Transport tax rates in the Altai Territory in 2021

| Vehicle type | Tax rate |

| Passenger cars [up to 100 hp ] [FL, YUL] | 10 rub. / hp |

| Passenger cars [from 100.01 hp up to 150 hp ] [FL, YUL] | 20 rub. / hp |

| Passenger cars [from 150.01 hp up to 200 hp ] [FL, YUL] | 25 rub. / hp |

| Passenger cars [from 200.01 hp up to 250 hp ] [FL, YUL] | 60 rub. / hp |

| Passenger cars [from 250.01 hp ] [FL, YUL] | 120 rub. / hp |

| Motorcycles and scooters [up to 20 hp ] [FL, YUL] | 6 rub. / hp |

| Motorcycles and scooters [from 20.01 hp up to 35 hp ] [FL, YUL] | 8 rub. / hp |

| Motorcycles and scooters [from 35.01 hp up to 45 hp ] [FL, YUL] | 15 rub. / hp |

| Motorcycles and scooters [from 45.01 hp ] [FL, YUL] | 50 rub. / hp |

| Buses [up to 200 hp ] [FL, YUL] | 50 rub. / hp |

| Buses [from 200.01 hp ] [FL, YUL] | 100 rub. / hp |

| Trucks [up to 100 hp ] [FL, YUL] | 25 rub. / hp |

| Trucks [from 100.01 hp up to 150 hp ] [FL, YUL] | 40 rub. / hp |

| Trucks [from 150.01 hp up to 200 hp ] [FL, YUL] | 50 rub. / hp |

| Trucks [from 200.01 hp up to 250 hp ] [FL, YUL] | 65 rub. / hp |

| Trucks [from 250.01 hp ] [FL, YUL] | 85 rub. / hp |

| Snowmobiles, motor sleighs [up to 50 hp ] [FL, YUL] | 25 rub. / hp |

| Snowmobiles, motor sleighs [from 50.01 hp ] [FL, YUL] | 50 rub. / hp |

| Boats, motor boats and other water vehicles [up to 100 hp. ] [FL, YUL] | 30 rub. / hp |

| Boats, motor boats and other water vehicles [from 100.01 hp ] [FL, YUL] | 100 rub. / hp |

| Yachts and other sailing-motor vessels [up to 100 hp. ] [FL, YUL] | 100 rub. / hp |

| Yachts and other sailing-motor vessels [from 100.01 hp ] [FL, YUL] | 200 rub. / hp |

| Jet skis [up to 100 hp ] [FL, YUL] | 125 rub. / hp |

| Jet skis [from 100.01 hp ] [FL, YUL] | 250 rub. / hp |

| Non-self-propelled (towed) vessels [FL, LE] | 100 rub. / hp |

| Airplanes, helicopters and other aircraft with engines [FL, LE] | 125 rub. / hp |

| Airplanes with jet engines [FL, YuL] | 100 rub. / hp |

| Other water and air vehicles that do not have engines [FL, LE] | 1000 rub. / hp |

| Other self-propelled vehicles [FL, LE] | 25 rub. / hp |

In order to calculate the amount of transport tax in the Altai Territory, it is necessary to multiply the tax rate by the number of horsepower of the vehicle.

Benefits for legal entities

They do not pay transport tax in the Smolensk region (or are entitled to payment at a reduced rate):

- Legal entities that have ambulances and fire trucks at their disposal;

- public organizations of disabled people;

- religious organizations and educational institutions founded by them;

- carriers ensuring the functioning of regular public transport routes;

- legal entities and individuals owning electric vehicles;

- aircraft organizations;

- enterprises engaged in international cargo transportation;

- Legal entities with at least 1,000 registered freight vehicles with engine power over 250 hp.

How is transport tax calculated?

First of all, it should be noted that the transport tax is a regional tax and in each region its value for different categories of transport can differ quite significantly.

The main parameter influencing the amount of the tax is engine power; it is not for nothing that this tax is popularly called the horsepower tax.

