Quick links

- Registration of compulsory insurance for pensioners

- Technical inspection for pensioners

- Calculation of the cost of compulsory motor insurance for pensioners

- Comprehensive solution for pensioners

Such a group of the population as pensioners in our country is not particularly wealthy, so issuing a compulsory motor liability insurance policy is a very difficult task for them, as it hits their wallets hard. However, in our company, all pensioners receive an additional discount when applying for compulsory motor liability insurance. Special MTPL program for pensioners.

Registration of compulsory motor liability insurance for pensioners

- The price is lower than everywhere else

- Free inspection

- Official registration

- Special conditions for pensioners

Only our company offers special conditions for insuring pensioners under the MTPL program. If you are a pensioner, then with us you will get the maximum benefit when you take out a compulsory motor liability insurance policy. What do you get? Firstly, we will give you a discount when applying for compulsory motor liability insurance, so our policy will be cheaper than anywhere else. Secondly, we issue only official policies; you can always check the legitimacy of the policy using the PCA database or with the insurance company. Thirdly, we will issue you a technical inspection completely free of charge if you do not have one. Fourthly, we will keep all the discounts that you had before; we guarantee that all the discounts that were valid before will remain with you. Thus, you get as many as 4 benefits that are valid only for pensioners, only in our company and only today! Just like one, two, three, four.

OSAGO stands for compulsory civil liability insurance and is one of the most important and necessary documents that allow you to drive a vehicle. Why is compulsory motor insurance policy so important? We all know that driving a car, motorcycle or other equipment is often dangerous, and on the road there is always the possibility of damaging your own or someone else’s car, which in turn is a very expensive property. It is precisely for such situations that the MTPL policy is designed, which is responsible for covering the damage that you cause to other road users, so that you do not have to pay a decent amount for repairs from your wallet.

Any driver driving a vehicle must have a valid insurance policy, or must be included in the insurance, unless it is open. Failure to have a policy will result in a fine of 800 rubles or suspension from driving until the violation is corrected. In addition, without MTPL you will not be able to register your car after purchase, and if you get into an accident, you also risk losing a large sum of money.

Registration of compulsory insurance for pensioners

Depending on the region where the insurance policy is issued, as well as other coefficients by which the cost of insurance is calculated, the price for it can be very high. Due to the difficult economic situation and low incomes, for some people living in the Russian Federation, obtaining insurance becomes a big problem. One of these categories of citizens are pensioners. Registration of compulsory motor insurance for pensioners living in large cities, such as Moscow, can cost as much as the size of the pension itself, which, of course, cannot but lead to sad thoughts. However, we are happy to announce that we provide a significant discount on insurance for pensioners. We will talk about this further.

Technical inspection for pensioners

When applying for a compulsory civil liability insurance policy, you must undergo a technical inspection and receive a diagnostic card confirming the serviceability of the insured vehicle. Here another problem arises, since this procedure also costs a certain amount of money, and going back a little higher, we also add the cost of a technical inspection to the cost of the compulsory motor insurance policy. This will be a serious blow to the wallets of not only pensioners, but all other policyholders. But you shouldn’t get upset and start wondering how much money will be spent on a compulsory motor insurance policy, because when you apply for a compulsory motor insurance policy, you can get a technical inspection absolutely free. Again, we clarify that the technical inspection will be free for you only when you apply for compulsory motor insurance.

Benefit for accident-free driving

The right to a discount in this category are those drivers who have purchased an insurance policy from the same insurance company for many years and have never applied for payment during the entire period. A benefit of this nature is called “Bonus-malus” - a system of discounts and allowances. Malus (surcharge) is applied by the insurer in case of systematic emergency driving.

The bonus (discount) for each accident-free year increases by 5%, but does not exceed 20% of the total payment.

Calculation of the cost of compulsory motor insurance for pensioners

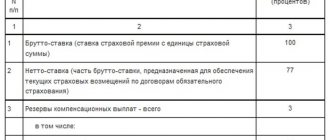

And so, going back a little higher, we remind you that registration of compulsory motor insurance for pensioners is provided at a significant discount. How the cost of compulsory insurance for pensioners is calculated in our company, and why the discount will be noticeable, we will now tell you. The fact is that the cost of a compulsory insurance policy is calculated by multiplying the base rate, which in almost all insurance companies is 4,118 rubles by a number of coefficients. The coefficients by which this tariff is multiplied are: driver experience, driving history, in particular accident rates, insurance region (for example, in a city where the population and traffic are larger, the cost of an insurance policy can be several times higher compared to a small region) and also technical data of the vehicle. All these coefficients are completely different for all policyholders, however, when insuring a car in Moscow, even if all the coefficients are minimal, the MTPL policy will still cost much more. In the situation regarding registration of compulsory insurance for pensioners, our company, as we have already mentioned, offers a good discount. Reducing the cost of compulsory motor insurance policies for pensioners is possible due to the fact that for this group of people, in our company the basic tariff is not 4,118 rubles, but 3,432 rubles. If we calculate taking into account all the coefficients, then the difference in the cost of an insurance policy before the discount and after can reach up to 3,000 rubles, which, of course, cannot but be good news for our clients who have reached retirement age.

