The Russian car market in 2021, with all the variety of car models, offers the buyer only the most popular ones - budget categories of sedans and a dozen luxury models. At the same time, many German cars with an average price tag and excellent equipment remain inaccessible to buyers from Russia.

What to do if a domestic dealer is not ready to offer the desired model of a German car, but you really want to get it? There is only one way out - buy a vehicle in Germany and deliver it home yourself. The procedure for customs clearance of a car in 2021 is not simple, but if you approach the matter competently, it will take a minimum of time and investment.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

What is customs clearance and why is it needed?

Any product crossing the border will undergo customs clearance in 2021. This procedure is popularly known as “customs clearance” and is necessary for free – legal – movement by car throughout the country.

Clearing a car through customs actually means obtaining legal permission to use the vehicle in Russia. This will allow you not to fear a meeting with law enforcement agencies, as well as to avoid fines and sanctions for “bypassing” customs clearance.

The categories of persons required to clear customs cars from Germany at the border are:

- Individuals and legal entities who import vehicles into the country for subsequent sale.

- Individuals who import cars for personal use and possible resale.

- Individuals who enter the country for a limited time in 2021.

The customs service will ask you to present documents for the car from Germany to verify the authenticity, after which the motorist will be asked to pay the import duty for the vehicle. The procedure is necessary for several reasons:

- Check the legality of purchasing a car to prevent cases of theft and other crimes.

- Calculate the cost of the duty taking into account the age of the vehicle, engine size and other parameters.

- Bring practical benefit to the country by replenishing the state budget.

When buying a car in Germany, it doesn’t hurt to make sure that the seller is honest. This will allow you to avoid problems at customs and bring the car safely to Russia (for example, if you bought a stolen car, customs officers have the right to seize it).

How to order a car transfer from Moscow?

Car transportation from Moscow

Buying a car in Moscow is attractive for many reasons. They offer a wide range of models, the ability to choose colors, and prices that are lower than in other regions. Anyone who owns a car in the capital will need to drive it from Moscow to their region of residence.

If you are young, energetic, have a lot of free time, and have an idea of how much it costs to drive a car from Moscow to your city, then you can go on a long journey on your own. But practice shows that there are many reasons that motivate you to look for a ferry driver from Moscow. These include:

- lack of a driver's license of the required category;

- poor driving skills;

- lack of time;

- reluctance to take risks with a new car (in this situation the road is the master of the situation).

Driving trucks on your own causes even greater difficulties. In addition to excellent driving skills, permits and time to obtain them are required.

Normative base

The procedure for registering foreign cars at customs is regulated by several legislative documents of the Russian Federation. These include:

- Customs Code. Contains general rules for customs clearance and the procedure for completing the procedure.

- Federal Law No. 5003-1 “On Customs Tariffs”, which contains tariff standards depending on the technical and other indicators of the vehicle.

- Decree of the Government of the Russian Federation No. 870 of August 30, 2012. “On the recycling fee”, which sets out the rules for calculating and paying these fees.

- The Code of the Russian Federation “On Administrative Offences”, which stipulates the responsibility of citizens for violation of customs procedures.

Terms and cost of customs clearance services for cars from Germany

On average, customs clearance of a car in Russia takes 1 day!

The price and cost of “customs clearance of cars” imported into the Russian Federation from Germany in our company are the minimum on the market and are discussed individually depending on the tasks and place of customs clearance. And on average they can be:

- for individuals: from 5,000 rubles;

- for legal entities or individual entrepreneurs (IP): from 10,000 rubles.

We are confident that we will become your reliable partner at customs!

When is it necessary to clear a car from Germany through customs in 2021?

Customs legislation is characterized by strict measures for the import of vehicles into the country. The owner has 24 hours to provide the car from Germany for inspection by an inspector and pay all duties, including tax. During this time, it is necessary to deliver the car to the customs point for the procedure for obtaining the necessary documents that allow further import of the vehicle.

Residents of the country in 2021 have the right to defer payments for up to 6 months (but up to 2 times within 1 year), provided that the vehicle is registered in another state. In case of violation of legislative acts, the person responsible for importing the car risks receiving a fine for an administrative offense, as well as being involved in a criminal case.

Requirements for customs clearance of a car from Germany

Key laws of Russia (as well as other countries of the Customs Union, including Germany) contain a number of standard requirements for regulating the import of vehicles in 2021. So:

- Legal entities and individuals have the right to import cars and trucks.