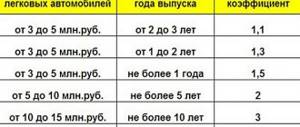

The formula for calculating the tax is simply the engine power multiplied by the appropriate coefficient. In some regional coefficients, the values differ for vehicles of different ages. See odds table below

250 horsepower

– this is the number of hp. after which the price almost doubles.

Procedure for calculating transport tax

The online transport tax calculator contains basic tariffs and rates required by law. In Art. 359 “Tax Base” lists the conditions under which the collection from a particular type of transport is calculated:

In Art. 361. “Tax Rates”, No. 117-FZ lists tariffs in rubles per horsepower, kilogram of traction force and per vehicle unit. We, as car owners, are interested in passenger cars.

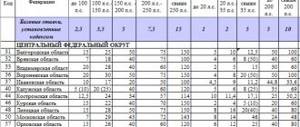

Table 1. Basic tax rate for transport tax for cars with a payload of up to 3.5 tons.

Engine power in l. With. (kW)

Prices for 1 l. With. very democratic and attractive. However, the basic transport tax table is the basis of tariffs. Regions set their own rates. They increase or decrease, but no more than 10 times the legal norm (clause 1, clause 2, article 361 of the Tax Code of the Russian Federation). In practice, many constituent entities of the Russian Federation have raised rates to the maximum, 10 times. For example, Moscow and St. Petersburg.

Now you can easily calculate transport tax yourself. To do this, use the formula: Br × Av × Ml × 1 = Int.

Transport tax calculator in the Altai Territory

Note:

If the link above does not work, or the information you are interested in is not available on the site, please let us know!

- Where to contact

- List of institutions (152)

- Reviews (7)

Online background check

Make an appointment

Personal Area

Send a request

Subscribe to thematic news and articles from GOGOV.RU. We will send you only the most interesting things.

Menu

- Services Housing issues Registration of housing ownership

- Dacha amnesty

- Privatization of housing

- Military privatization

- Support of housing transactions

- Coordination of apartment redevelopment

- Legalization of apartment redevelopment

- Housing disputes

- Compensation for damage from apartment flooding

- Recognition of the right to a share in unfinished property

- Collection of penalties from the developer

- Disputes over defects in new buildings

- Registration of ownership of a land plot

- Temporary registration for 90 days

- Receiving insurance compensation

- Consumer rights Protection

| The subject of the Russian Federation: | |

| Vehicle: | |

| Year of manufacture of the vehicle: | |

| Vehicle power: | l/s |

| Vehicle cost: | ₽ |

| Tax rate per 1 l/s: |

| Increasing factor: |

| The amount of tax on a vehicle is: |

Print page

Transport tax rates in the Altai Territory

| Name of taxable object | Rate (RUB) for 2021 |

| Passenger cars | |

| up to 100 hp (up to 73.55 kW) inclusive | 10 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 20 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 25 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 60 |

| over 250 hp (over 183.9 kW) | 120 |

| Motorcycles and scooters | |

| up to 20 hp (up to 14.7 kW) inclusive | 6 |

| over 20 hp up to 35 hp (over 14.7 kW to 25.74 kW) inclusive | 8 |

| over 35 hp up to 45 hp (over 25.74 kW to 33.1 kW) inclusive | 15 |

| over 45 hp (over 33.1 kW) | 50 |

| Buses | |

| up to 200 hp (up to 147.1 kW) inclusive | 50 |

| over 200 hp (over 147.1 kW) | 100 |

| Trucks | |

| up to 100 hp (up to 73.55 kW) inclusive | 25 |

| over 100 hp up to 150 hp (over 73.55 kW to 110.33 kW) inclusive | 40 |

| over 150 hp up to 200 hp (over 110.33 kW to 147.1 kW) inclusive | 50 |

| over 200 hp up to 250 hp (over 147.1 kW to 183.9 kW) inclusive | 65 |

| over 250 hp (over 183.9 kW) | 85 |

| Other self-propelled vehicles, pneumatic and tracked machines and mechanisms | 25 |