What are the benefits for pensioners under compulsory motor liability insurance?

For ordinary pensioners (if they are not disabled or labor veterans) no discounts are provided. An elderly person can only count on a discount for an accident-free record and a bonus for being over 59 years old.

Discount conditions for disabled pensioners in 2021:

- half or a third of the amount paid under the agreement will be compensated;

- pensioner status is not enough for preferential treatment (discounts and special calculations are applied only to persons who can prove disability);

- disability of group I, II or III is sufficient as a basis;

- the size of the discount depends on the final cost of the policy;

- The benefit can be used no more than once a year.

Article on the topic: The procedure for drawing up a European protocol and its submission to the insurance company

Discounts are not regulated by clear standards and change from year to year. For reference, it is recommended to study the terms and conditions published on the insurance company website or contact the company manager for advice.

Comprehensive solution for pensioners

And so, summing up all of the above, we can safely say that if you are a citizen of the Russian Federation of retirement age, then by insuring yourself, you can save your money well. In addition to the discount that pensioners can receive when taking out a compulsory motor insurance policy, passing a technical inspection also becomes absolutely free for them, as was mentioned a little earlier. Our company strives to make the life of our clients easier and make it a little more pleasant, and we really hope that in return, you will always be happy to advise your friends and relatives to take out a compulsory motor insurance policy in , where, regardless of the complexity of their situation related to obtaining a compulsory motor insurance policy, they will be able to do this within one hour.

Other organizations

OSAGO for drivers with less than 3 years of experience

Young drivers with less than 3 years of experience experience difficulties when applying for an MTPL policy for their vehicle, so our company pays great attention to this issue.

OSAGO for the culprit of an accident

Almost all drivers get into an accident; after such an event, some perpetrators of accidents cannot take out a compulsory MTPL insurance policy. Our company can help such drivers restore justice and take out a policy.

OSAGO for a driver without experience

It is difficult for a young driver without experience to obtain MTPL insurance for his vehicle, since insurance companies flatly refuse to issue a policy to such drivers. However, our company has offers specifically for such drivers.

OSAGO for individuals and legal entities

Not all insurance companies and insurance brokers work with individuals and legal entities, and even those who do can process all categories of vehicles, but our company can handle everything.

OSAGO for Volkswagen Polo

For all owners of Volkswagen Polo, we are ready to provide unique offers for issuing compulsory motor third party liability insurance policies. Fully official design. We work with individuals and legal entities. Any purpose of use including taxi.

OSAGO for Finland

If you are going to travel to Finland with your car, then you will need a compulsory motor liability insurance policy, which is called a green card. With this policy you will safely cross the border with Finland.

OSAGO for individuals

Our company is ready to present a range of MTPL insurance services for individuals. We insure all categories of vehicles, apply all discounts and select the best offers for individuals.

OSAGO for Honda Accord

For Honda Accord owners, our company has special conditions for obtaining an MTPL policy. We issue compulsory motor liability insurance for any region for Honda owners. We have an additional discount on Honda Accord!

OSAGO for Hyundai Solaris

Registration of an MTPL policy for a Hyundai Solaris car. We even process taxi registrations for owners from other regions. We make a paper policy on a pink form. We will select the best offers for you.

OSAGO for those registered in another region

Compulsory motor liability insurance for those registered in another region is always a problem. You will be sent for a car inspection, which lasts more than a month, and it’s not a fact that they will give consent!

OSAGO for ZIL

All owners of ZIL cars are faced with the problem of obtaining compulsory motor liability insurance. There are several reasons for this - firstly, these are trucks, and secondly, most often these are old cars. Therefore, all insurance companies refuse such vehicles, but not us!

OSAGO for foreign cars

If you come from abroad and you need to take out a compulsory motor liability insurance policy in Russia, then we are ready to do this for you. We are insurance brokers and work with the largest insurance companies.

OSAGO for abroad

If you travel abroad in a personal car, then you will need to take out a special MTPL policy for traveling abroad, called a green card. The cost of this policy is low.

