What is loss of marketable value of a car?

TPV is the loss of marketable value of a vehicle, which means that your vehicle has suffered damage that causes the vehicle to lose its original value.

A similar interpretation is given in the Resolution of the Supreme Court of the Russian Federation; according to this interpretation, UTS means nothing more than damage, which in turn refers to insured events.

To explain this in simple words, that is, translated into human language, TTS is a significant reduction in the quality of your car, including its appearance.

Receiving compensation through court

The judicial practice of collecting vehicle insurance under CASCO insurance is extremely contradictory. If the TTS agreement is included in the list of exclusions of grounds for payment or stipulates a natural form of receiving compensation, it is almost impossible to achieve compensation. In all other cases, most often the court sides with the victim.

Penalty for evading a court decision

If the insurer refuses to satisfy the court decision, the victim may apply to the court for payment of a penalty and interest for the use of funds.

Who is entitled to receive payment?

TPV is a parameter that reflects the difference between the cost of a car before an accident and the price of a car after an accident or any other incident and recovery.

Everyone has the right to expect payment, but only under certain conditions, which include the fact that CASCO must provide for payment in the event of loss of the marketable value of the car. But again, even this point does not apply to all points.

According to current laws, the vehicle only applies to the following vehicles:

- A car from the Russian automobile industry should be no older than three years, and a foreign one no older than five.

- A car from a domestic manufacturer should be worn out by no more than 35%, and a foreign one by no more than 40%.

- The mileage of your car should be no more than 50,000 kilometers for a domestic brand and no more than 100,000 for a foreign one.

There is also a clause that the TTS will not be paid if the damage to the car is not related to the insured event or the car can be easily restored using first-complexity repairs.

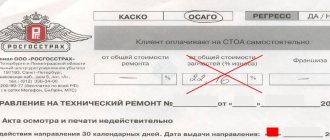

UTS under CASCO subject to repair at a service station

After an accident or careless repair, the car is only restored, but does not restore its property value.

This refund applies to vehicles (VMV) for the following types of repairs:

- if the distorted body geometry has been reset;

- partial or complete replacement of body parts that cannot be removed;

- Repair of individual moving and non-moving parts of the body;

- full or partial painting of the body, as well as painting of plastic elements (spoilers, bumpers, mirror housings, etc.);

- complete disassembly of the interior, which can lead to damage to the factory assembly.

These repairs can significantly reduce a vehicle's market value, which is why they apply to both accident-damaged and non-accident vehicles.

After all, a car that was not involved in an accident, but has undergone the above-mentioned repair work, is also subject to the insurance calculation of the UTS.

What are the subtleties of calculation?

At the moment, in our country there are several methods of calculation to compensate for the TCB. The authors of one of the methods are the Central Bank of the Russian Federation. Their methodology is based on the law on compulsory motor liability insurance, and specifically Article 12.1 clause 3. There are also methods of the Ministry of Justice and Halbgewax. The disadvantage of the method is that it is focused only on foreign cars.

To calculate compensation for vehicle insurance using the Halbgewax method, the following data is required: the age of the car, the price of parts, repair costs and labor costs. First of all, the cost of the car on the market is taken and divided by the cost of a completely new car, the result obtained is multiplied by 100% and if the answer is less than 40%, then it makes no sense to calculate the vehicle price.

The calculation of the TTC by the method of the Ministry of Justice has been used since immemorial 2013. Nowadays, it is relevant only in court proceedings, if it comes to conducting an examination. The goal is to determine the cost of car repairs and in the assessment of the vehicle. The object of study is the machine or data provided by the owner. According to this methodology, the amount of LTV (loss of marketable value) will be directly proportional to the type of damage and its characteristics.

And finally, the method developed by the Central Bank of the Russian Federation. This method also has its own subtleties and nuances of calculation. The authors of this technique proposed special rules for determining how to photograph a car; there are certain rules for photographing a car and many other information.

What the law says

Payment of vehicle insurance under CASCO insurance is not stipulated in any legislative act. As for the insurance itself, its nuances are spelled out in the Law of the Russian Federation under number 4015-1 and the Civil Code of the Russian Federation. The relationship between the parties (the policyholder and the insurer) is based on an agreement with the terms of cooperation and the signatures of the participants. The Civil Code of the Russian Federation (clauses 1 to 4) states that citizens and insurers have the right to prescribe conditions that suit them in the agreement.

