State Duma comment

A proposal to abolish the transport tax was made in the State Duma. Deputy Andrei Baryshev, representing the United Russia party, submitted a bill to abolish the transport tax to the lower house of parliament. In addition, the deputy came up with a proposal to add a vehicle tax to the cost of fuel. The document is available in the State Duma’s electronic database.

The proposal to abolish the transport tax caused active discussions. There are both supporters and opponents of this change.

Andrey Baryshev’s document proposes replacing the transport tax with an increase in fuel prices. The deputy believes that the abolition of the transport tax will help:

Dear OSAGO? Restore KBM now

and stop overpaying insurers!

The service will send an application to RSA. Recovery time for KBM: from 12 hours. Find out more

- Rationally distribute funds for road construction and repair;

- Get rid of excess taxation of some vehicles;

- Increase the number of environmentally friendly vehicles on the road.

This change will affect almost all types of transport.

On the other hand, representatives of the automobile industry recall a similar proposal several years ago, when prices were raised, but the tax was never canceled. It is quite possible that this is exactly the situation awaiting motorists this time too.

Will the transport tax be abolished in 2018?

Not long ago, reports appeared in the Russian media that the country's President Vladimir Putin allegedly signed Law No. 335-FZ, according to which the transport tax in Russia is abolished and all debts under it are eliminated.

Some publications claimed that starting this year, individuals and entrepreneurs will be exempt from transport tax, and road taxes will be included in the price of gasoline and diesel fuel.

However, in fact, this information is fake, as stated by representatives of the Federal Tax Service. In fact, the transport tax will not be abolished in the near future, and there is no amnesty for those who have not paid it for several years.

Chief State Tax Inspector of the Property Taxation Department of the Federal Tax Service of Russia for the Republic of Dagestan N.N. Efendiyev claims that this law does not talk about the abolition of transport tax.

“Here we are talking about the decision made to write off uncollectible debt, that is, for those debts of property taxes of individuals for which the tax authorities will not carry out the full range of measures for forced collection,” says a specialist in the commentary on the NSF website.

According to him, the law states that “uncollectible and subject to write-off is the arrears of transport tax, personal property tax and land tax, incurred by individuals as of January 1, 2015, and for 2014.

Thus, taxes for 2021 have already been calculated for Russians, and many have already received notices at their post offices. Transport tax must be paid before December 3, 2018.

How will this change affect drivers' costs?

The majority of the Russian vehicle fleet consists of budget cars with engine power not exceeding 100 horsepower. People will continue to travel millions of kilometers every day, consuming huge amounts of fuel.

Due to the changes, the state will begin to receive much more. This is due to the fact that drivers who actively use the vehicle will spend more money on gas.

According to Baryshev, the change will help avoid excessive taxation of citizens, and will also encourage them to purchase environmentally friendly electric cars.

Renew OSAGO at the best price!

New vehicle tax rules will come into force in 2021

From 2021, uniform deadlines for payment of transport tax and advance payments on it have been introduced for taxpayer organizations, the Federal Tax Service reminds on its website

Thus, the tax is payable no later than March 1 of the year following the expired tax period, and advance payments for it, if they are introduced by the law of a constituent entity of the Russian Federation, no later than the last day of the month following the expired reporting period.

Also, for the tax period 2021 and subsequent periods, the obligation to submit a transport tax return to the tax authority is canceled.

To ensure complete payment of tax, starting next year, organizations will be sent messages about the amounts of transport tax calculated by the tax authorities. They are compiled on the basis of information available to the tax authority, including information received from government agencies registering vehicles, as well as information about tax benefits declared by the company. Such messages are sent within the following time frames:

- no later than six months from the date of expiration of the established deadline for payment of tax for the expired tax period;

- no later than two months from the date the tax authority receives information entailing recalculation of tax for previous tax periods;

- no later than one month from the date the tax authority receives information from the Unified State Register of Legal Entities that the organization is in the process of liquidation.

