Today, tax authorities send individuals an invoice for taxes that must be paid, so car owners believe that there is no need to know how the calculation is carried out and what affects it.

However, this is quite important information, especially when buying a car.

So, knowing what the transport tax on a car depends on, you can choose a more economical car that will not be too expensive to maintain and pay taxes.

For passenger cars

Tax legislation establishes that transport tax calculations are carried out only in accordance with the documents submitted to the tax authorities (Article 362 of the Tax Code of the Russian Federation).

Transport tax rates are established in Art. 361 of the Tax Code of the Russian Federation, however, at the regional level, entities can independently set the size of rates. The law specifies that the bet should not exceed ten times the amount.

The following factors influence the amount of transport taxation:

- place of vehicle registration;

- vehicle category (trucks, passenger cars, self-propelled vehicles);

- car power;

- age of the vehicle;

- how long the car has been owned.

From the age of the car

As for the age of the car, the transport tax depends on the year of manufacture according to the letter of the Ministry of Finance of the Russian Federation dated January 18, 2012 N 03-05-05-04/01.

The document establishes the procedure for determining the years that have passed since the car was produced. It is this information that is needed in transport tax calculations. The age of the car affects the tax rate.

This can be explained with an example: if the car has been used for more than 5 years and has a power of over 250 hp, then the rate in this case will be 45 rubles. for 1 hp , if the service life of the machine is 7 years, then the rate is 70 rubles. for 1 hp

The number of years of the car is determined as of January 1 of the year following the year of manufacture of the car.

From engine power

Another factor that is taken into account when calculating transport tax is the power of the car. Each region has its own rates, which depend directly on the power of the car. How does transport tax depend on horsepower?

Everything is quite simple, the lower the engine power, the lower the tax rate. The minimum power of a car that is subject to tax is 100 hp.

In this case, the minimum bet is 2.5 rubles. for 1 hp If the owner is the owner of a powerful car - 250 hp, then you will have to pay 15 rubles. for 1 hp

From registration

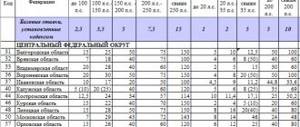

Depending on the place of registration of the car, the tax rates may vary. Look at this in more detail in the table.

Rates in different regions in 2019:

| Engine power | The amount of tax in the Tax Code of the Russian Federation for 1 hp. | Tax amount per 1 HP in Kemerovo | Maximum tax per 1 HP Novosibirsk city |

| up to 100 hp | 2,5 | 8 | 6 |

| over 100 hp up to 150 hp | 3,5 | 14 | 10 |

| over 150 hp up to 200 hp | 5 | 45 | 30 (up to 5 years in use) 22.5 - from 5 to 10 years 15 - more than 10 years |

| over 200 hp up to 250 hp | 7,5 | 65 | 60 - up to 5 years 45 - from 5 to 10 years 30 - more than 10 years |

| over 250 hp | 150 - up to 5 years 112.5 - from 5 to 10 years 75 - more than 10 years | 15 | 135 |

Thus, the table data shows that regional rates for passenger cars in 2021 differ markedly from those established by tax legislation.

It is worth noting that in Novosibirsk, when calculating transport tax, regional authorities also take into account the period of use of the car, and accordingly, the longer this period, the lower the tax rate.

For a small car up to 100 hp. in Novosibirsk you need to pay 6 rubles. for every hp , and in Kemerovo - 8 rubles. , which makes a fairly significant difference.

Fees included in the price of auto dealers

Despite the fact that all taxes and fees in this case must be paid by car dealers, because They are the ones who benefit from the sale of goods; in fact, such payments are usually included in the cost of cars:

- tax on the import of transport into the country;

- recycling collection;

- VAT.

As a rule, the overpayment in the form of taxes for the buyer reaches huge amounts, calculated from the total cost of the equipment. For example, consider the calculation using the following formula:

The starting price of the car in the showroom is VAT 18% – the price of customs duty – recycling fee.

For example, a Seat car in its basic configuration costs 750,000 rubles. To find out its value minus all taxes, you need to do the following:

750,000 – 135,000 (VAT) – 44,200 (disposal fee) – 345,928 (customs duty) = 224,872 rubles.