- The amount of financial fees is subject to individual calculation. Here they take into account the status of the person (individual/legal), the purpose of import (for personal use or sale), the cost of the car, engine parameters and other details that make up the financial side of customs clearance of a car from Germany.

- The amount of the customs rate does not depend on the country of origin of the imported car (with the exception of Russian-made vehicles). At the same time, all payment transactions can be carried out both in rubles and in foreign currency.

- In 2021, the import into the country of vehicles from Germany with a high class of environmental hazard (all vehicles below the Euro-5 class) is legally prohibited.

- A private person has the right to import no more than 1 car within 1 year. It is possible to use a preferential tariff rate.

- Importing a car from Germany requires filling out a declaration. This is the key document according to which customs duties are calculated in 2021.

If you are inexperienced in vehicle customs clearance, it is better to use the services of brokers, since the customs clearance procedure is quite complex (checking the legality of the purchase and other nuances), both in terms of organization and legal literacy.

Basic requirements of the customs clearance process

The laws of the Russian Federation stipulate the basic rules for the import of foreign-made cars. Among them:

- Both legal entities and individuals have the right to import vehicles from Germany and the European Union. No more than one car per year is allowed for private import. If you need to bring more than one car during the year, you must obtain special permission from customs. When an individual imports a car three or more times, all customs duties are levied on him as a legal entity.

- The amount of customs duty for the import of foreign cars is the same for all cars brought from EU member countries.

- Cars with an environmental class below Euro 5 are prohibited for import and customs clearance in Russia.

- In each individual case, the cost of customs clearance of a car from Germany may have a different meaning. There may be several reasons for this:

- Who is importing the vehicle - an individual or legal entity;

- Year of car manufacture;

- Volume of the car's internal combustion engine;

- Power;

- Environmental class;

- Special equipment – presence or absence;

- Other features.

- The declaration and its filling out is an integral part of the car customs clearance process, since the amount of customs duty is calculated on the basis of this data.

- The customs clearance process for cars imported from Germany is the same for the entire territory of Russia.

IMPORTANT! If all customs documents are filled out correctly, the customs clearance process takes no more than one day. If violations are detected, this time can extend up to two weeks.

Required documents

A responsible approach to importing a car will help reduce unnecessary costs and save a lot of time, but for this you need to take care of the full package of documents. Including from the seller on the German side. After all, the success of crossing the Russian border largely depends on the correctness of their preparation.

To clear customs of a car from Germany in 2021, you will need the following documents:

- Internal and foreign passport of a citizen who is directly involved in the import of cars.

- Technical passport of the vehicle (necessarily foreign).

- Certificate confirming environmental safety.

- Clearly filled out form in form T1 (transit declaration).

- Completed declarations TD-6 and TD-7 (the latter gives the right to preferential import).

- Purchase agreement or mortgage.

- Transit permit, license plate (transit) and insurance.

Do not forget that correctly completed documents are already half the success. Carefully check all the papers on the spot, because even a small typo can play a cruel joke when passing the border.

Step-by-step instructions for customs clearance of cars from Germany in 2021

The procedure for completing customs clearance of a car in 2021 begins with the provision of all prepared documents to customs officers and follows a few simple steps:

- As soon as you arrive at the Russian border, you must submit a completed declaration to customs. The employee enters all the information specified in it in a special journal and assigns a unique number to the entry.

- The verification of received documentation begins. The information specified in the declaration is carefully verified with the accompanying documents for the vehicle from Germany. Just at this stage, the inspector has the right to reject consideration of the case if inaccuracies, errors or insufficient information are discovered during the inspection.

- A technical inspection is being carried out. The actual condition of the car must correspond to that stated in the papers.

- If the check is successful, the customs officer signs the declaration and puts the necessary stamps.

- The last step is to calculate the cost of fees. The verified documents and the finished calculation are sent to the relevant departments, where the information received is entered into a common database for control checks (for search purposes, the number of imported vehicles during the year, etc.).

Upon completion of the inspection, the owner is issued a vehicle passport and a certificate for the right to import this car from Germany into Russia (one copy is kept by customs officers).

Customs clearance taxes

The total amount of payments and tax on a car from Germany during customs clearance in 2021 is calculated depending on the year of manufacture, vehicle category and other parameters that form the final figure. In total, the car owner will have to pay:

- Customs duty.

- Customs clearance.

- Recycling collection.

- Duty for import of vehicles.

- VAT 18% (value added tax).