OSAGO for school bus

The bus is a non-segment for insurance companies and school buses are no exception, many people face big problems when insuring a bus. We specialize in non-segmented vehicles and registration of compulsory motor liability insurance for them.

OSAGO for Chevrolet Niva

Taking out an MTPL policy for a Chevrolet Niva can create a lot of problems for car owners, but we are ready to offer special conditions for obtaining insurance for this popular car.

OSAGO for Skoda Kodiak

For Skoda Kodiak owners, our company has special conditions for issuing MTPL insurance policies with an additional discount. We will provide more than 5 insurance companies to choose from.

OSAGO for Chevrolet Cruze

If you are the owner of a Chevrolet Cruze car and do not know where to apply for an MTPL policy, then this article is especially for you. In our company, you will not only be able to take out a policy for this car, but also do it on the most favorable terms.

OSAGO for Schengen

If you are going to travel to the Schengen zone in your own car, then you will need to apply for a special type of compulsory motor liability insurance, you can do this in our company. This type of MTPL is called a green card.

OSAGO for Georgia

If you are going to travel to Georgia by car, then you will need compulsory motor liability insurance, which is valid on the territory of Georgia. You can obtain this OSAGO form from our company.

OSAGO for traffic police

One of the mandatory documents required by the traffic police to register a car in Russia is an MTPL insurance policy. You should think about issuing a policy for the traffic police in advance, otherwise registration will be denied to you.

OSAGO for trucks for individuals

Trucks are a non-segment for insurance companies, both for individuals and legal entities. However, there is no need to despair, because our insurance center will help you in obtaining an MTPL policy for a truck if the owner is an individual.

OSAGO for a new car

Have you bought a car? - Fine. After purchasing a new car, the first thing you need to do is take out an MTPL policy. In our company, you can always take out an MTPL policy for a new car from a showroom or a used car.

OSAGO for beginners

It is not so easy for young drivers to take out a compulsory motor liability insurance policy and insure their car. Many insurance companies are turning away young drivers. However, we have a few suggestions for those new to the road.

OSAGO for driving with a trailer

One of the points that the insurer must ask the client when applying for compulsory motor liability insurance is whether the vehicle will be operated with a trailer. Many vehicles are not used at all without a trailer. Driving with a trailer on a policy that does not have the trailer ticked is an offence.

OSAGO for Europe

For cars that travel to Europe, you also need a compulsory motor liability insurance policy; most often, a green card is sufficient. In our company you can apply for any type of MTPL for Europe.

OSAGO for Crimea

The MTPL policy is mandatory throughout the Russian Federation, including for residents of Crimea. However, many insurance companies refuse to provide insurance as soon as they see the region of registration of the owner - CRIMEA.

OSAGO for apartments

An apartment is one of the best investments, so you need to insure it so that your investment does not go nowhere. Few people know that there is an analogue of OSAGO for an apartment.

OSAGO for accounting

It's no secret that without compulsory motor insurance it is impossible to register a car with the traffic police. However, many do not know where to apply for compulsory motor liability insurance for registration. Our company is ready to take on all obligations for obtaining insurance for your car. With our insurance, you are 100% guaranteed to register your vehicle with the traffic police.

OSAGO for Ukrainians

If you come from Ukraine, then in Moscow it will be difficult for you to obtain an MTPL policy for your car, so our company specializes in issuing MTPL policies for citizens with foreign rights, including Ukrainians.

OSAGO for educational vehicles

Training cars are associated with increased danger on the roads, so not every insurance company is ready to accept such cars, but we will select for you the best offers for compulsory motor vehicle liability insurance for training cars.

OSAGO for a leased car

If you have a leased car, then you understand how difficult it is to issue an MTPL policy for such a vehicle. However, our company is ready to help you with this.

Accident in the parking lot

Often, an accident does not happen on the road, but when the car is parked, what to do in this situation, because the second participant in the accident most often has already left the scene of the accident, and the damage to the car has been caused, is it possible to receive payment under compulsory motor liability insurance in this case?

Duplicate diagnostic card

Creating a duplicate of a valid diagnostic card has become a real problem. However, this article describes the solution. Read on to find out how to get a duplicate of the technical certificate.

Left OSAGO

Recently, fraud schemes involving fraudulent MTPL policies have become more frequent, and both paper policies and electronic ones are counterfeited; read the article on how to avoid becoming a victim of fraudsters.

Road accident without compulsory motor liability insurance

Almost every driver gets into an accident, but it is possible that one of the participants in the accident does not have a compulsory motor liability insurance policy. What should you do in this case? options for solving the problem.