Thus, the actual cost of vehicles can be several times lower if all fees are subtracted from the prices, but it is not profitable for car dealerships to do this, because In this case, they will lose profit.

Tax on importing cars into the country

Each type of tax included in the cost of new cars should be considered separately, because Some of them must be paid not only by legal entities, but also by individuals.

For example, fees for importing vehicles into the territory of the Russian Federation, which consist of the following indicators:

- engine type: you will have to pay more for a diesel engine than for a gasoline engine;

- assessment of the cost of equipment in accordance with an expert opinion (can be carried out in individual cases);

- recycling fee for environmental control, in which case a certificate of conformity is issued;

- customs clearance fee.

The first part of the payments consists of customs clearance, and the second – taxes and fees. The amount of duty depends on the price of the vehicle, and this can be seen in the table below:

| Cost of the car (customs) | Amount of duty |

| Up to 325,000 rub. | 54%, but not less than 2.5 Euro per 1 cm3 |

| From 350,000 to 650,000 rubles. | 45%, but at least 3.5 Euro per 1 cm3 |

| From 650,000 to 1,625,000 rubles. | A similar percentage, but not less than 5.5 Euro per 1 cm3 |

| From 1,625,000 to 3,250,000 rubles. | The rate is at least 7.5 Euro per 1 cm3 or 48% |

| From RUB 3,250,000 to RUB 6,500,000. | 15 Euro per 1 cm3 or 48% of the customs value |

| More than 6,500,000 rubles. | 48% or 20 Euro per 1 cm3 |

The calculation of the cost of customs duties changes for cars “aged” from 3 to 5 years or more than 5 years, regardless of the country of origin.

There are several ways to clear cars through customs, which can save money, but are not entirely legal, and some of them carry administrative or even criminal penalties:

- Unit-by-unit import: STS and license plate numbers of supposedly “broken” vehicles are prepared, but instead, equipment of a similar brand is imported from abroad.

- Inheritance: a car is registered in the name of an elderly person, who subsequently includes this property in his will. When a citizen dies, the vehicle becomes the property of the actual owner, and inherited property is exempt from duties.

- Reducing engine displacement and increasing the year of manufacture. To do this, documents with incorrect data are fabricated in a foreign country.

- Temporary importation by a foreign mission. This option is only suitable for non-residents of the Russian Federation.

- Import of a car for special purposes for citizens with physical defects by social welfare authorities. As a rule, such equipment is documented as charitable assistance to a specific person from a foreign citizen, and the recipient is usually registered with social security.

Value added tax

VAT is another type of tax that may be included in the sales receipt when purchasing a car at a car dealership.

As a rule, it is displayed as a separate line in the document.

Buyers are not required to pay it, and some organizations may be exempt from it:

- companies that, due to their activities, already pay VAT;

- non-residents of the Russian Federation;

- executive authorities and other state or municipal organizations.

All enterprises belonging to the above circle can return VAT when selling equipment, because their money had already been spent on such purposes. To return the money, you must contact the territorial office of the Federal Tax Service with a corresponding application, because it is impossible to automatically return paid fees in Russia.

Let's look at an example:

Lux LLC purchased a car in March 2010 at a price of 150,000 rubles, and VAT in the amount of 22,000 rubles was also paid. and subsequently returned from the budget. A month later, the car was sold for 118,000 rubles, of which VAT was 18,000 rubles. The amount of depreciation during operation is 54,000 rubles.

The company's accounting policy provides for the determination of revenue for VAT on payment, so the original cost of the equipment, as well as depreciation and residual price, will be written off.

Recycling collection

This type of fee appeared in Russia only in 2012 in order to ensure the environmental safety of the environment and human health from the harmful effects of cars during their operation.

Initially, it was planned that all the money received in this way would be used to improve the environment, but now it is actually intended for the further safe disposal of each piece of equipment for which this tax was paid.

Some people believe that every citizen is required to pay a recycling fee when purchasing a car, but this is not at all true, because Such transfers are made only in two cases:

- If equipment is imported from abroad. For example, an individual buys a car in Japan and independently delivers it to Russia. The fee is paid once upon import.