| Snowmobiles, motor sleighs | |

| up to 50 hp (up to 36.77 kW) inclusive | 25 |

| over 50 hp (over 36.77 kW) | 50 |

| Boats, motor boats and other water vehicles | |

| up to 100 hp (up to 73.55 kW) inclusive | 30 |

| over 100 hp (over 73.55 kW) | 100 |

| Yachts and other motor-sailing vessels | |

| up to 100 hp (up to 73.55 kW) inclusive | 100 |

| over 100 hp (over 73.55 kW) | 200 |

| Jet skis | |

| up to 100 hp (up to 73.55 kW) inclusive | 125 |

| over 100 hp (over 73.55 kW) | 250 |

| Non-self-propelled (towed) ships for which gross tonnage is determined (from each registered ton of gross tonnage) | 100 |

| Airplanes, helicopters and other aircraft with engines (per horsepower) | 125 |

| Airplanes with jet engines (per kilogram of thrust) | 100 |

| Other water and air vehicles without engines (per vehicle unit) | 1000 |

FILESDownload table of rates for 2021 in DOC format

Note to the table: the values in the Altai Territory are given for 2021, 2021, 2021, 2021, 2021, 2021. To select rates for a specific year, use the selector. These rates are applied in the cities of: Barnaul, Biysk, Rubtsovsk, Novoaltaisk, Zarinsk, Kamen-on-Obi, Slavgorod, Aleysk, Yarovoe and other settlements of the Altai Territory.

In the Altai Territory, more than 580 thousand transport tax payers are registered, on which 890 thousand vehicles are registered. In relation to citizens and legal entities, the norms and procedure for collecting taxes are regulated by regional law No. 66-ZS of October 10, 2002.

How to calculate car tax in the Smolensk region

Changes to OSAGO. The priority form of compensation for damage will now be restoration repairs at a service station. More details

Payment of tax and advance payments of tax is made by taxpayers to the budget at the location of vehicles in the manner and within the time limits established by the laws of the constituent entities of the Russian Federation. At the same time, the tax payment deadline for taxpayers who are organizations cannot be set earlier than the deadline provided for in paragraph 3 of Art. 363.1 Tax Code of the Russian Federation. The tax amount is calculated taking into account the number of months during which the vehicle was registered to the taxpayer, based on the results of each tax period, based on documented data on vehicles subject to taxation (Articles 52 and 54 of the Tax Code of the Russian Federation).

Subject of the Russian Federation : Smolensk region

OKTMO : 66000000

Payment deadline (for 2021) for individuals. persons: no later than 01.12.2021

The calculator will help calculate the transport tax for 2021 and 2020 for the cities of Smolensk, Vyazma, Roslavl, Yartsevo, Safonovo, Gagarin and other settlements of the Smolensk region.

In addition to paying transport tax, to drive a car you need to buy a compulsory insurance policy . Casco is voluntary insurance of a vehicle (vehicle) against damage, theft or theft, which is purchased at the request of the vehicle owner. It is important to understand that OSAGO is compulsory insurance of civil liability of vehicle owners to third parties: payments under the policy are made in favor of the victim, and comprehensive insurance is voluntary property insurance that protects the interests of the insured (beneficiary) regardless of his fault. Therefore, unlike compulsory motor liability insurance, the cost of comprehensive insurance is not regulated by the state, but is set by the insurance company itself. buy comprehensive insurance and compulsory motor insurance policies from insurance companies.

Transport tax benefits Smolensk region 2021, 2020

Adoptive parents; family-type orphanages created in the form of educational institutions.

application of the adoptive parent, documents confirming the status of the adoptive parent; an agreement concluded between the founder and a family-type orphanage in accordance with the legislation of the Russian Federation

taxpayer's application, certificate of conscription for military service and the period of its completion, issued by the military commissariat, document confirming death during military service under conscription, document confirming family relations with the deceased (deceased) serviceman

submission to the tax authority of documents confirming the right to benefits

in relation to ambulances and ambulances

statutory documents, employment contracts, information on the average number of employees and the wage fund, VTEK certificate

order to include cars in the mobilization reserve

in relation to vehicles used to perform mobilization tasks.

religious organizations, as well as educational organizations, the only founders of which are religious organizations.