To pay the duties and fees established by law, the car owner must provide a number of information:

- Vehicle make and country of origin.

- The exact year of manufacture of the car.

- Type, power and engine size.

- The actual cost of the car.

- Indicate the owner's status.

If all the documents are collected, you can start paying taxes and fees.

Basic customs fees and documents

Before you find out how much customs clearance of a car costs, you need to study what duties and fees are required to be paid. The list includes:

- Value added tax. Its calculation depends on many factors, including customs fees, duties and recycling fees. Thus, it varies depending on the vehicle specifications and the tariff.

- Excise tax It is fixed and is calculated from the amount of the cost of the car, which is determined at the customs post.

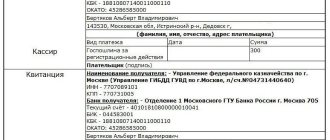

- Recycling fee. The funds will be used in the future for the recycling of vehicles in the event of their decommissioning. The rate depends on the age of the vehicle. If it is more than 3 years, the amount will increase. Payment is made by the car owner himself. The process goes through the treasury account. However, to confirm the correctness of the calculation, he is obliged to provide a package of documents to the authorized body.

- Customs duty. It is considered a mandatory amount that is charged on all goods (trailer, cars, motorcycles). The legislation specifies parameters on which in the future it will depend on how much customs clearance will cost in relation to customs duties. These include the type of fuel consumed, engine power, cylinder volume, year of manufacture, etc. Based on this data, accurate collection calculations can be made using a special calculator.

- Duty. The rate of such a fee is fixed in the legislative document of the customs authority. It is determined depending on the type of vehicle.

It should be understood that all customs clearance procedures related to the payment of taxes and fees cannot always be easily and quickly carried out independently. Therefore, most car owners turn to special companies or services for help that can provide consultation or handle the process on an individual basis.

However, payment is only one of the necessary actions in order to import a car into Russia. It is important to collect the necessary package of documents, on the basis of which it will be possible to calculate the cost of customs clearance of the car and obtain an import permit. Depending on the type of transport and other parameters, the list of documents may vary. The standard list includes:

- documents for the vehicle (provided together with copies);

- customs declaration;

- certificate confirming the presence of the GLONASS system;

- car insurance policy (together with the contract).

The package of documents may include other certificates, certificates, passports, etc.

The cost of customs clearance of a car from Germany in 2021

The formation of the duty in 2021 directly depends on the age of the imported car from Germany, therefore it is divided into the following categories:

- car with zero mileage;

- from 1 year to 3 years;

- from 3 to 5 years;

- from 5 years and older.

Each category is based on a specific tariff scale. The customs clearance price may be lower or higher depending on the engine volume of the vehicle (parameters are calculated based on m3 and a specific cost is obtained from them).

Features of customs clearance of cars (vehicles) from Germany to Russia in 2021 by legal entities

The main feature when registering (customs clearance) of cars from Germany by legal entities or individual entrepreneurs is the need to check the presence of the manufacturer’s mark in the register of intellectual property objects (ROIS), which serves to protect the interests of copyright holders. If the car’s trademark is included in the ROIS, then to clear it through customs you will need to obtain permission - a power of attorney from the copyright holder in the Russian Federation.

Register of Intellectual Property Objects (ROIS)

In addition, you need to pay a fee, duty, excise tax, VAT and recycling fee, which is much more expensive for legal entities and individual entrepreneurs than for individuals.

Documents and information for customs clearance of a car in Russia by a legal entity or individual entrepreneur:

- Contract of sale;

- Invoice for payment of the vehicle;

- Registration of a legal entity or individual entrepreneur with customs;

- Technical certificate;

- Payment of a deposit at customs in advance (if the car is planned to be imported under its own power);

- Documents for installing GLONASS;

- OTTS or SBKS depending on the age of the car;

- Payment of recycling fee.

Table for calculating payment at a single tariff

The final amount of the customs clearance fee determines the cost of the car from Germany. You can calculate it using the table:

| Cost of a car from Germany (in rubles) | Fee amount (in rubles) |

| Up to 200,000 | 500 |

| 200 000 – 450 000 | 1 000 |

| 450 000 – 1 200 000 | 2 000 |

| 1 200 000 – 2 500 000 | 5 500 |

| 2 500 000 – 5 000 000 | 7 500 |

| 5 000 000 – 10 000 000 | 20 000 |

| 10 000 000 – 30 000 000 | 50 000 |

| Over 30 million | 100 000 |

| *The fee for motorcycles is 250 rubles | |

Tariff schedule

It is advisable to visualize how the tariff changes depending on the technical parameters of the car using tables in order to develop an understanding of how much it costs to clear a car from Germany through customs.