Working as an insurance agent under compulsory motor liability insurance

To become an insurance agent for issuing MTPL policies for all categories and regions, you need to leave an application and our specialists will provide you with all the necessary access to a whole range of services!

OSAGO for a tractor

One of the types of special equipment that require registration of compulsory motor liability insurance is tractors. However, many tractors are not a segment of the insurance company, so the owners of such vehicles hear refusals from insurance companies. Read the article about how to get a policy for a tractor.

OSAGO for a combine harvester

Agricultural combines require a compulsory motor liability insurance policy during their operation, but where are they issued and how to do this? If everything is clear with passenger cars, then it is difficult to insure a combine harvester.

OSAGO for a scooter

Official registration of a compulsory motor liability insurance policy for a scooter, as well as other small motorcycles, has become a big problem lately, so our company is opening special offers for compulsory motor liability insurance for scooters.

OSAGO for ATV

One of the most common types of special equipment is an ATV, and it is a full-fledged participant in the movement, so it is necessary to take out a compulsory motor liability insurance policy for it.

OSAGO with delivery

OSAGO with delivery to AutoPlus is the most convenient way to get insurance without leaving your home. The courier will deliver the policy to any place you want and at a time convenient for you - quickly and without any problems.

OSAGO for a dump truck

A dump truck is not a very common type of special equipment, so it may have problems with insurance under MTPL, but you need to get insurance. Read the article about how to make a policy for a dump truck and what difficulties may await you when applying for it.

OSAGO for an excavator

One of the types of special equipment that you can order from our company is excavators. In many insurance companies you will hear a refusal, since an excavator is not a segment, but not with us. We have been issuing compulsory motor liability insurance for excavators for more than 5 years, working with both legal entities and individuals.

OSAGO for a truck

One of the riskiest businesses is the transportation of goods. It is important that the trucks used for transportation are officially insured, but many do not know where and how to do this.

OSAGO for a snowmobile

Not all insurance companies insure such a unique type of equipment as a snowmobile, but situations often arise when the vehicle needs to be transported to another location and a compulsory motor liability insurance policy is required for the move. Taking out insurance for a snowmobile.

OSAGO for tractor

Registration of an MTPL policy for special equipment is a big problem for both individuals and legal entities. One of the problematic types of special equipment is the tractor. Read the article on how to apply for insurance for a tractor.

OSAGO for special equipment

Registration of compulsory insurance policies for various types of special equipment is a very difficult task, as it turned out. Many insurance companies prohibit insuring various types of special equipment.

OSAGO for registration

Is it necessary to take out a compulsory MTPL insurance policy in order to register a car and how to do this, read the article. Many drivers wonder whether insurance is needed to register.

OSAGO for the haul

There are situations in which it is necessary to take out a compulsory motor liability insurance policy for a short period of time to move a vehicle and one place to another; read the article on how to do this.

OSAGO category C

Recently, it has become a problem to issue an MTPL policy for category C vehicles; many insurance companies refuse to insure trucks, since they do not fall under the insurance segment. Read the article about how to apply for a policy.

CASCO for taxi

One of the specializations of our company is issuing CASCO policies for taxis. Taxi is one of the riskiest businesses for a car, so it is important to apply for CASCO insurance to be sure that you will not be left with nothing if the taxi gets into an accident. Read more about registering CASCO insurance for a taxi in the article.

OSAGO category D

Category D is one of the problematic categories when applying for an MTPL policy, but our company is ready to help you and obtain insurance for a category D vehicle without any problems. Read more about the design of category D in the article.

Osago for taxi 2019

Taxi is one of the most popular vehicle segments, millions of drivers are employed in the taxi industry and therefore changes in taxi insurance will affect a large number of people in 2021.

Number plates of Russian regions on cars 2019

Region codes in Russia are written on state license plates. Each region corresponds to a specific code, but sometimes it is necessary to identify a particular region by its code or, conversely, by its region code. Regions of Russia in 2021.

Registering a car with the traffic police 2019

All vehicles in the Russian Federation are subject to mandatory registration. How to register a car in 2021, what’s new in the process of registering a car with the traffic police.

Driving license categories 2019

There are a large number of different categories of driver's licenses and not everyone knows what this or that category means. The article provides a convenient table of categories, with which you can always find out all the necessary information.

Access to registration of E-OSAGO

Now there are a large number of platforms for issuing E-OSAGO policies, to which we can give you access so that you can independently issue an OSAGO policy and receive a commission.

