into account only that part of the funds which have not yet been paid to the victim. Under MTPL you can receive the maximum amounts:

- if the car is damaged – 400 OSAGO + 400 for penalties = 800 thousand rubles;

- if there is harm to health – 500 OSAGO + 500 for a penalty = 1 million rubles.

However, you can additionally recover funds for fines, moral damages and legal costs. If the court satisfies your demands, the insurer will be obliged to pay more than the established 800 thousand and 1 million.

The restrictions described above apply only to individuals. Legal entities can receive an unlimited amount as compensation for penalties.

Penalty under the MTPL agreement – how to get it?

According to the law, a penalty for late payment under compulsory motor liability insurance requires mandatory pre-trial communication with the insurance company - there is no need to immediately go to court.

Pre-trial practice on penalties under OSAGO

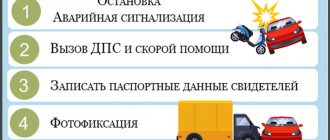

Going to court with a claim for a penalty for compulsory motor liability insurance is preceded by a voluntary settlement of the conflict. It implies the following algorithm.

- Submitting an application to the insurance company for payment of the penalty with settlement.

- A written complaint addressed to the head of the Bank of Russia branch about the delay in payment by the insurer. A copy of it must be attached to the application to the insurance company.

The calculation of the penalty for compulsory motor liability insurance for 2021 can be reflected in the text of the application or issued as a separate document. It is drawn up in two copies - the first is sent to the insurer by mail with a notification or handed over against signature. The latter is placed on the victim’s copy. It is recommended to apply for a penalty after paying off the principal debt. Only in this case can you accurately calculate the days of penalties under OSAGO. The amount collected directly depends on their quantity.

The law on compulsory motor liability insurance considers penalties as compensation to the insured for losses incurred due to the impossibility of timely restoration of a car or health damaged in an accident.

It is more beneficial for the applicant to resolve the issue through the court - there is an opportunity to receive not only a penalty, but also compensation for moral damage and a fine for untimely satisfaction of legal requirements.

OSAGO penalty in court

The statement of claim for the MTPL penalty is filed in the magistrate’s court at the plaintiff’s place of residence. It sets out in detail the claims against the insurance company, describes the pre-trial settlement process and its result, and formulates the requirements. The following documents are attached to the claim.

- An agreement with an insurance company or a policy.

- Documents confirming the right to apply for insurance payment.

- A claim for a MTPL penalty addressed to the insurer, sent to him earlier and remaining unanswered.

- Calculation of the amount to be recovered on a separate sheet or in the text of the claim.

- Paid receipt for state duty.

Insurance companies do not benefit from litigation. If the claim is satisfied, the court awards them a fine, compensation for legal costs and moral damage to the victim. The amount of such a fine can be up to 50% of the amount of insurance compensation. If the latter is partially paid, the fine is calculated based on the amount owed.

Several calculation examples

Now you know how the penalty for compulsory motor liability insurance is calculated. Let's look at a few examples.

Option one - the insurance company set the amount of damage at 170 thousand rubles. By the end of the 20-day period, 78 thousand had been paid. The penalty period is 80 days. You can file a claim or claim for non-payment of remaining funds using the formula:

(170-78) * 1% * 80 = 73,600 rubles.

The second option is delay in repairs. Let’s assume that the workshop missed the deadline, and therefore the car did not have time to repair. In this example, we take the cost of the entire repair - 220 thousand, a percentage of 0.5 and the number of days, for example, 44. Then we calculate the penalties:

220 * 0.5% * 44 = 48,400 rubles.

Please note that the amount of the penalty under OSAGO in the case of repairs cannot exceed the cost of eliminating car breakdowns. Accordingly, even if the number of days is 200, the maximum amount will be 120 thousand.

The third option is that the insurer did not send a written refusal of the insurance payment on time. This is also considered a violation, since the driver was waiting for a decision and did not repair the car. In this case, the insured amount is used (for example, 80 thousand), the number of days is 60 and the percentage is 0.05%:

80 * 0.05% * 60 = 2,400 rubles.