Individuals:

| Car price | Tax rate |

| Up to 8500 euros | 0.54 |

| Up to 16,700 euros | 48%, but not less than 3.5 euros per 1 cubic meter. cm. |

| Up to 42300 euros | 48%, but not less than 5.5 euros per 1 cubic meter. cm. |

| Up to 84500 euros | 48%, but not less than 7.5 euros per 1 cubic meter. cm. |

| Up to 169,000 euros | 48%, but not less than 15 euros per 1 cubic meter. cm. |

| Above 169,000 euros | 48%, but not less than 20 euros per 1 cubic meter. cm. |

The amount is also affected by the year of manufacture and engine size of the car.

Legal entities:

| Up to 1000 cc cm. | Up to 1500 cc cm. | Up to 1800 cc cm. | Up to 2300 cc cm. | Up to 3000 cc cm. | Above 3001 cc cm. | |

| Up to 3 years | 0.23 | 0.23 | 0.23 | 0.23 | 0.23 | 0.23 |

| From 3 to 5 years | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 |

| From 5 to 7 years old | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 | 0.25 |

| Above 7 years | 1.4 euros per 1 cubic meter cm. | 1.5 euros per 1 cubic meter cm. | 1.6 euros per 1 cubic meter. cm. | 2.2 euros per 1 cubic meter. cm. | 2.2 euros per 1 cubic meter. cm. | 3.2 euros per 1 cubic meter. cm. |

Customs clearance of cars from Germany not older than 3 years

To calculate the cost of importing “young” cars from Germany not older than 3 years, use the following table:

| Car price (in Euro) | Duty amount as a percentage of engine volume |

| Up to 8 500 | 54% or not less than 2.5 € / 1 cm3 |

| 8 500 – 16 700 | 48% or not less than 3.5 € / 1 cm3 |

| 16 700 – 42 300 | 48% or not less than 5.5 € / 1 cm3 |

| 42 300 – 84 500 | 48% or not less than 7.5 € / 1 cm3 |

| 84 500 – 169 000 | 48% or not less than 15 € / 1 cm3 |

| Over 169,000 | 48% or not less than 20 € / 1 cm3 |

The information is relevant for new cars with minimal mileage, where the actual price and age of the vehicle are indicated. For example, an inexpensive car from Germany in 2021 can be cleared through customs for 2.5 Euros per 1 cm3 of engine volume and pay a customs duty of 54% of the cost of the car.

Customs duties on imported goods

Expensive items that a citizen takes with him across the German border are subject to customs duty. The maximum value of goods exempt from duty in 2021 is:

- 300 € - for each person on land transport.

- 430 € – for passengers of airliners and sea vessels.

- 175 € - for children under 15 years old on any transport.

More expensive property must be declared by contacting the customs control point. For example, your watch costs 500 €, which means you need to include it in the declaration and pay import duty. For goods and things from EU countries, the conditions are different.

Which goods from EU countries are subject to duty?

If you bought expensive items for personal use in any EU state, then Germany allows you to transport them into its territory without customs duties. However, quantitative restrictions have been introduced on some goods from the EU:

- Cigarettes - 4 blocks (40 packs of 20 pcs.).

- Cigarillos - up to 400 pcs.

- Cigars - 200 pcs.

- Tobacco by weight - up to one kg.

- Alcohol with a strength of over 22% - 10 l.

- Wines, liqueurs - 20 l.

- Champagne - 60 l.

- Beer - 110 l.

- Coffee and coffee drinks - 10 kg.

Sample German export declaration

Exceeding the approved volumes is subject to the excise duty law. There is a separate rate for each product category. For example, the import of cigarettes into Germany is regulated by the legal norm “Tobacco Tax Law” (TabStG), § 2 “Tax rate”.

Most Germans manage to transport larger quantities and avoid paying duty, citing purely personal use.

What duty is required for importing goods into Germany from third countries?

Duty-free import of goods into Germany from non-EU countries is stricter in 2021. The amount of transported property is limited. If you are accompanying cargo worth more than 300 € or 430 €, but not more than 700 €, you will have to pay a fee of 15–17.5% of the cost.

