Car tax 2021 - canceled or not. Latest news for today, 12/06/2018.

The abolition of transport tax in Russia is one of the most discussed topics in motorist circles.

After all, there is an opinion that the principle of taxation itself is somewhat unfair. The controversy was further fueled by the information that President Putin signed a law abolishing the transport tax in Russia. Is this really so and what will change for car owners, we will consider in this material. Issues related to the regulation of transport tax are specified in Chapter 28 of the Tax Code of the Russian Federation. Also, Article 12 of Federal Law No. 436-FZ of December 28, 2017, amending the Tax Code, is devoted to it.

A new wave of rumors about the law on the abolition of transport taxes in Russia in 2021

Previously, in addition to the rules for calculating car tax, there was a specially designated line “for luxury” - an additional fee was imposed on all cars that cost more than 3 million rubles. For those who did not pay transport tax last year, everything will be written off this year. The President issued an order that now citizens who have an unpaid bill for using transport, starting in 2015 (and, accordingly, the penalty for this payment) will have all their debts written off. According to the new rules, the use of vehicles will begin without previous debts.

Indeed, a bill to completely abolish the transport tax was submitted for consideration on June 5, 2021. This caused a new wave of rumors related to changes in Chapter 28 of the Tax Code, which regulates the replenishment of the budget through fees from vehicle owners. But already at the stage of preliminary consideration, the document was rejected and on July 2 was transferred to the archive.

Has the transport tax been abolished in 2021?

For quite a long time, information has been discussed on various resources that Vladimir Putin signed a decree abolishing the transport tax. But is the transport tax really abolished in 2021? Answer: no. The document, which many perceive as a presidential decree on the abolition of the transport tax, is actually called Federal Law No. 436-FZ of December 28, 2017. In addition to amendments to other articles of the Tax Code of the Russian Federation, Article 12 deals with the recognition of bad debts for this type of tax obligations that arose as of 01/01/2015. Therefore, it is more correct to say that transport tax debts were canceled in 2018.

The tax amnesty will be carried out automatically. That is, vehicle owners do not have to go anywhere. If the car owner has regularly paid all his bills and has no debt obligations to the Federal Tax Service, he is not subject to Law No. 436-FZ, and no refund of funds from the budget is provided. Individuals and individual entrepreneurs can count on debt forgiveness. Consequently, legal entities will still have to repay all debts.

Law on the abolition of transport tax debts in Russia in 2018 for passenger cars

In Russia, every citizen or organization that owns a car is a tax payer. Moreover, it does not matter whether the car is used for its intended purpose, whether it is in good working order, how old the car is and what its power is - tax is required for any registered car. Organizations calculate taxes themselves.

Until 2021, the President of the Russian Federation signed a law regarding the cancellation of transport tax debts in the country. Law of November 27, 2021 No. 335-FZ with amendments to the Tax Code of the Russian Federation.

Putin signed a law that judged everyone. Now everyone is absolutely happy that new fair rules have been introduced. The President simply increased fuel prices. Gasoline has become more expensive, which means that heavy car users will pay much more than those who drive very rarely. Due to numerous requests, the uniform law was repealed. Now a person can have at least ten cars - he won’t pay an extra ruble for one. Payment for motor vehicles will be calculated from the increased excise tax on gasoline. Thus, whoever drives as much pays as much.

Some “experts” linked the abolition of the transport tax for passenger cars with the planned increase in the excise tax on gasoline. This reshuffling was justified by the fact that the burden applies both to persons who intensively use the car, and to those who have the car in the garage, even in a faulty condition. In the event of an increase in the excise tax and the abolition of technical requirements, large expenses would fall on the shoulders of active drivers, which, according to “experts,” would be fair. But these expectations were not justified - the TN was not replaced by increased excise taxes. And the increase in excise tax on gasoline itself, by decision of the Government, has been frozen since July 2021 due to a sharp increase in the cost of gasoline.

From July 1, rates have been reduced:

- -per ton of Euro-5 gasoline from 11,892 to 8,213 rubles;

- - per ton of diesel fuel - from 8,258 to 5,665 rubles.

In addition, in the future, in the event of a sharp jump in gasoline prices, there is an option to reduce the excise tax and increase the duty on Russian exports. Therefore, the abolition of transport tax due to an increase in excise rates is not expected even in the future.

Transport tax 2021 in Russia: how and when to pay

Since the abolition of the transport tax in 2021 (Putin provided only an amnesty) is very illusory, it is worth talking about some of the nuances of paying this fee. According to the existing norms of the Tax Code of the Russian Federation, it must be paid annually before December 1 of the year following the reporting year. For example, for 2021 you must pay before 12/01/2018. The amount of the fee depends on:

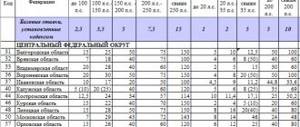

- region of residence;

- vehicle brands and models;

- Year of release;

- engine power.

You can find out the amount by using a special online calculator on the official website of the Federal Tax Service.