the only founders of religious organizations or educational institutions are religious organizations

submission to the tax authority of documents confirming the right to benefits

in relation to fire engines (cars)

taxpayers engaged in international road transport of goods, in relation to trucks with engine power over 250 hp. (over 183.9 kW) used for international road transport of goods.

documents confirming the implementation of international road transport of goods in relation to trucks with engine power over 250 hp; vehicle registration certificate

for trucks with engine power over 250 hp. (over 183.9 kW), used for international road transport of goods and corresponding to environmental class 3

taxpayers engaged in international road transport of goods, in relation to trucks with engine power over 250 hp. (over 183.9 kW) used for international road transport of goods

documents confirming the implementation of international road transport of goods in relation to trucks with engine power over 250 hp; vehicle registration certificate

for trucks with engine power over 250 hp. (over 183.9 kW), used for international road transport of goods and corresponding to environmental class 4

taxpayers engaged in international road transport of goods, in relation to trucks with engine power over 250 hp. (over 183.9 kW) used for international road transport of goods

documents confirming the implementation of international road transport of goods in relation to trucks with engine power over 250 hp; vehicle registration certificate

for trucks with engine power over 250 hp. (over 183.9 kW), used for international road transport of goods and corresponding to environmental class 5

taxpayers carrying out regular transportation of passengers by public road transport in intercity, suburban and city traffic, in relation to buses with a gas engine type.

documents confirming regular transportation of passengers by public road transport in intercity, suburban and urban traffic

in relation to buses with a gas engine type

List of departments of the State Road Safety Inspectorate of the Altai Territory

Pospelikha district, Pospelikha village, Vokzalnaya street, 13

Taking exams, issuing a driving license Tue: from 09:00 to 20:00, break: from 14:00 to 15:00 Wed, Fri: from 09:00 to 18:00, break: from 13:00 to 14:00 Thu , Sat: from 09:00 to 17:00, break: from 13:00 to 14:00 Registration of vehicles and trailers Tue: from 09:00 to 20:00, break: from 14:00 to 15:00 Wed: from 09:00 to 18:00, break: from 13:00 to 14:00 Sat: from 09:00 to 17:00, break: from 13:00 to 14:00

Ust-Kalmansky district, Ust-Kalmanka village, Gorky street, 56

Registration of vehicles and trailers Wed: from 09:00 to 18:00, break: from 13:00 to 14:00

Petropavlovsky district, Alekseevka village, Kolkhoznaya street, 1

Taking exams, issuing driving license Thu: from 09:00 to 17:00, break: from 13:00 to 14:00 Registration of vehicles and trailers for them Fri: from 09:00 to 18:00, break: from 13:00 until 14:00

+7 (38573) 2-13-10 (for vehicle registration issues) +7 (38594) 2-22-53 (for checks, inquiries and registration) +7 (38577) 2-13-72 (for checks, inquiries and records)

Charyshsky district, Charyshskoye village, Shtifmana lane, 1

Taking exams, issuing driving license Wed: from 09:00 to 18:00, break: from 13:00 to 14:00 Sat: from 09:00 to 17:00, break: from 13:00 to 14:00 Registration of vehicles and trailers for them Tue: from 09:00 to 20:00, break: from 14:00 to 15:00 Thu: from 09:00 to 17:00, break: from 13:00 to 14:00 Fri: from 09 :00 to 18:00, break: from 13:00 to 14:00

Biysk, Perevozny lane, 8

Execution of administrative legislation Tue: from 15:00 to 20:00 Wed, Fri: from 14:00 to 18:00 Sat: from 09:00 to 13:00 Preparation of documents about road accidents daily: around the clock

+7 (duty department) +7 (road inspection) +7 (on IAZ issues) +7 (on road accident issues)

Tax calculation and payment deadlines for organizations

An organization is recognized as a tax payer if a vehicle is registered for it in the manner prescribed by current regulations.

After registration actions, the legal entity undertakes to make advance payments equal to 25% of the tax amount for the year. The reporting period is a quarter, after which the legal entity has exactly one month to transfer funds to the account of the regulatory authority. Advance payments are not paid for vehicles with a permissible maximum weight above 12 tons. At the end of the year, organizations must pay the remaining tax amount calculated in accordance with the submitted declaration. Deadline: February 5th.