The message is sent via TKS or through the taxpayer’s personal account, and if it is impossible to transmit by these methods, it is sent by registered mail or handed to the head or representative of the organization personally against signature.

For individual taxpayers, starting from 2021, the amendment introduced to paragraph 2 of Art. 52 of the Tax Code of the Russian Federation. Now the tax authorities take into account all amounts of overpaid property taxes, personal income tax and penalties available to a citizen as of the date of generation of the tax notice, if before the date of generation of the tax notice the tax authority has not received an application for a credit or refund of the amounts of overpaid tax. This ensures “end-to-end” intertax accounting of overpayments in favor of an individual for all periods of its occurrence.

From July 1, 2021, a rule will apply that transport tax will not be recalculated if it entails an increase in the previously paid tax amount according to the tax notice. This provision is aimed at observing the legitimate interests of bona fide taxpayers who have paid tax notices on time. A similar condition applies from 2021 to the recalculation of land tax and property tax for individuals.

Starting next year, a new procedure for calculating tax will apply to a vehicle that has ceased to exist due to its loss or destruction. As a general rule, the tax is calculated on the basis of information submitted to the Federal Tax Service of Russia by the bodies conducting state registration of vehicles. Now an exception has been made from it for objects that have ceased to exist: the calculation of tax on them ceases from the first day of the month of their death or destruction on the basis of an application submitted by a citizen to the tax authority.

Features of the transport fee

The main purpose of this type of taxation is to accumulate financial resources that will be spent on building new roads and repairing old road surfaces

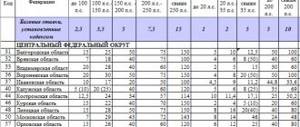

However, it is worth understanding that this type of fee is levied on vehicle owners, and the transport tax rate in 2021 will directly depend on the following two important factors:

- the period of time during which the vehicle was used;

- engine power, measured in horsepower.

If with the first of these aspects everything is extremely clear to most drivers, then in the case of the second factor sometimes there is a misunderstanding, namely, how to correctly recalculate the car’s horsepower.

For such calculations it is worth using the following equality:

1 kW = 1.35962 l. With.

For example, if a car has a power of 135 kW, then the calculation is made as follows:

135x1.35962 = 183.55 l. With.

The abolition of transport tax in 2021 applies to all passenger cars

Show/Hide text

Russian President Putin abolished the transport tax. Previously, this type of payment was applied to all citizens who own a car. This applied to both individuals and individual entrepreneurs. The inspectorate calculated the amount and sent the payment. Usually the tax was paid for last year before the first of December of the current year; in 2021 there is no such tax as transport tax.

In Russia, every citizen or organization that owns a car is a tax payer. Moreover, it does not matter whether the car is used for its intended purpose, whether it is in good working order, how old the car is and what its power is - tax is required for any registered car. Organizations calculate taxes themselves. Until 2021, Vladimir Putin, the President of the Russian Federation, signed a law regarding the cancellation of transport tax debts in the country. Law of November 27, 2021 No. 335-FZ with amendments to the Tax Code of the Russian Federation.

Why was the transport tax canceled in 2021 for passenger cars?

The transport tax was already so familiar to many citizens that it is difficult to imagine its abolition.

Putin signed a law that judged everyone. Now everyone is absolutely happy that new fair rules have been introduced. The President simply increased fuel prices. Gasoline has become more expensive, which means that heavy car users will pay much more than those who drive very rarely.

Due to numerous requests, the unified law was repealed, the Ros-Register portal reports. Now a person can have at least ten cars - he won’t pay an extra ruble for one. Payment for motor vehicles will be calculated from the increased excise tax on gasoline. Thus, whoever drives as much pays as much.

Previously, in addition to the rules for calculating car tax, there was a specially designated line “for luxury” - an additional fee was imposed on all cars that cost more than 3 million rubles. For those who did not pay transport tax last year, everything will be written off this year.