The Civil Code of the Russian Federation (Article 929, paragraph 1) states that the transfer of an insurance payment is possible upon the fact of an insured event (taking into account the conditions specified in the agreement between the parties). In other words, in the absence of vehicle insurance in the form of a separate risk, the insurer is not obliged to pay compensation under CASCO. This statement can also be found in the definition of the RF Armed Forces under number 16-КГ17-38.

In the case of compulsory motor liability insurance, the opposite situation has developed. For this type of insurance, compensation under UTS is mandatory from January 25, 2015. This is due to the attribution of loss of marketable value to part of the damage received as a result of the accident. The rule also applies in cases where the car is sent to a service station for repairs.

How can I receive payments?

The whole principle by which the money will be paid. If the contract contains a clause regarding such payments, then the insurance company will definitely pay them, as this is provided for in the contract.

To receive payment, you need to come to the insurance company with which you entered into an insurance contract and fill out an application in accordance with all the requirements.

It is drawn up in two copies, one copy remains in your hands, the second remains with the insurance company.

There are situations when insurers refuse to accept applications made by their own company, or they assure that they do not accept such papers. Only a competent lawyer who specializes in such issues will help you here.

There is a certain algorithm for how to receive payment via UTS:

- Submitting a claim to the insurance company.

- It is necessary to contact independent experts (persons not interested in paying compensation) so that they can help you establish the extent of the loss and properly document all this.

- Filing a lawsuit if you are denied compensation for loss of market value.

- You urgently need to prepare all the necessary papers that indicate that you own a vehicle.

- It is necessary to request all the papers from the service station (service station) where the car was repaired, which will indicate exactly what parts are needed, their cost and the cost of all work.

- Adding help form 154.

If the car has already undergone repair work after an accident, then the driver must submit a package of certificates that are collected by the traffic police.

Already at the very first stage, it is necessary to collect such papers as: CASCO policy, insurance passport, right to drive a vehicle. If an examination is suddenly needed, the results are also added.

How to calculate the amount of payments under TCB

To understand how much TTS you can expect, you will have to contact a special appraiser. He makes a calculation, taking into account which components of the transport object were damaged and how this affected the characteristics and appearance of the vehicle.

IMPORTANT! You can only count on receiving this payment if no more than 24 months have passed since the incident.

There are two main methods used for calculation:

- Ministry of Justice;

- Halbgevaxa.

The first is used more often because it is recognized by the court. It consists of multiplying the cost of the car before the incident by special coefficients, which are taken from a list approved by the Ministry of Justice.

The second method has a similar calculation procedure, but takes into account other indicators. It is used to determine the vehicle's vehicle vehicle's vehicle's age no more than 60 months.

To carry out the calculations, you need to know two coefficients:

- Relative cost of repair A. A = (CO/CR) * 100%.

- The ratio of the price of work to the price of spare parts B. B = (CP/SM) * 100%.

Where, СО – cost of repair;

CR – the price of the vehicle at the time of the incident;

CP – cost of work;

SM – price of materials and spare parts.

After this, using a special table, you will need to determine the final coefficient for calculating the TCB.

Having found out the value of the coefficient, you can determine the desired value:

UTS = (K/100) * (CR + CO).

Features of the application

Design in a free style, since the law does not provide for a form. The application states the following: in the header of the document you must indicate your passport details, mobile phone number and email. The text of the application must indicate the events in which the car was damaged (accident, someone damaged it, and so on). At the bottom of the document you must indicate where you need to transfer the money (bank card number, etc.), the date on which the application was submitted and do not forget the signature.

How to assess the loss of marketability of a car

Calculations are made based on an examination of the general condition of the car, losses incurred after an accident and the cost of repair work. Expert assessments can be carried out by private companies with a license or government specialists appointed by the court.

Stages of assessing loss of marketability:

- The applicant contacts a specialized company to determine the cost of the necessary repairs;

- The specialist appoints an exact place and time for the examination. This information is sent to the insurance company and all participants in the accident;

- On the appointed day, in front of witnesses, the expert takes measurements and provides an assessment report no later than 5 working days.

Who pays for the loss of a car's presentation in an accident?