- If a used car is purchased from a person who is exempt from paying the recycling fee or who has not transferred it within the established time frame.

Thus, recycling fees are paid only once for each vehicle, regardless of the number of owners. In most cases, this is done by car dealerships when delivering new cars.

There are several situations where citizens or organizations may be exempt from paying recycling fees:

- If the car is over 30 years old, it is used for non-commercial purposes, and the numbers of its engine, frame and body are also preserved.

- If the equipment is registered as the property of diplomatic missions and consulates, or employees employed in such bodies.

- If the transport is imported into the territory of the Russian Federation by a participant in the program for the resettlement of compatriots from abroad, and uses it for personal purposes.

The basic (minimum) recycling fee rate for passenger cars is RUB 20,000; for freight, passenger and commercial passenger transport – 150,000 rubles.

To save on taxes and fees, you should give preference to small cars with a small amount of horsepower and a small engine capacity per cm3. This will not only significantly reduce the amount of various payments, but also significantly reduce gasoline costs. There are no other ways to save, except for the use of benefits for certain categories of citizens.

Calculation example

You can calculate the cost of transport tax for a passenger car using a certain formula:

Tax rate x Car power x Car ownership period

So, if you own a VAZ 2103, which was purchased in February 2013, and deregistered in August 2013, the engine power of this car is 89 hp, accordingly, you need to pay the tax before October 1, 2015, then the amount tax will be:

Regional rate -12 rub. x power - 89 x tenure - 7 / 12 months = 623 rub.

This means that the transport tax amount will be 623 rubles. You can calculate the cost of tax using online calculators or go to the official website of the Federal Tax Service of the Russian Federation.

However, if the owner knows all the necessary data about the car, calculating the transport tax will not be difficult.

In this formula, the only thing you need to find is the established rate in the region where the car is registered.

So, if you calculate the tax on a hatchback with a power of 100 hp, then its amount in Moscow and the Penza region will be different: 12 and 14 rubles. respectively for 1 hp.

Thus, if the owner of the car lives in Moscow and owns a car with a power of up to 65 hp, then it is necessary:

65x12 rubles/1 (if the car was owned for 12 months) = 780 rubles.

If only 6 months, then the calculation will look like this:

65x12/*(12/6) = 390 rub.

In principle, the price is acceptable in both the first and second cases.

If we take into account the more powerful and executive class of Mercedes cars, whose power is 571 hp, then the rate will be equal to 150 rubles. , and the amount of transport tax for 12 months is 85 thousand 650 rubles.

Where does the transport tax money go

? Are pensioners exempt from paying transport tax? Read here.

Who is entitled to benefits?

There is a certain category of persons entitled to transport tax benefits.

Please note that such benefits are only available after you notify your tax office. To do this, you must submit an application in the prescribed form (1150063).

(PDF format).

When submitting an application, you do not need to attach documents and confirm your right to receive benefits - by law, the tax office itself is required to do this.

So, who gets tax breaks? The number of such persons is again determined by the regions independently. But most often their list is the same between most regions.

You can also find benefits in your region very easily. To do this, select yours in the form on the official website of the Federal Tax Service Nalog.rf, and you will see the corresponding legal act that regulates tax legislation in 2021 in your region. By searching this law you will find the benefits of your city.

For disabled people

Disabled people, in particular, are eligible for a vehicle tax reduction in 2021, but not everyone. Here's who they're entitled to:

- disabled people of groups I and II, but no more than for one car with a capacity depending on the region of no more than 100-200 horsepower,

- the same type of citizens of lower groups, but who received disabilities in combat - also for one car up to 100-200 hp,

- legal guardian of an incapacitated disabled person since childhood for one car with a power of no more than 100-200 hp,

- parent or guardian of the child.

Large families

One of the parents in a large family (more than 3 children) is entitled to a tax benefit, and here this most often does not depend on the power of the car.

Something else useful for you:

- What are the changes to traveling abroad with debts since October 2017?