The President issued an order that now citizens who have an unpaid bill for using transport, starting in 2015 (and, accordingly, the penalty for this payment) will have all their debts written off. According to the new rules, the use of vehicles will begin without previous debts.

Deadlines for payment of transport tax in 2021 for passenger cars

The deadline for submitting the declaration in 2021 depends on who pays - individuals (including individual entrepreneurs) or legally. For individuals and individual entrepreneurs. Individuals and individual entrepreneurs pay tax no later than December 1. Thus, tax for 2021 must be paid no later than December 1, 2021.

Receipts for payment should arrive in the mail in the summer. If the letter suddenly gets lost, there is another way to find out the amount of tax and pay - through your personal account of the Federal Tax Service. Simplified has tested paying taxes through your personal account. This is convenient: payment slips for paying taxes for 2021 are available in your personal account. They can be printed on a printer and paid at the bank.

The easiest way is to pay taxes directly in your personal account using a bank card. But it is necessary for the bank that issued the card to enter into an agreement with the Federal Tax Service. Almost all major banks have done this.

For whom the transport tax has been canceled in 2021

From 2021, individuals and individual entrepreneurs no longer owe the state transport tax for periods before January 1, 2015. This follows from Law No. 436-FZ, which was signed by Putin on December 28, 2021.

Tax debts of citizens and entrepreneurs are written off automatically. The state forgot about unpaid payments for transport tax, personal property tax, and land tax.

Debts that were incurred as of a date before January 1, 2015 will be written off. If any penalties were accrued, then they were also forgiven.

There is no need to submit any documents to the tax office. The tax authorities will write off everything themselves and cover the debts. There is no need to attend the inspection in person. If a person has a tax debt for 2014. And by 2018, penalties for non-payment also accrued. This year, both the tax debt and all penalties will be written off. Everything will be written off automatically; you won’t have to write any statements.

Source

Refutation

Transport tax in 2021: canceled or not

The news about the abolition of transport tax in 2021 turned out to be fake. No amendments were made to the legislation to abolish its payment. Only certain categories of citizens who own cars can count on privileges.

Information about the reduction, freezing and even complete abolition of transport tax in 2021 is being actively disseminated online and in the media. At the same time, arguments are given in favor of such changes, but without reference to official sources and bills. Such news has no basis. Putin V.V. did not sign the relevant resolutions or decrees on the abolition of the transport tax. Therefore, car owners will have to pay a tax once a year, the amount of which depends on the region of registration and the engine power of the car.

Grounds for cancellation of TN

Since the issue of TN is quite relevant for motorists, any news is taken seriously. And adherents who try to “read between the lines” present amendments to the laws in their own interpretation.

Thus, throughout 2021, several times the network was excited by news about the abolition of the transport tax. The basis for such mythical conclusions were very real amendments, bills and comments from legislators:

— The law on tax amnesty for debts on taxes on transport and land, which was signed in December 2021 and came into force on January 1, 2021.

— D. Medvedev’s comments on the bill on the abolition of the transport tax on electric vehicles for 5 years. - was submitted to the State Duma for consideration in November 2021 and May 2021, but was never adopted.

The spread of fake news was commented on by the Federal Tax Service, which officially announced on its website on May 21, 2021 that the transport tax has not been cancelled.

Excise or tax

Some “experts” linked the abolition of the transport tax for passenger cars with the planned increase in the excise tax on gasoline. This reshuffling was justified by the fact that the burden applies both to persons who intensively use the car, and to those who have the car in the garage, even in a faulty condition. In the event of an increase in the excise tax and the abolition of technical requirements, large expenses would fall on the shoulders of active drivers, which, according to “experts,” would be fair.