A rate of 15% applies to preferential states: Turkey, Canada or Ukraine. Goods and things valued at over 700 € are taxed according to a certain scale of rates, which is guided by the customs controller. Payment is charged immediately after settlement.

If it is not possible to pay the fee on the spot, a 10-day period is provided to fulfill the obligation. In this case, the goods will remain at customs as collateral.

Passing customs control in Frankfurt am Main:

Customs clearance of cars from Germany older than 3 years, but not older than 5 years

If the car has crossed the 3-year mark, but has not reached 5 years of age, the calculation principle changes slightly:

| Engine capacity (cm3) | Duty amount for cars from 3 to 5 years old |

| Up to 1,000 | 1.5 € / 1 cm3 |

| 1 000 – 1 500 | 1.7 € / 1 cm3 |

| 1 500 – 1 800 | 2.5 € / 1 cm3 |

| 1 800 – 2 300 | 2.7 € / 1 cm3 |

| 2 300 – 3 000 | 3 € / 1 cm3 |

| Over 3,000 | 3.6 € / 1 cm3 |

Customs payments for customs clearance of a car by an individual

The price of customs clearance of a car from Germany in 2021 for individuals differs from the price of customs clearance for legal entities and individual entrepreneurs (IP) and is regulated by Decision No. 107 of December 20, 2017. Table 1 shows the uniform rates of customs duties and taxes payable.

Table 1. Customs duties on cars from Germany for individuals

| Categories of vehicles for personal use, bodies of vehicles for personal use | Customs duties, taxes payable |

| Passenger cars (except for cars specifically intended for medical purposes) and other motor vehicles intended primarily for the transportation of people, classified in heading 8703 of the EAEU CN FEA (except for vehicles specified in paragraphs 1 and 4 of Table 2 in 107 Solutions): | |

| For cars less than 3 years old: | |

| worth up to 8500 euros equivalent | 54% of the cost, but not less than 2.5 euros per 1 cubic meter. cm engine displacement |

| costing more than 8,500 euros, but more than 16,700 euros in equivalent | 48% of the cost, but not less than 3.5 euros per 1 cubic meter. cm engine displacement |

| costing more than 16,700 euros, but not more than 42,300 euros in equivalent | 48% of the cost, but not less than 5.5 euros per 1 cubic meter. cm engine displacement |

| costing more than 42,300 euros, but not more than 84,500 euros in equivalent | 48% of the cost, but not less than 7.5 euros per 1 cubic meter. cm engine displacement |

| costing more than 84,500 euros, but not more than 169,000 euros in equivalent | 48% of the cost, but not less than 15 euros per 1 cubic meter. cm engine displacement |

| worth more than 169,000 euros equivalent | 48% of the cost, but not less than 20 euros per 1 cubic meter. cm engine displacement |

| For cars more than 3 years old, but not more than 5 years old: | |

| whose engine displacement does not exceed 1000 cubic meters. cm | 1.5 euros per 1 cubic meter cm engine displacement |

| whose engine displacement exceeds 1000 cubic meters. cm, but does not exceed 1500 cubic meters. cm | 1.7 euros per 1 cubic meter cm engine displacement |

| whose engine displacement exceeds 1500 cubic meters. cm, but does not exceed 1800 cubic meters. | 2.5 euros per 1 cubic meter. cm engine displacement |

| cm engine displacement exceeding 1800 cc. cm, but does not exceed 2300 cc. cm | 2.7 euros per 1 cubic meter. cm engine displacement |

| whose engine displacement exceeds 2300 cubic meters. cm, but does not exceed 3000 cubic meters. cm | 3 euros per 1 cubic meter cm engine displacement |

| whose engine displacement exceeds 3000 cubic meters. cm | 3.6 euros per 1 cubic meter. cm engine displacement |

| For cars over 5 years old: | |

| whose engine displacement does not exceed 1000 cubic meters. cm | 3 euros per 1 cubic meter cm engine displacement |

| whose engine displacement exceeds 1000 cubic meters. cm, but does not exceed 1500 cubic meters. cm | 3.2 euros per 1 cubic meter. cm engine displacement |

| whose engine displacement exceeds 1500 cubic meters. cm, but does not exceed 1800 cubic meters. cm | 3.5 euros per 1 cubic meter. cm engine displacement |

| whose engine displacement exceeds 1800 cubic meters. cm, but does not exceed 2300 cc. cm | 4.8 euros per 1 cubic meter cm engine displacement |

| whose engine displacement exceeds 2300 cubic meters. cm, but does not exceed 3000 cubic meters. cm | 5 euros per 1 cubic meter cm engine displacement |

| whose engine displacement exceeds 3000 cubic meters. cm | 5.7 euros per 1 cubic meter. cm engine displacement |

From the table we can conclude that customs clearance of used (used) cars from Germany, aged from 3 to 5 years, is most profitable!