As you can see, you are allowed to receive a small refund due to an unsent refusal. Naturally, during a lawsuit, you can also demand compensation for legal costs.

Penalty under compulsory motor liability insurance. Calculation scheme in 2021. Sample claim for incorrect calculation

A penalty is a part of the amount of money that is determined at the legislative level, and must be paid by one party to the other party in the event of failure to fulfill contractual obligations. In the field of compulsory motor liability insurance, the penalty is applied unilaterally, namely to a legal entity (insurer) in case of delay, which may occur when considering applications for payments or claims.

Sample calculation of penalties under compulsory motor liability insurance from September 1, 2014 under old contracts

Previously, in relation to contracts that were concluded before 09/01/2014, rules were applied that stated: when submitting an application and relevant documents by the policyholder, the insurer is obliged to consider this application within 30 days and pay the insurance portion, and in certain situations send a reasoned refusal . The insurance company usually met this deadline, but according to the Supreme Court Jurisprudence Review for the third quarter of 2012, if you underpay for insurance coverage, you may also be entitled to a penalty.

Until September 1, 2014, the amount of the penalty was calculated for each day of delay in accordance with 1/75 of the Central Bank refinancing rate that was in effect for that period.

But since September 1, 2014, there have been changes in the legislation that excluded this paragraph from the law “On Compulsory Motor Liability Insurance”; therefore, today all calculations for penalties are carried out on the basis of the current Federal Law of April 25, 2002 No. 40 - FZ.

So, how to calculate the penalty under compulsory motor liability insurance if the insurer did not send you a reasoned refusal on time?

If the deadline for sending a reasoned refusal of insurance compensation to the victim is not met, the insurer, for each day of delay, pays the victim money in the form of a financial sanction in the amount of 0.05 percent of the insurance amount established by this Federal Law for the type of harm caused to each victim.

Paragraph 3 of paragraph 21 of Article 12 of the Federal Law of April 25, 2002 No. 40 - Federal Law

As you know, the maximum payments in relation to life and health are 500,000 rubles, and in relation to property - 400,000 rubles. Based on this, the conclusion suggests itself that the payment of a penalty for a day of delay will be the same for everyone.

500,000 rubles * 0.05% = 250 rubles in case of harm to life and health.

400,000 rubles * 0.05% = 200 rubles in case of damage to property.

To calculate the full amount of the penalty, you need to multiply the cost of a day of delay by the number of days overdue: 250 (200) * number of days.

To calculate the number of days, you need to take the date the application and all relevant documents were submitted to the insurance company, and add 20 days to it minus holidays. If, for example, you happen to fall on one of the holidays, then the final date shifts by +1 day.

Important!

If the victim, with the consent of the insurer, repairs his car at a service station with which the insurer does not have an agreement, the insurer is obliged to issue a referral for repairs within 30 calendar days (excluding non-working holidays). In this case, according to paragraph 1 of clause 21 of Art. 12 of the Federal Law of April 25, 2002 No. 40 - Federal Law, the number of days of delay is counted after the expiration of the 30-day period.

When the 20 days have expired, the overdue period begins from the next day. You can consider a penalty until the insurance company gives you a reasoned refusal or until the day the court makes a decision.

Let's look at an example. You have accumulated 30 days of delay in a property damage (accident) case. 30 * 200 = 6000 rubles will be a penalty.

In the event that you are expecting an insurance payment or a referral for repairs, the penalty in this case is assigned in the amount of 1% for each day of delay. If the restoration period is exceeded, the penalty is 0.5% of the insurance compensation for each day of delay.

Thus, the formula for calculating the penalty under compulsory motor liability insurance in 2021 is as follows:

K=S x N% x D, where K is the total amount of the penalty, S is the amount of insurance compensation, N is the percentage of the penalty for each day, and D is the number of days of delay.