But these expectations were not justified - the TN was not replaced by increased excise taxes. And the increase in excise tax on gasoline itself, by decision of the Government, has been frozen since July 2021 due to a sharp increase in the cost of gasoline. From July 1, rates have been reduced:

— per ton of Euro-5 gasoline from 11,892 to 8,213 rubles; - per ton of diesel fuel - from 8,258 to 5,665 rubles.

In addition, in the future, in the event of a sharp jump in gasoline prices, there is an option to reduce the excise tax and increase the duty on Russian exports. Therefore, the abolition of transport tax due to an increase in excise rates is not expected even in the future.

Bill on the abolition of encumbrance

Indeed, a bill to completely abolish the transport tax was submitted for consideration on June 5, 2021. This caused a new wave of rumors related to changes in Chapter 28 of the Tax Code, which regulates the replenishment of the budget through fees from vehicle owners.

But already at the stage of preliminary consideration, the document was rejected and on July 2 was transferred to the archive.

Why the transport tax will not be abolished - expert opinions

Back at the end of 2021, the Ministry of Transport made a proposal to replace the transport tax with a new environmental fee. But in this case, the tax burden would fall on the owners of old cars. This proposal was commented on by RANEPA.

“In Moscow and large cities the concentration of expensive and new cars is higher. But the tax on them may be lower than the existing one due to their higher environmental class. And in the regions there are quite a lot of old vehicles - the tax burden for their owners may increase,” said Elena Pilevina, an IBD teacher.

The State Duma Committee on Budget and Taxes also opposes the abolition of the tax, since such innovations will lead to “lost income”, and there are no sources of compensation for them.

If fees are linked to excise taxes, there will inevitably be an increase in prices not only for gasoline, but also for food and other goods, which will affect the welfare of not only car owners, but also Russians who do not own cars.

In addition, this type of fee is regional - it is distributed for the repair and maintenance of roads. Its abolition will lead to a “hole” in local budgets, which will have to be compensated with federal funds.

Even the reduction of excise taxes on gasoline, the revenues from which are distributed in a ratio of 60:40 between the regions and the federal center, led to the need to compensate for local losses.

“... this entire volume (103 billion rubles) will fall on the federal budget,” said Ilya Trunin, Deputy Head of the Ministry of Finance.

Therefore, in the near future, until a full-fledged alternative to the transport tax is found, this type of fee will not be abolished.

Latest news about TN

However, changes affecting the payment of transport tax in 2018 did occur.

Passenger car owners should take into account that:

Citizens are freed from old debts, including transport taxes. Reference! Starting from January 2021, debts that were incurred before January 1, 2015, as well as fines and penalties accrued for such arrears, will be written off.

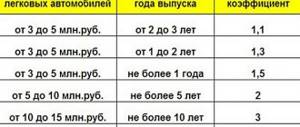

The applied coefficient when calculating the fuel charge for expensive cars has been changed upward. Popularly, such amendments were called a “luxury tax”, since the provision applies only to passenger cars whose cost exceeds 3 million rubles.

Additional coefficient when calculating the fuel charge for expensive cars

Cost of car, million rubles - Coefficient - Age of car, years 3-5 - 1.1 - Less than 3 5-10 - 2 - Less than 3 10-15 - 3 - Less than 10 More than 15 - 3 - Less than 20

From August 2021, a citizen can transfer all property taxes in a single payment, regardless of the amount of movable and immovable property he owns.

The corresponding changes to Federal Law No. 232, as reported by RBC, were signed by the President of the Russian Federation V.V. Putin. July 29. Starting from the new year, such payments can be made through multifunctional centers.

In addition, projects are under consideration that include:

— Cancellation of technical requirements for owners of electric passenger cars from January 2021 for 5 years, which should stimulate the development of the market for environmentally friendly vehicles.

— Providing benefits to large families, providing for a reduction or complete elimination of the burden.

However, these proposals are not being submitted for consideration for the first time, and there is no guarantee that they will be considered and accepted.

Who is exempt from paying transport tax?