It is legally established that all insurance payments are made at the expense of the insurer, except for cases specified in the contract or the insurance limit is exceeded for one of the types of insurance. When the latter event occurs, the claimant can submit a request for payment of TTC under another insurance or make a corresponding claim against the person at fault.

Calculation of compensation for loss of marketable appearance of a car in an accident

Payment for loss of the vehicle's marketable condition is carried out based on the calculation of the vehicle's technical value. Today there are many calculation methods. The most popular are the methods of the Guiding Document (the Ministry of Justice method) and Halbgewax.

Calculation of the loss of marketability of a car according to the “Guide Document” system occurs using complex mathematical formulas and calculations. Therefore, it is used only by insurance experts. In contrast, the Halbgewachs method is quite simple to calculate, although it is not so popular among specialists and is used more as an additional or verification method.

The calculation is made using the formula:

VTS = (Maximum value coefficient of VTS ÷ 100%) × [(Price of a used car ÷ Price of a new one)/100%+ Total cost of repairs)]

Let's look at it using a separate example.

On February 15, 2021, in Chelyabinsk, at the intersection of Komarova and Salyutnaya streets, a collision occurred between a Renault Logan 2016 car and a Toyota Camry 2013. The cause of the accident was traffic violations by the second driver. At the time of the collision, the market value of Renault was 390 thousand rubles. The amount of repair losses is 81.9 thousand rubles. The cost of a new vehicle is 420 thousand rubles.

UTS=(4.25÷100)×[(390÷420)×100%]+81.9)=7.427 thousand rubles.

There are some rules for using the calculation of loss of marketability of a car:

- The service life of this vehicle does not exceed 5 (for a foreign car) and 3 years (for a domestic car).

- The maximum wear level is 35%.

- The mileage of a foreign car is up to 100 thousand km, domestic – 50 thousand km.

Loss of the vehicle's marketable appearance according to the law

Legislative norms of the Russian Federation protect owners of MTPL and CASCO insurance packages from unlawful actions of the insurance company. With the right approach to resolving the issue, you can achieve full compensation for the TTS, even if you have to file a claim with the courts.

How to get

To obtain CASCO insurance, the policyholder has the right to contact a specialist of the insurance company with which a valid property insurance agreement has been concluded. If the insurer refuses to voluntarily pay compensation for the loss of the marketable vehicle, then a claim should be filed with the judicial authorities. It is important to remember that the limitation period for UTS under CASCO is two years from the date of receipt of a written refusal from the insurance company. This also applies to the satisfaction of the UTS’s claim for compulsory motor vehicle insurance.

Required documents

To claim under CASCO vehicle insurance, you must fill out an application for vehicle insurance compensation, attaching the following documents to it:

- CASCO insurance contract;

- identification document of the applicant;

- passport of the representative (if interests are represented by a third party with a notarized power of attorney);

- driving license;

- conclusion of an independent commodity and transport examination on damage to the vehicle and the cost of restoration repairs.

Submission of the application must be recorded in the insurance company's incoming correspondence journal, indicating the date of receipt and the incoming number.

If the insurer refuses to consider the application for compensation for the vehicle insurance and resolves the issue by filing a claim in court, the list is supplemented with:

- statement of claim;

- a copy of the application to the insurance company;

- a written response from the insurer on the results of consideration of the insured’s application for payment of compensation;

- a copy of the traffic police report on the circumstances of the accident and the damage to the vehicle;

- a copy of the incident notice;

- a copy of the report on the occurrence of the insured event;

- an inspection report of the vehicle by an insurer's expert;

- agreement with an independent expert organization.

In addition to collecting the documents provided to the court, you should take a responsible approach to filling out the statement of claim.

How to write an application and sample correctly

A statement of claim based on the refusal of the insurance company to pay for insurance coverage under CASCO must be drawn up in simple written form. You can also type it on your computer. The document must reflect:

- the full name of the judicial body where the claim is addressed;

- information about the defendant (name of the insurance company);

- plaintiff's details;

- information about the second participant responsible for the traffic accident;

- the amount of the claim and the amount of the state fee paid;

- the name of the application and the subject of the controversial issue (in the center of the sheet);

- a statement of the sequence of legally significant facts (relationships with the insurer, details and subject of the contract, the fact of filing a claim, what response was received, etc.);

- provisions of regulatory documents confirming the violation of the rights of the plaintiff (policyholder);

- where, when and on what basis was an independent expert assessment of the cost of restoration repairs carried out;

- calculation of technical equipment;

- the essence of the claims (collection of auto insurance under CASCO, compensation for legal costs, state duties);

- a list of copies of documents attached to the statement of claim;

- date of application and signature of the applicant.