If the deadline for making an insurance payment or the deadline for issuing a direction to repair a vehicle to the victim is not met, for each day of delay the insurer pays the victim a penalty (penalty) in the amount of one percent of the amount of insurance compensation determined in accordance with this Federal Law by the type of harm caused to each victim. When compensating for damage on the basis of clauses 15.1 - 15.3 of this article in case of violation of the period established by the second paragraph of clause 15.2 of this article for the restoration of the damaged vehicle or the period agreed upon by the insurer and the victim and exceeding the period established by the second paragraph of clause 15.2 of this article for the restoration of the damaged vehicle funds, the insurer, for each day of delay, pays the victim a penalty in the amount of 0.5 percent of the amount of insurance compensation determined in accordance with this Federal Law, but not more than the amount of such compensation.

Paragraph 2 of paragraph 21 of Article 12 of the Federal Law of April 25, 2002 No. 40 - Federal Law.

Some insurance companies offer their clients an online calculator for calculating penalties under compulsory motor liability insurance in 2021. However, the calculation formula is quite simple, and you can calculate the exact amount of the penalty yourself.

As in the example earlier, we count 20 days from the date of submission of documents, and starting from the next day we count all overdue days, waiting for the full amount of insurance coverage or a referral for repairs.

Let's consider the situation: an independent expert has assigned you an insurance payment in the amount of 40,000 rubles, and the period of delay is 60 days, therefore the penalty is 40,000 * 1% * 60 = 24,000 rubles.

If you know in advance when your court hearing will take place, we recommend calculating the full amount of the penalty before this date and demanding to recover it in full in the statement of claim.

It is important to know that in order to file a claim with the court after the payment period has expired, you must first send a repeated application to the insurance company, where it will be considered within 15 days if submitted electronically or 30 days if submitted in person or by mail.

2. The financial organization is obliged to consider the application of the consumer of financial services and send him a reasoned response on satisfaction, partial satisfaction or refusal to satisfy the presented requirement:

1) within fifteen working days from the date of receipt of the application of the consumer of financial services if the said application is sent in electronic form in a standard form approved by the Council of the Service, and if no more than one hundred and eighty days have passed since the date of violation of the rights of the consumer of financial services;

2) within thirty days from the date of receipt of the application of the consumer of financial services in other cases.

clause 2 art. 16 Federal Law of June 4, 2018 N 123-FZ “On the Commissioner for the Rights of Consumers of Financial Services”

A situation may also occur when an incorrect calculation of the penalty in a claim under compulsory motor liability insurance was made, on the basis of which the insurance company paid less. In this case, you can go to court again and demand the rest of the money.

But it is worth remembering that before going to court, you should draw up a second application and send it to the insurance company.

If you are unsure that you can resolve this issue on your own, our free legal assistance is always ready to provide our services as a representative.

When they can refuse

Inexperienced motorists without the support of lawyers often make simple mistakes, which become the reason for the denial of the claim. You may be refused in the following cases:

- the driver did not complete the claim procedure;

- documents supporting your claim have not been submitted;

- a force majeure event, for example, there was a fire in the company that destroyed all documents, which led to a delay;

- incompetence of the plaintiff - ignoring contact with the insurer, incorrectly indicating the bank account for payment of compensation, or other.

If the MTPL insurance payment is refused, no penalty will be paid.

Grounds for payment of a penalty

Based on Art. 12 clause 21 No. 40-FZ “On OSAGO” the insurance company is obliged to pay a penalty in the following cases:

- delay in insurance payment or registration of a referral for repairs;

- if the car repair lasts longer than the period established by law;

- delay in denial of insurance compensation;

- failure to comply with the deadline for the return of the insurance premium.

According to Art. 16.1 clause 5 No. 40-FZ in a number of cases the insurer is released from the obligation to pay a penalty. Such situations include:

- inability to timely fulfill the terms of the contract due to force majeure beyond the control of the company;

- failure by the insurer to fulfill its obligations due to the fault of the victim or the insured.