In addition to the specified payment, you must pay:

The recycling fee when importing a car is paid once. It is intended for disposal of the vehicle after removal from service. For individuals, the size of the recycling fee depends on the age of the car.

Table 2. Recycling fee for cars from Germany for individuals

| Recycling collection | |

| car less than 3 years old: | 3400 rubles |

| car over 3 years old: | 5200 rubles |

Customs duty is paid for processing the customs declaration; its amount for individuals depends on the value of the car.

Table 3. Customs duty on cars from Germany for individuals

| Declared value of cargo upon import | Rates of customs clearance fees |

| Inclusive up to 200,000 rubles | 500 rub. |

| Over 200,000 rubles and inclusive up to 450,000 rubles | 1000 rub. |

| Over 450,000 rubles and inclusive up to 1,200,000 rubles | 2000 rub. |

| Over 1,200,000 rubles and inclusive up to 2,500,000 rubles | 5500 rub. |

| Over 2,500,000 rubles and inclusive up to 5,000,000 rubles | 7500 rub. |

| Over 5,000,000 rubles and inclusive up to 10,000,000 rubles | 20,000 rub. |

| Over 10,000,000 rubles | 30,000 rub. |

Customs clearance of cars from Germany over 5 years old

The calculation of the amount for cars from Germany over 5 years of age will differ from the previous categories:

| Engine capacity (cm3) | Duty amount for cars over 5 years old |

| Up to 1,000 | 3 € / 1 cm3 |

| 1 000 – 1 500 | 3.2 € / 1 cm3 |

| 1 500 – 1 800 | 3.5 € / 1 cm3 |

| 1 800 – 2 300 | 4.8 € / 1 cm3 |

| 2 300 – 3 000 | 5 € / 1 cm3 |

| Over 3,000 | 5.7 € / 1 cm3 |

An example of calculating customs clearance of a car from Germany in 2021

If you decide to buy a German car in the manufacturing country, do not be lazy and make a preliminary calculation. This will help to estimate the real costs of customs clearance in Russia. Let's look at 2 examples - for a “young” and an “old” car.

To carry out the calculation in 2021, it is necessary to determine the year of manufacture, as well as clarify the approximate price tag and engine size of the desired vehicle. First, we calculate the duty on cars under 3 years old:

- Volkswagen Polo brand. Released March 30, 2021. Costs 5,000 Euro. The engine capacity is 1.2 liters (or 1,200 cm3).

- Let's look at the calculation table for cars not older than 3 years. The cost of the vehicle does not exceed 8,500 Euro. Accordingly, the calculation looks like this:

Duty based on interest rate: 5,000 (price) x 0.54 = 2,700

Duty by engine volume: 2.5 x 1,200 (volume) = 3,000

- From the resulting calculations we always choose the larger value. The total fee will be 3,000 Euro.

Now let’s calculate the duty for a car that has crossed the 5-year mark. So:

- Brand BMW X3. Released April 10, 2010. Costs 35,000 Euro. The engine capacity is 3 liters (or 3,000 cm3).

- The age of the vehicle is suitable for the table of cars older than 5 years. We get the duty amount: 5.7 x 3,000 = 17,100 Euro

If you calculate the duty on a car of a similar brand that is not younger than 3, but not older than 5 years, the amount will be as follows: 3.6 x 3,000 = 10,800. Examples clearly show that it is much more profitable to clear customs for cars of “middle” age.

Therefore, when purchasing, take a closer look at the release date: perhaps the chosen car will be over 3 years old in a week, and will allow you to save a lot on customs clearance.

Is it possible to drive a non-customs cleared car?

The customs law allots exactly one day to complete all procedures in 2021 - providing the car for inspection by an inspector and paying the required fees, duties and taxes.

Otherwise, the responsible person receives a serious fine for single violations, when the total amount of the debt does not exceed 1 million rubles, and is also subject to criminal prosecution if the unpaid fees amount to more than 1 million rubles.