Deadline for payment of transport tax for legal entities in [tn_year_curr] year:

- for [tn_year_prev] year - no later than March 1 of the year [tn_year_curr]

- for the 1st quarter of [tn_year_curr] of the year - no later than April 30 of [tn_year_curr] of the year

- for the 2nd quarter [tn_year_curr] of the year (6 months) - no later than July 31 [tn_year_curr] of the year

- for the 3rd quarter [tn_year_curr] of the year (9 months) - no later than October 31 of the year [tn_year_curr]

- for the 4th quarter and the entire [tn_year_curr] year - no later than March 1 of the [tn_year_next] year

Privileges

The company is deprived of transport tax benefits if the payment is not made by the owner of the organization. The list of documents confirming benefits has been clarified, these include:

- payment report in paper or electronic form;

- a report from your personal account from the Platon portal, subject to the presence of a qualified electronic digital signature.

Who is exempt from paying transport tax and has benefits? Owners of electric vehicles should breathe a sigh of relief because for them the payment of car tax has been canceled in full. Also exempt:

- disabled people whose car has a power of less than 10 hp;

- tractors, combines and other vehicles specified in paragraph 2 of Art. 358 Tax Code of the Russian Federation.

Transport tax calculator provided by calcus.ru

Other organizations

city of Sevastopol

Calculation of the amount of transport tax in the region - the city of Sevastopol. Calculation for any type of vehicle with any power. Luxury tax calculation.

Republic of Crimea

Calculation of the amount of transport tax in the region - Republic of Crimea. Calculation for any type of vehicle with any power. Luxury tax calculation.

Yamalo-Nenets Autonomous Okrug

Calculation of the amount of transport tax in the region - Yamalo-Nenets Autonomous Okrug. Calculation for any type of vehicle with any power. Luxury tax calculation.

Chukotka Autonomous Okrug

Calculation of the amount of transport tax in the region - Chukotka Autonomous Okrug. Calculation for any type of vehicle with any power. Luxury tax calculation.

Khanty-Mansiysk Autonomous Okrug-Yugra

Calculation of the amount of transport tax in the region - Khanty-Mansiysk Autonomous Okrug-Ugra. Calculation for any type of vehicle with any power. Luxury tax calculation.

Jewish Autonomous Region

Calculation of the amount of transport tax in the region - Jewish Autonomous Region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Saint Petersburg

Calculation of the amount of transport tax in the region - St. Petersburg. Calculation for any type of vehicle with any power. Luxury tax calculation.

Moscow city

Calculation of the amount of transport tax in the region - the city of Moscow. Calculation for any type of vehicle with any power. Luxury tax calculation.

Yaroslavl region

Calculation of the amount of transport tax in the region - Yaroslavl region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Transbaikal region

Calculation of the amount of transport tax in the region - Trans-Baikal Territory. Calculation for any type of vehicle with any power. Luxury tax calculation.

Chelyabinsk region

Calculation of the amount of transport tax in the region - Chelyabinsk region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Ulyanovsk region

Calculation of the amount of transport tax in the region - Ulyanovsk region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Tyumen region

Calculation of the amount of transport tax in the region - Tyumen region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Tula region

Calculation of the amount of transport tax in the region - Tula region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Tomsk region

Calculation of the amount of transport tax in the region - Tomsk region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Tver region

Calculation of the amount of transport tax in the region - Tver region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Tambov Region

Calculation of the amount of transport tax in the region - Tambov region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Smolensk region

Calculation of the amount of transport tax in the region - Smolensk region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Sverdlovsk region

Calculation of the amount of transport tax in the region - Sverdlovsk region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Sakhalin region

Calculation of the amount of transport tax in the region - Sakhalin region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Saratov region

Calculation of the amount of transport tax in the region - Saratov region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Samara Region

Calculation of the amount of transport tax in the region - Samara region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Ryazan Oblast

Calculation of the amount of transport tax in the region - Ryazan region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Rostov region