Since the transport tax is a local fee, benefits and other preferences for its payment are determined by regional legislation.

As for federal regulations, owners of heavy vehicles weighing more than 12 tons are exempt from paying it. But they receive such an indulgence if they pay a fee for damage caused to roads in an amount commensurate with the TN.

Owners are exempt from paying at the federal level:

Low-power (up to 100 hp) specially equipped cars for disabled people, which are received or purchased through social security authorities.

Agricultural machinery, including combines, tractors, trucks used for transporting agricultural products, fertilizers, etc.

A vehicle that has been stolen upon presentation of a document confirming this fact. At the regional level, certain categories of individuals may be partially or completely exempt from paying tax:

— parents of many children and parents of a disabled child; — WWII veterans; — persons with a certain group of disabilities; — military pensioners; — victims during the liquidation of the Chernobyl accident.

In some regions, pensioners and labor veterans and owners of gas-powered cars have preferences in paying transport tax.

You can familiarize yourself with the regulatory legal acts and orders regulating the payment of property taxes, including deadlines, rates and benefits, on the Federal Tax Service website by selecting the type of fees and region.

This type of benefit is declarative. For information about the application form and the list of required documents, check with your local tax authority.

Note! Late payment or refusal to pay taxes leads to the accrual of penalties and fines, which may be levied in court.

Source

Will the vehicle tax be abolished in 2021?

Almost all vehicle owners are interested in whether the vehicle tax will be abolished in 2021 for passenger cars. A few years earlier, some deputies proposed eliminating tax levies on vehicles, starting in 2021. But, unfortunately, then this initiative was not supported by the majority.

The government did not dare to cancel the tax levy, which annually replenishes the state treasury by tens and even hundreds of billions of rubles. According to the Ministry of Economy and Development, it is almost impossible to cancel this income item at this stage, because according to statistical data today, the total amount of debt of the country’s regions is almost two trillion rubles, and Russian administrative entities also violated the standard prohibiting the excess of the debt amount by more than half revenue sector of the budget. An additional loss of one and a half hundred billion in national currency could further aggravate the state’s financial problems.

Preferential conditions apply only to owners of vehicles whose weight exceeds twelve tons. Until now, for the operation of such large vehicles, owners had to pay colossal sums of money, including financial compensation for the damage they caused to the road surface, as well as monetary contributions to a system called “Plato”. Now the amounts of taxes levied on them are subject to careful adjustment by employees of this system. In cases where this fee amount is greater than or equal to the transport tax, the truck owner does not pay a fiscal fee at all.

Increase in transport tax

Most ordinary people who own vehicles are primarily interested in the following important question: what will the transport tax be in 2021?

We can confidently reassure vehicle owners: at the moment there are no plans to increase the transport tax, at least there is no official information regarding this issue.

As for changes in legislation, they will affect only the timing of making transport payments, namely:

- individuals will be required to pay transport tax until December 1, 2021, although previously payments were accepted until October 1, in other words, owners are given the opportunity to find the required amount;

- legal entities pay the transport fee until February 1, 2018, while simultaneously making a deposit for the next reporting period.

Transport tax, cancellation 2021: State Duma news

Some representatives of the State Duma proposed abolishing the fee back in 2017. However, has the transport tax been abolished in 2021? Not yet. Most officials said that it is now impossible to completely abandon it. Refusal of the budget revenue item could lead to an increase in the deficit, which would negatively affect the country's economy as a whole. The situation may even worsen the financial crisis in the country.

According to the current Russian Minister of Finance, a complete abandonment of the transport tax will lead to an inevitable increase in excise taxes on gasoline and other types of fuel. The economy is not yet ready for such reforms. But the cancellation of transport tax debts in 2018 is quite possible. The President has repeatedly come up with such an initiative. However, there are no concrete decisions yet; bills are at the development stage. It is planned to completely write off debts that are impossible to collect.