- Is it possible to register a car with the MFC today and how? Instructions

- Tax was assessed on a sold car: how not to pay and can it be collected?

What parameters are taken into account when calculating tax?

Before you begin the calculations you must:

- Find transport tax rates for the required region, because each region has the right to set its own rates. Sometimes the tables even provide rates taking into account the year of manufacture of the car, in which case the table will be more expanded.

- Find the engine power in the car documents.

- Find out the year of manufacture of the car.

- Compare the data obtained with the table and multiply the indicated rate by the power of the machine.

In principle, everything is quite simple, the main thing is to find a valid table with rates for a specific region for the current year.

For trucks

When determining the calculation of transport tax on a truck, you need to pay attention to the provisions of Art. 358 of the Tax Code of the Russian Federation, which contains a list of vehicles that are subject to taxation and which are not.

The tax is calculated taking into account the power of the car engine, as a result of which, according to the established tariffs, you will have to pay:

| engine power up to 100 hp | 2.5 per 1 hp |

| 100 -150 hp | 4 rub. for 1 hp |

| 150-200 hp | 5 rub. for 1 hp |

| 200-250 hp | 6.5 rub. for 1 hp |

| more than 250 hp | 8.5 rub. for 1 hp |

In this case, the established federal tariff is indicated, which can be changed at the regional level, and accordingly the tax amount will also be higher.

It is worth noting that tax legislation prohibits raising rates by more than 10 times the established tariffs.

The deadline for paying the tax, as well as the mechanism for depositing the amount of money, is also set by regional authorities, so the tax on the same truck in different regions may differ significantly.

If the owner wants to save money, he needs to study the established rates in each region and register the car in a more profitable area for him.

So, for comparison, we offer regions where there is a tax on freight transport, with a power of 100 hp. cheaper:

| Chechen Republic | 200 rub. |

| The Republic of Ingushetia | 500 rub. |

| Krasnoyarsk region | 600 rub. |

| Chukotka Autonomous Okrug | 500 rub. |

| Transbaikal region | 1000 rub. |

The following areas were more expensive:

| Primorsky Krai | 2500 rub. |

| Kemerovo region | 2500 rub. |

| Leningrad region | 2500 rub. |

| Saint Petersburg | 2500 rub. |

| Moscow | 2500 rub. |

To calculate the transport tax, you only need to know the engine power and the tax rate established in the region.

If it is quite difficult to convert engine power into horsepower, then we provide you with a system in which 1 kilowatt = 1.359 hp.

If you still have difficulties with the calculations, you can turn to the Internet, where there are many online calculators that will calculate the transport tax to be paid.

The system will automatically calculate the amount; all you need to do is enter:

- the period for which tax must be paid;

- truck power;

- the region in which the car was registered.

Today, there are no legal ways to reduce the tax, but it is possible to register a car in a region where the tax rate is lower. This option is not prohibited by law, but it is not particularly encouraged.

For buses

If the tax rate for transport has not been established at the regional level, then the rates set out in the Tax Code of the Russian Federation are taken into account.

The formula for calculating transport tax for buses is similar to other vehicles:

Engine power x established rate x length of ownership of the car/number of months per year.

In principle, the power of buses is up to 200 hp. has a tax rate of 11 to 50 rubles. , depending on the city or country in which the bus is located.

So, today, having a fairly prestigious and powerful car is quite expensive and prestige in this case no longer matters, because in addition to paying a fairly large amount for transport tax, you also need to fork out for its repair, replacement of parts, and refueling.

Agree, all this pleasure is quite expensive, and the amount of tax can only rise every year.

Calculating the amount of transport tax is the responsibility of the tax authorities, who send a receipt with the amount and deadline for paying the tax.

If you do not pay the specified amount on time, you will also need to pay a fine and penalty.

To find out which cars are not subject to transport tax in 2021, see the article: which cars are not subject to transport tax.

What the new transport tax law says in 2021 is available on the page.

Where is the lowest transport tax in Russia in 2021 is shown in the table.

A selection for you!

Download forms and sample documents for motorists to a safe place.