Calculation of the amount of transport tax in the region - Rostov region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Pskov region

Calculation of the amount of transport tax in the region - Pskov region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Perm region

Calculation of the amount of transport tax in the region - Perm region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Penza region

Calculation of the amount of transport tax in the region - Penza region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Oryol Region

Calculation of the amount of transport tax in the region - Oryol region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Orenburg region

Calculation of the amount of transport tax in the region - Orenburg region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Omsk region

Calculation of the amount of transport tax in the region - Omsk region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Novosibirsk region

Calculation of the amount of transport tax in the region - Novosibirsk region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Novgorod region

Calculation of the amount of transport tax in the region - Novgorod region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Nizhny Novgorod Region

Calculation of the amount of transport tax in the region - Nizhny Novgorod region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Murmansk region

Calculation of the amount of transport tax in the region - Murmansk region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Moscow region

Calculation of the amount of transport tax in the region - Moscow region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Magadan Region

Calculation of the amount of transport tax in the region - Magadan region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Lipetsk region

Calculation of the amount of transport tax in the region - Lipetsk region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Leningrad region

Calculation of the amount of transport tax in the region - Leningrad region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kursk region

Calculation of the amount of transport tax in the region - Kursk region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kurgan region

Calculation of the amount of transport tax in the region - Kurgan region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kostroma region

Calculation of the amount of transport tax in the region - Kostroma region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kirov region

Calculation of the amount of transport tax in the region - Kirov region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kemerovo region

Calculation of the amount of transport tax in the region - Kemerovo region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kamchatka Krai

Calculation of the amount of transport tax in the region - Kamchatka Territory. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kaluga region

Calculation of the amount of transport tax in the region - Kaluga region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kaliningrad region

Calculation of the amount of transport tax in the region - Kaliningrad region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Irkutsk region

Calculation of the amount of transport tax in the region - Irkutsk region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Ivanovo region

Calculation of the amount of transport tax in the region - Ivanovo region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Voronezh region

Calculation of the amount of transport tax in the region - Voronezh region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Vologda Region

Calculation of the amount of transport tax in the region - Vologda region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Volgograd region

Calculation of the amount of transport tax in the region - Volgograd region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Vladimir region

Calculation of the amount of transport tax in the region - Vladimir region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Bryansk region

Calculation of the amount of transport tax in the region - Bryansk region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Belgorod region

Calculation of the amount of transport tax in the region - Belgorod region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Astrakhan region

Calculation of the amount of transport tax in the region - Astrakhan region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Arkhangelsk region and Nenets Autonomous Okrug

Calculation of the amount of transport tax in the region - Arkhangelsk region and Nenets Autonomous Okrug. Calculation for any type of vehicle with any power. Luxury tax calculation.

Amur region

Calculation of the amount of transport tax in the region - Amur region. Calculation for any type of vehicle with any power. Luxury tax calculation.

Khabarovsk region

Calculation of the amount of transport tax in the region - Khabarovsk Territory. Calculation for any type of vehicle with any power. Luxury tax calculation.

Stavropol region

Calculation of the amount of transport tax in the region - Stavropol Territory. Calculation for any type of vehicle with any power. Luxury tax calculation.

Primorsky Krai

Calculation of the amount of transport tax in the region - Primorsky Territory. Calculation for any type of vehicle with any power. Luxury tax calculation.

Krasnoyarsk region

Calculation of the amount of transport tax in the region - Krasnoyarsk Territory. Calculation for any type of vehicle with any power. Luxury tax calculation.

Krasnodar region

Calculation of the amount of transport tax in the region - Krasnodar Territory. Calculation for any type of vehicle with any power. Luxury tax calculation.

Altai region

Calculation of the amount of transport tax in the region - Altai Territory. Calculation for any type of vehicle with any power. Luxury tax calculation.

Chuvash Republic

Calculation of the amount of transport tax in the region - Chuvash Republic. Calculation for any type of vehicle with any power. Luxury tax calculation.

Chechen Republic

Calculation of the amount of transport tax in the region - Chechen Republic. Calculation for any type of vehicle with any power. Luxury tax calculation.