In addition, the tax office must send a notice indicating the amount of the payment. Tax authorities must send this document no later than 30 days before the deadline for payment. Having received the notification, the vehicle owner can make a payment. If for some reason the notification is not received before December 1, you should not hope that the Federal Tax Service has completely forgotten about the payment. It is recommended that you contact the tax authorities yourself, this will allow you to avoid the accrual of penalties and fines in the future. If the notification is received, but the owner of the vehicle is in no hurry to transfer the funds, the Federal Tax Service has the right to collect the funds forcibly.

In addition, according to paragraph 3 of Article 363 of the Tax Code of the Russian Federation, the Federal Tax Service cannot send a notification for more than three tax periods. That is, this year the Federal Tax Service can send notifications for 2021, 2021 and 2015.

Transport tax in 2021

At the moment, changes regarding the transport tax are only being considered by deputies. Among the possible changes is its cancellation and, as a result, an increase in the price of fuel. Thus, those who travel more often will pay more. The law received wide public support, since the current accrual system is not entirely fair.

Another option is to keep the law in place, but the tax will be calculated based on mileage rather than engine power. If no new laws are adopted by January 1, 2021, the calculation will be carried out according to the old scheme.

Cancellation of transport tax 2021 in Russia: pitfalls of amnesty

The amnesty for vehicle payments will not affect all debtors, as it might seem at first glance. Let's figure out why this situation has developed.

In 2021, tax authorities may send the payer a notice, which may include contributions for 2021, 2021 and 2015. Consequently, it will not be possible to recover amounts not paid before 2015. That is, in this case, the abolition of the transport tax (Putin signed the tax amnesty law) has no practical meaning.

Let's consider another case. The car owner has not paid for his vehicle, and the Federal Tax Service sends a corresponding notification. After this, the unscrupulous car enthusiast still did not repay the debt, and its amount began to exceed 3,000 rubles. In this case, tax authorities have the right to go to court to recover funds within six months. That is, the Federal Tax Service still retained the right to collect large debts. Moreover, the three-year collection period can be extended by court action.

If the debt does not exceed 3,000 rubles, tax authorities can monitor this debt for three years. And when it exceeds the established limit, you can apply for collection within six months.

From this we can conclude that the amnesty will affect those vehicle owners whose debt does not exceed 3,000 rubles.

Transport tax, cancellation 2021: latest State Duma news for today

Despite the fact that the adopted law is only an amnesty for debtors, it cannot be said that there is no chance that legislators will abolish the transport tax in 2021. After all, this issue is raised periodically in the State Duma. For example, in June of this year, bill No. 480908-7 was introduced. In it, legislators proposed canceling Chapter 28 of the Tax Code of the Russian Federation, and in return including the fee in the cost of fuel. This would allow for a more equitable taxation principle. Since the amount of the fee paid would directly depend on the frequency of use of the car. Despite the fact that this proposal received very wide public support, the project was rejected at the preliminary review stage. Thus, the law abolishing the transport tax from 2018 currently remains only a dream for car enthusiasts.

Presidential Decree on cancellation

However, on the Internet you will find the most contradictory information about this and a number of myths. According to the most common of them, Russian President Putin signed a decree abolishing the transport tax as such in Russia. And this applies to absolutely all car owners of any car.

That is, the tax is supposedly abolished as such altogether. And the change took place in the spring - in April 2021.

This turned out, unfortunately, to be untrue - in fact, this very distorted and transformed news came from two sources:

- Medvedev’s comment that the transport tax has been abolished for electric vehicles, but the regions do not take advantage of this,

- new law of 2021 on tax amnesty until 2015.

Even the Tax Service had to comment on such a flow of fake news about the abolition of the transport burden.

Car tax 2021 in 2021. Amendments are to be made to the law on transport tax

Collecting a transport tax from Russians is beneficial for the government. According to statistics for the current year, almost every second citizen of the country has his own vehicle, so the share of the budget from the horsepower fee is quite significant.

Different Russian regions may have different tax rates. It can be changed, but officials propose making it fixed throughout the country. It is interesting that some officials are proposing to abolish the transport fee altogether and replace it. For example:

- increase the general excise tax price on fuel and other combustibles;

- calculate the amount of the fee based on the environmental indicators of the vehicle;

- calculate the total tax amount not taking into account horsepower, but depending on engine size.

If you increase the overall excise tax price on fuel, the tax burden will be fairly distributed. Car owners who travel frequently will begin to buy fuel in larger volumes, therefore, the budget will be replenished more.

For whom the transport tax has been canceled in 2021, Putin’s decree: what is a transport tax

Transport tax is a tax levied on owners of registered vehicles. This type of tax is regional. Its amount, the procedure and terms for its payment, reporting forms, as well as tax benefits are established by the legislative authorities of the constituent entities of the Russian Federation. Federal legislation determines the object of taxation, the procedure for determining the tax base, the tax period, the procedure for calculating tax and the limits of tax rates.

The objects of taxation are cars, motorcycles, scooters, buses and other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, motor boats, jet skis, non-self-propelled (towed vessels) and other water and air vehicles registered in accordance with the established procedure in accordance with the legislation of the Russian Federation.