OSAGO without inspection

If you want to take out a MTPL insurance policy, but you are sent to have your vehicle inspected, then we can help you and issue a policy without inspecting your car.

How much does it cost to get your license in 2021?

Every year, thousands of people want to take the driving test at the traffic police and get a driver's license. If you have already attended a driving school, then you will be interested in the cost of passing the exam at the traffic police.

Car re-registration in 2019

How to re-register a car to a new owner in 2021, as well as what reasons exist for re-registration, all these issues are discussed in the article.

Do I need to take an exam when replacing a license 2019

Many drivers are interested in the question of whether they will need to retake the exam when replacing their license in 2021. Let's answer this question, because many drivers have already failed, for example, the theoretical part of the exam.

Replacement of rights in 2021

Since licenses are issued for a certain period, there comes a time for every driver when he needs to change his license, but not everyone knows where and how to do this. Read about the process of replacing rights in the article.

OSAGO day to day

Today, electronic MTPL policies are valid only after three days, but what to do if you urgently need a MTPL policy and you don’t have time to wait 3-4 days. In this case, you can contact Our company and we will issue you a paper policy on the day of your application!

OSAGO for pensioners

Such a group of the population as pensioners in our country is not particularly wealthy, so issuing a compulsory motor liability insurance policy is a very difficult task for them, as it hits their wallets hard. However, in our company, all pensioners receive an additional discount when applying for compulsory motor liability insurance. Special MTPL program for pensioners.

OSAGO in 2021

OSAGO is a type of insurance that concerns all car owners, therefore changes in the process of registration and calculation of insurance for a vehicle concern almost every citizen of our country. Read about changes in the field of auto insurance and compulsory motor liability insurance in particular in 2021 in the article.

Inspection in 2021

Changes are inevitable, if you want to know what will happen to car inspection in 2021, then read the article. The article provides comprehensive information about diagnostic cards and technical inspection in general. VET and OTO registers in 2021.

OSAGO for foreign citizens

Every day a huge number of foreign citizens from near and far abroad come to Russia. Naturally, foreigners may sometimes need a compulsory motor liability insurance policy in order to move around the territory of the Russian Federation by car. About how to apply for compulsory motor liability insurance for foreign citizens.

Electronic PTS in 2021

It's no secret that one of the main trends in our state is the transfer of all document flow to electronic form. This trend also affected vehicles. Electronic PTS will be introduced in 2021. About the pros and cons of a new type of documents.

OSAGO for old cars

If you are the owner of an old car, then you have already understood or will understand that getting compulsory motor liability insurance for it is not such an easy task and not all insurance companies undertake to insure such vehicles; read the article on how to insure an old car.

OSAGO-rural and village registration

Many people who come to large cities have a rural or rural residence permit (registration) and it is not at all easy for them to get an MTPL policy in the city, since insurance companies begin to put spokes in the wheels and do not issue the policy. What to do if you still need to take out a policy.

OSAGO with temporary registration

Often people who have a temporary registration wonder whether they will be able to get car insurance. Temporary registration itself does not limit the issuance of a policy, however, there are some nuances that you should know...

OSAGO with registration in the region

Recently, people who are registered in the regions of Russia are faced with the problem of applying for a car insurance policy in Moscow. Read the article about why this happens and how to apply for a policy with registration in the region.

OSAGO for Daewoo Matiz

One of the problems faced by owners of low-power cars such as Daewoo Matiz is obtaining an MTPL insurance policy. Read about why it is difficult to get insurance for a Matiz and how to do it in general.

How is insurance paid to pensioners?

OSAGO is designed to guarantee the liability of a motorist if an accident occurs due to his fault. In order for the victim to receive payment, the accident must be correctly recorded. The action plan and procedure for insurance compensation for pensioners do not differ from the standard ones.

Using the Euro protocol:

- Fill out the protocol form together with the culprit.

- To obtain evidence, take photos from the scene of the incident.

- Come to the Investigative Committee office within 5 days after the accident.

- Draw up and submit an application for compensation, provide the car for evaluation.

- Receive a referral to a service station for repairs or expect a cash payment.

Article on the topic: Features of KBM in OSAGO

Registration with a call to the traffic police:

- Call the traffic police or emergency commissioner.

- Wait until they arrive and fill out the protocol.

- Contact the department and make a request for a copy of the protocol.

- Appear at the traffic police office to pick up the case materials.

- Come to the insurer's office to write an application for compensation and provide evidence of the accident.

- Present the car for damage assessment.

- Wait for compensation.

The insurer will independently offer the most convenient compensation option: repairs at the station or cash payment. Service station services are available to companies in large cities where they have official representative offices.