You can view the template for a statement of claim to the judicial authorities by clicking on the following link.

When will the insurance company pay the TTS?

Insurance companies often refuse to pay the TTS, because... not interested in additional costs. Most often, the reason for refusal is non-compliance with the insured event, namely:

- the client’s car is fully functional after repair;

- there are no fatal defects on the car;

- lost profits due to TTS are irrelevant, because the insurance does not cover commercial transactions with the car.

The decision of the Supreme Court established that the vehicle insurance is compensation, the payment of which is obliged to be made by the insurance company to the owner of the vehicle. At the same time, the TTS is equal to the costs of car repairs and replacement of failed units, and is paid along with them. From this we can conclude that TC can only be obtained together with compensation for the restoration of emergency transport.

Acceptable reasons for refusal to pay TCB

However, despite the Decree and payment obligations, insurance companies always provide for a number of cases in which the insurance policy is not subject to compensation if:

- the vehicle has been in use for more than 5 (foreign cars) or 3 (domestic) years;

- mileage is more than 100 thousand km for foreign cars and 100 thousand for cars of the domestic automobile industry;

- defective areas and faulty transport mechanisms requiring repairs already existed before the accident;

- car wear and tear is 35% or 40% for foreign cars and domestic models, respectively;

- the total amount of insurance compensation exceeds repair costs by more than 20%;

All these restrictions are directly related to the calculation of the size of the control system. In some cases, when the amount of compensation cannot be clarified or it exceeds the cost of the damage item, the TTS may not be paid:

- the vehicle already had defective areas and damaged components before the accident;

- repair of a faulty part exceeds the market value of a new analogue;

- visible points of unprofessional car repair or part replacement.

For these reasons, it is important to understand that the insurance company does not have to prove the existence of an uninsured event to deny payment. It will be enough that it is impossible to establish the final cost of the vehicle. To avoid these consequences during an accident, you need to record everything down to the smallest detail.

List of insurance cases under CASCO

But there are also positive aspects in matters of payment of TCB. Insured events include not only damage to vehicles in an accident; you can count on vehicle compensation in the following cases:

- collision in the parking lot and in the yard;

- collision during an emergency stop;

- damage due to natural and man-made incidents (large hail, fallen tree, industrial fire);

- arbitrary fire of a vehicle, provided that it was not caused by faulty electrics;

- illegal actions of vandals and robbers.

Insurance companies allow car owners to independently choose in which cases they want to insure their car. For example, if a vehicle is insured only against road accidents, theft and robbery, then if it is damaged at the hands of hooligans, insurance compensation will not be paid.

Compensation for vehicle insurance is possible if you have a CASCO policy, in which vehicle insurance is considered one of the components of the “Damage” risk.

If this clause is not in the contract, then the injured car owner may well turn to the culprit of the accident with a civil claim and demand compensation for damages privately in accordance with Art. 1064 of the Civil Code of the Russian Federation.

Refund is possible if:

- the risk is covered by the policy or you intend to sue the insurance company;

- the culprit of the accident was another person;

- repair costs of at least 5% of the cost of the car;

- The car is new and meets the parameters for calculating the vehicle vehicle.

However, there have already been precedents when policyholders have sought compensation for vehicle insurance from the insurance company even if compensation for vehicle insurance was not provided for in the contract at all. But this is done only in court, since the insurer did not recognize the vehicle accident as an insured event.

For the risk of loss of value, old cars (foreign cars older than five to seven years, and domestic cars older than three years) or those that are very actively used (for example, as a taxi or for transporting goods) cannot be insured. The amount of wear and tear on the vehicle should not exceed 35-40%, depending on the country where the car was produced.

It is unlikely that the company will agree to insure for this risk a car with existing serious damage (corrosion, deformed elements, etc.). The RTS is not calculated for very minor repair work, the so-called repair of the first category of complexity. The vehicle will not be assessed if the vehicle has already been repainted in the area that requires replacement.