However, in 2021, the law provides for exceptions that allow you to drive a non-customs cleared car from Germany through Russian territory. The measures are temporary and apply to 2 categories of persons:

- Citizens of a foreign country who have registered a temporary stay of a car in Russia. You will not have to pay fees, duties and taxes if the vehicle is registered in another country. From the moment of entry, the period of movement of a car within the Russian Federation is limited to 1 year.

- Russians who bought a vehicle with registration in another state and entered the territory of Russia under the form of temporary import. In this case, the law allows the free movement of the car for 6 months (with the possibility of extending this “privilege” once), after which duties, fees and taxes must be paid in full.

The procedure for temporary stay is regulated by one of the provisions of the customs legislation “Agreement on the procedure for movement” with the participation of “Instruction on the procedure for performing customs operations” No. 311 of June 18, 2010.

The order was rejected

In the 1990s, you could make good money by driving a car from abroad. Forums where former drivers communicate are replete with nostalgic phrases: “I made money in Moscow,” “I moved about 6,000 cars in 14 years.” From one car, the driver received on average from 3 to 6 thousand “coins” - dollars, deutsche marks, francs (remember, the euro was introduced only in 1999).

There were two schemes for buying and selling cars. According to the first, the person agreed in advance with the client that he would bring him a specific car, for example, “a BMW 5-series in the back of an E34, produced in 1993 with a 2-liter engine and a leather interior.” The search circle was narrowed, time was saved. True, the income was not the greatest, since the client often knew perfectly well how much such a car costs abroad, and it was not possible to “wind up” much. They took it in turnover - you could manage to turn around 3-4 times in a month and, as a result, earn good money.

The second option is “for luck.” The driver was traveling abroad, where he bought the most popular brands and models of cars in Russia. Here there was more room for increasing the price, which is where those “up to 6 thousand per car” came from. And with a successful situation and a quick sale of a popular brand, it was possible to go for the goods in a month and return back up to 2-3 times.

Today, single people have practically fallen out of the picture, automobile expert Igor Morzharetto shares his memories: “The payment for the services of one person is quite high. He has to come to the place, eat on the road, pay for gas, this adds overhead costs to the final price of the car. As a result, business today is justified only if transport costs are reduced. And this can only be done by transporting several cars at a time on car carriers. And this type of hauling still exists.” The classic haul “died” also because Russia has a good secondary vehicle fleet.

There were two main areas in which distillers worked in the 90s. The European territory of Russia up to the Urals was saturated with cars from Europe, mainly from Germany. In addition, there was a small, but quite status-bearing “trickle” of American cars, which were transported by ferry to the Finnish port of Kotka or to the German Hamburg.

And in the Far East, Siberia and partly in the Urals, right-hand drive Japanese women ruled the roost! At the same time, in the heyday of the era of driving, the situation reached the point that in Vladivostok, for example, even municipal service cars were right-hand drive. Japanese spare parts that were integrated with our cars were also popular.

Today, the transport of Japanese cars to the Far East is more likely to be alive than dead. “Although the scale is, of course, no longer the same, up to 20 thousand used cars come to Russia from Japan every year. At the same time, in the heyday of the distillation, up to 400 thousand pieces were imported. There were about the same number from Europe,” the expert recalls. Today, he continues, they are trying to get around the duties in different ways. “They have invented and continue to invent “constructors”, when a car is disassembled and imported into the country under the guise of spare parts, for which you need to pay a lower duty. And here it is already being assembled back and documents are selected for it. But this path is very criminalized in essence,” the expert notes.

The route has changed orientation today. Only exclusive cars are brought to order from Europe, the future owner of which understands exactly what he is willing to pay for. But inside Russia there is freedom for business. Different regions have different prices for used cars. As a result, cars are driven from cheaper regions to more expensive ones. Mainly from Moscow and large cities to the south and the Urals. However, this is no longer as profitable as it used to be. “You can save a little on logistics and receive the ordered car from a car transporter, and not from a private driver. The second way to save money is through people who can help you find a cheaper car. But at the same time, the benefit will still be a maximum of 100-150 thousand rubles, the profit is scanty, and there are too many problems and wasted time,” the expert sums up.

What are the dangers of driving a car that has not been cleared through customs in 2021?

For violation of laws, the state provides sanctions that the owner of a car from Germany risks receiving if they are unaware of or deliberately violate customs procedures. Regulates the procedure for punishment. 16 Code of Administrative Offenses of the Russian Federation and Art. 194 of the Criminal Code of the Russian Federation. The total amount of “fines” in 2021 directly depends on the form of the offense:

- The deadline for filing a customs declaration was delayed - from 1 to 2.5 thousand rubles.