The Republic of Khakassia

Calculation of the amount of transport tax in the region - Republic of Khakassia. Calculation for any type of vehicle with any power. Luxury tax calculation.

Udmurt republic

Calculation of the amount of transport tax in the region - Udmurt Republic. Calculation for any type of vehicle with any power. Luxury tax calculation.

Tyva Republic

Calculation of the amount of transport tax in the region - Republic of Tyva. Calculation for any type of vehicle with any power. Luxury tax calculation.

Republic of Tatarstan

Calculation of the amount of transport tax in the region - Republic of Tatarstan. Calculation for any type of vehicle with any power. Luxury tax calculation.

Republic of North Ossetia-Alania

Calculation of the amount of transport tax in the region - Republic of North Ossetia-Alania. Calculation for any type of vehicle with any power. Luxury tax calculation.

The Republic of Sakha (Yakutia)

Calculation of the amount of transport tax in the region - Republic of Sakha (Yakutia). Calculation for any type of vehicle with any power. Luxury tax calculation.

The Republic of Mordovia

Calculation of the amount of transport tax in the region - Republic of Mordovia. Calculation for any type of vehicle with any power. Luxury tax calculation.

Mari El Republic

Calculation of the amount of transport tax in the region - Republic of Mari El. Calculation for any type of vehicle with any power. Luxury tax calculation.

Komi Republic

Calculation of the amount of transport tax in the region - Komi Republic. Calculation for any type of vehicle with any power. Luxury tax calculation.

Republic of Karelia

Calculation of the amount of transport tax in the region - Republic of Karelia. Calculation for any type of vehicle with any power. Luxury tax calculation.

Karachay-Cherkess Republic

Calculation of the amount of transport tax in the region - Karachay-Cherkess Republic. Calculation for any type of vehicle with any power. Luxury tax calculation.

Republic of Kalmykia

Calculation of the amount of transport tax in the region - Republic of Kalmykia. Calculation for any type of vehicle with any power. Luxury tax calculation.

Kabardino-Balkarian Republic

Calculation of the amount of transport tax in the region - Kabardino-Balkarian Republic. Calculation for any type of vehicle with any power. Luxury tax calculation.

The Republic of Ingushetia

Calculation of the amount of transport tax in the region - Republic of Ingushetia. Calculation for any type of vehicle with any power. Luxury tax calculation.

The Republic of Dagestan

Calculation of the amount of transport tax in the region - Republic of Dagestan. Calculation for any type of vehicle with any power. Luxury tax calculation.

Altai Republic

Calculation of the amount of transport tax in the region - Altai Republic. Calculation for any type of vehicle with any power. Luxury tax calculation.

The Republic of Buryatia

Calculation of the amount of transport tax in the region - Republic of Buryatia. Calculation for any type of vehicle with any power. Luxury tax calculation.

Republic of Bashkortostan

Calculation of the amount of transport tax in the region - Republic of Bashkortostan. Calculation for any type of vehicle with any power. Luxury tax calculation.

Republic of Adygea

Calculation of the amount of transport tax in the region - Republic of Adygea. Calculation for any type of vehicle with any power. Luxury tax calculation.

Benefits for individuals

In relation to cars (with engines up to 100 hp), motorcycles and scooters (up to 45 hp), the following are exempt from paying tax:

- disabled people of all groups, as well as disabled children;

- citizens over 55 years of age for women and 60 for men;

- victims of the Chernobyl disaster;

- one of the guardians of a disabled child;

- one of the guardians in a family with three or more children;

- minors.

The tax benefit can be used only in relation to one object at the citizen's choice.

FILESOpen the table of transport tax benefits in the Altai Territory

Rules and deadlines for paying taxes for individuals

For residents of the region, the deadline for paying transport tax is December 1. But already in the year following the reporting year, citizens do not make any advance payments. There is no need to make your own calculations. All necessary information on each taxable item owned by the payer will be received in a letter from the Federal Tax Service. The tax authority, receiving information from registering organizations, sends out special notices to the individual’s place of residence, informing them of the need for payment.