In all other cases, the TTC can be calculated in monetary terms. An independent expert is invited to evaluate the TTS, who prepares his opinion and determines the amount of payment.

When calculating the amount of compensation, the wear and tear of the car and parts can play a very significant role. Exceptions are CASCO policies, which initially stipulate that payments are made without taking into account wear and tear.

Depreciation rates in each company are different, but for market leaders it is usually 20% for the first year, 12% for the second and subsequent years. The calculation of the vehicle's vehicle rating also depends on the amount of wear: if the machine is heavily worn, then this indicator is not calculated at all.

The CASCO insurance company does not compensate for the loss of marketable value of all vehicles. Thus, payment of compensation is provided in the following cases:

- Domestic vehicles with a service life of no more than 3 years, number of kilometers traveled - no more than fifty thousand, degree of wear no more than forty percent;

- Foreign vehicles with a service life of no more than 5 years, number of kilometers traveled - no more than one hundred thousand, degree of wear no more than forty percent;

- Freight vehicles with a service life of no more than two years;

- Vehicles that have not been involved in traffic accidents;

Payments for vehicle repair may be accrued if the amount required to repair the vehicle exceeds ten percent of its original cost. If the cost of damage to the car is less than ten percent, the CASCO insurance company has the right to refuse payment.

However, in practice, insurance companies refuse to make payments, citing the fact that loss of value is not included in the list of insured events for which payments are due. To avoid such a refusal, you need to:

- At the time of concluding the insurance contract, discuss the terms of payment of insurance policy if necessary;

- Find out which of the listed insurance cases, if necessary, can be interpreted as loss of value of the car;

- Ask to familiarize yourself with insurance programs that provide payments for TTS;

- In the contract, specify the maximum/minimum amount of payments under the TTS (preferably as a percentage);

By confirming all of the above nuances at the stage of concluding the contract, the car owner will have a greater chance of receiving the required payments under CASCO insurance for vehicle insurance.

Otherwise, if the insurance company refuses to compensate for the loss of value, the vehicle owner will have sufficient grounds to file a corresponding claim in court.

A pre-trial claim is drawn up on behalf of the policyholder in the name of the insurer. In it, the dissatisfied car owner sets out the essence of filing a complaint, as well as the requirement to pay a certain amount of the TTS, which was determined by an independent appraiser (attach the document of the independent assessment to the claim). In addition, the complaint refers to a possible appeal to the court.

A sample claim for payment of TTS can be downloaded below, or downloaded from the official portal of the insurance company.

Anti-insurance - standard block

Read about how to sue an insurance company for CASCO here.

To do this, you will have to draw up a statement of claim for the recovery of vehicle insurance from the insurance company. A sample claim can be downloaded on the Internet, obtained by directly applying to the court, or drafted by seeking the help of a qualified lawyer.

Loss of commodity value (LCV) is damage caused to elements and components of transport, as well as surfaces during repairs, technical inspection or during a traffic accident, as a result of which the selling price of the car is reduced and the appearance deteriorates.

In other words, UTS is a decrease in quality and damage to the external car.

IMPORTANT! If the market value of a vehicle decreases, as well as in the event of an accident or in the absence of the culprit, insurers in court are asked to include calculations of the loss of market value in compensation for CASCO insurance.

There are several methods that are used to calculate the vehicle's vehicle technical characteristics. You can independently calculate the loss of marketable value using the methodology of the Guidance Document, however, this calculation will be of a reference nature, since no one will consider it at the official level.

FAQ

Is it possible to receive compensation for vehicle insurance simultaneously under OSAGO and CASCO?

No - you can only compensate for the loss of market value using one type of insurance.

Is it possible to receive compensation if the policy provides for repairs instead of payment of indemnity?

Yes, you can still count on payment under the vehicle insurance policy, even if the car was repaired at a service station for insurance purposes. However, you will only be able to receive compensation for certain types of work:

- Changing or restoring body geometry after serious damage

- Replacement, including partial, of attached body parts

- Repair of removable and non-removable body parts

- Painting, including partial painting, of parts and body parts

- Violation of factory assembly during disassembly for the purpose of overhaul

If the car belongs to one person, and the policy is issued to another, who will receive compensation?

In this case, only the owner of the car can count on compensation. He will also have to fill out an application and order an examination.