List of vehicles not subject to transport tax

Each region has its own rules regarding cars and other vehicles that are not subject to mandatory state duty. The government of most constituent entities of the Russian Federation has exempted owners of domestic cars with a power of less than 100 hp from paying contributions. With. The following vehicles are not subject to any transport tax:

- cars equipped for use by disabled people (up to 100 hp), purchased or received from OSZN;

- tractors, milk tankers, machines for transporting fertilizers and other vehicles used for agricultural activities;

- motor, rowing boats up to 5 liters. With.;

- transport that is registered with institutions involved in passenger and freight transportation;

- military equipment used by government agencies.

If, according to local legislation, the vehicle is not subject to transport tax, but state duty has been assessed, the citizen must contact the Federal Tax Service. On the form from the tax office, you must indicate the number of the legal act, according to which the car is exempt from annual contributions.

An application for recalculation of the state duty can be left on the website nalog.ru, using the login and password received from the Federal Tax Service, or using an existing account on the State Services portal. Some individuals simply decide not to pay the erroneously assessed tax, but the existing debt will not be written off on its own. A penalty will be charged on the debt, so to write off the state duty you need to contact the Federal Tax Service.

Object of taxation

The object of taxation for the calculation of transport tax is vehicles. This definition includes: cars, motorcycles, scooters, buses and other self-propelled machines and mechanisms on pneumatic and caterpillar tracks, airplanes, helicopters, motor ships, yachts, sailing ships, boats, snowmobiles, motor sleighs, motor boats, jet skis, non-self-propelled (towed) ships and other water and air vehicles registered in accordance with the established procedure.

We will be looking at cars.

Procedure for calculating transport tax

To calculate transport tax, you need to know the amount of horsepower and the current tax rate. If everything is clear with horsepower, then the transport tax rate is set independently in each region.

The law establishes the following minimum tax rate limits:

| Name of taxable object | Minimum tax rate limit (rubles) | Maximum tax rate limit (rubles) |

| Passenger cars with engine power (per horsepower): | ||

| up to 100 hp (up to 73.55 kW) inclusive | 1 | 25 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 1,4 | 35 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 2 | 50 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 3 | 75 |

| over 250 hp (over 183.9 kW) | 6 | 150 |

| Motorcycles and scooters with engine power (per horsepower): | ||

| up to 20 hp (up to 14.7 kW) inclusive | 0,40 | 10 |

| over 20 hp up to 35 hp (over 14.7 kW to 25.74 kW) inclusive | 0,80 | 20 |

| over 35 hp (over 25.74 kW) | 2 | 50 |

When calculating transport tax, the number of months during which the vehicle was registered in the person’s name is taken into account. In this case, the month of vehicle registration is considered as a full month.

Towards the end of May of the following year, the tax office sends a notification about the calculation of the transport tax payable. It specifies the make of the car, the number of hp, the tax rate, the number of months and the deadline for paying the transport tax.

Example 1.

We will calculate based on the maximum bet. A VAZ 2114 car has 80 horsepower, which turns out to be 80*25=2000 rubles per year.

Example 2.

You purchased and registered a car on November 27, 2012. The car's power is 120 hp. We count at the maximum rate. 120 hp * 35 rubles * 2 months of 2012 (2/12) = 700 rubles payable for 2012.

Don’t be late in paying your transport tax, otherwise the bailiffs will start hunting for you, and as you know from the news, they come up with different ways to find a debtor.

The transport tax calculator is available on the tax website.

Are you satisfied with the transport tax rate in your region?

- Deadline for payment of transport tax

- Transport tax if owned for less than a month

- Transport tax for less than a month

- Transport tax on a stolen car

- Luxury car tax

- Car sales tax

- Transport tax for heavy goods vehicles

- Where to pay tax on a temporarily registered car

- You can get a tax deduction for studying at a driving school

- Transport tax in Crimea

- Transport tax for a snowmobile

- Transport tax for ATV

- Tax for parking space

- Transport tax will not be canceled

Every car owner wants to drive on roads “like in Europe.” And most of them are ready to make some effort for this. And although maintaining roads in working condition is the concern of the state, it still takes money from drivers for this.

Transport tax 2021 – calculator

| Engine power in hp |