- Payment of customs charges was delayed - from 500 rubles to 2.5 thousand rubles.

- They committed other violations regarding the import/export of vehicles - from 1 to 2 thousand rubles.

- The export of a car imported into the country temporarily was delayed for up to 2.5 thousand rubles.

In case of repeated violation of legal acts, a citizen may completely lose his car on legal grounds, and if the accumulated debt exceeds 1 million rubles, criminal liability is provided.

The risks are as follows:

- The fine for late payment is from 100 to 500 thousand rubles.

- Community service for a total of up to 480 hours.

- Imprisonment for up to 2 years (or community service of a similar duration).

Follow the legal framework in order to clear the purchased car through customs without consequences.

Autonomy and intermediaries

It is problematic for an ordinary person without experience to bring a car from abroad on their own. Difficulties can lurk at any stage - from selecting a good copy and ending with clearance at customs.

Professional firms are not always honest with the client. Most drivers openly inflate mileage in order to make more profit, and some even buy damaged cars and cheaply return them to their salable condition on the way to Russia, for example, in Lithuania. A common situation: a buyer sets the task of finding a specific car with a mileage of no more than 100,000 km. Pickers look for a good copy within the agreed amount, but with twice as much mileage. After some simple manipulations, the satisfied client receives a car with the desired mileage.

The drivers prefer cars from Germany. German cars have always been cheaper, and local operation can be called gentle. For example, in France or Belgium, cars with similar mileage and age are much more tired (both the body and the components), although they may be cheaper. If a car has driven less than 100,000 km in Germany, it can be considered practically new.

The drivers prefer cars from Germany. German cars have always been cheaper, and local operation can be called gentle. For example, in France or Belgium, cars with similar mileage and age are much more tired (both the body and the components), although they may be cheaper. If a car has driven less than 100,000 km in Germany, it can be considered practically new.

What innovations are planned for 2021?

In the near future, favorable conditions for customs clearance of cars from Germany await citizens who import cars with powerful engines. Thus, with an engine volume from 2,800 cm3 to 3,200 cm3, the duty can be reduced to 12.5%.

In 2021, special preferences will be given to SUVs and crossovers of the “Sport Utility Vehicle” type (sports-utility cars) with all-wheel drive. With an engine capacity of 3,500 - 4,200 cm3, the duty will drop to 12.5%, and for cars with an engine capacity of over 4.2 liters, the fee will be 10% of the nominal value.

However, you should not delude yourself prematurely, since the amendments have not yet been adopted and plans can be adjusted at any time. Let us remind you that no fundamental changes are expected in the segment of “light” cars, except for an increase in the cost of vehicles against the backdrop of a weakening ruble. Accordingly, this will increase the cost of customs clearance of the car.

In conclusion, about the nuances of uncleared cars from Germany

Sometimes motorists, without studying the legislative framework, are somewhat naive about going through customs. It is a mistake to believe that buying a car in another country without registering ownership automatically gives you the right to drive it throughout Russia using a general power of attorney from the official owner.

In fact, this is a direct violation of the law, since such a right can only be granted to foreign citizens who enter the country in private cars and for a certain period of time. Such an exception will not apply to Russians in 2021, and it is important to remember this so that traveling in a non-customs-cleared car from Germany does not “go sideways.”

Specifics of customs work

In 2021, the German customs service, in addition to excise and duty duties, performs the following functions:

- Controls migration flows.

- Fights smugglers.

- Promotes environmental protection.

Expanded powers are helped by the latest high-tech supervision equipment and modern infrastructure of the department. German Customs has the following assets:

- Administration - 43 buildings.

- Customs posts - 288 points.

- Commissariats - 23 objects.

- Operational customs - 8 objects.

- Laboratories - 5 objects.

- Payment acceptance branches - 4 cash centers.

Within the 30-kilometer border zone, the customs service has more powers than the German Land Police. Employees can inspect the car and search any person who arouses the slightest suspicion. The department has:

- Squads of operatives.

- Paramilitary security units.

- Canine service units.

Alleged violators are politely invited to voluntarily declare goods or hand over property prohibited for transportation into the country. Some citizens take advantage of the lack of borders and deliberately violate the rules of entry and exit from the country.

But to suggest that there are no border controls is misleading. Every visitor is monitored. In case of the slightest suspicion, the person will be questioned, and if necessary, his personal belongings will be thoroughly searched.