Since September 1, 2012, there has been a legislative provision that environmental safety from the harmful effects of the operation of wheeled vehicles (chassis) must be ensured, among other things, by paying a recycling fee. This fee is paid for each wheeled vehicle (chassis) imported into the Russian Federation or manufactured in the Russian Federation (this requirement does not apply to vehicles for which PTS was issued before the above date). Without paying the recycling fee (in appropriate cases), it will not be possible to properly issue a vehicle passport, which will make it impossible to register the vehicle.

Who exactly pays the recycling fee? As a result of what actions of the manufacturer is a mark indicating payment of the fee is placed on the vehicle title, taking into account the changes that came into force in January 2014? What other changes should vehicle manufacturers take into account?

How to pay the recycling fee for special equipment

Clause 3 of Article 24.1 of the Federal Law of the Russian Federation “On Production and Consumption Waste” defines 2 collectors of the disposal fee:

- Federal Customs Service - when importing special equipment into Russian territory from other countries;

- Federal Tax Service - from manufacturers operating in Russia, as well as persons who bought special equipment here from sellers who did not pay the tax.

The legislation obliges the payer to submit the necessary documents and transfer money to the Federal Treasury account using the codes:

- 182 1 1200 120 - for self-propelled vehicles, trailers produced in the Russian Federation;

- 182 1 1200 120 - for wheeled vehicles.

DST

No, of course, let's operate with facts. Let's consider the draft regulatory document. By the way, the last time in Russia the recycling fee for special equipment was raised in 2021. For new motor graders with engines up to 100 HP. With. the coefficient for calculating the size of the recycling fee (CUS) will be equal to 7, and for models imported to us from other countries over 3 years old - already 42. With a base rate of 172,500 rubles, the recycling fee will be 1,207,500 rubles for new ones and 7,245,000 rubles for used ones cars

Cat 140 GC

The price of new, more powerful graders with a power plant of up to 140 hp. With. a recycling fee of 1,242,000 rubles will be laid down. 7,452,000 rubles will be added to the price of those imported from other countries to the secondary market over the age of 3 years.

Recycling coefficient for new graders with power from 140 to 200 hp. With. stated at 12.8, and for used ones - 76.8. For the most powerful with engines from 200 hp. With. this figure is 23.2 and 139.2, respectively.

Meanwhile, when we asked you to choose the best motor grader, our partners from the ID-Marketing agency told us that foreign models are in great demand among us. As many as 17 factories constantly bring their products here.

For bulldozers the picture is approximately the same, but with different numbers. So, new cars with engines up to 100 hp. With. will receive a coefficient of 7, up to 200 l. With. – 16, up to 300 l. With. – 24, up to 400 l. With. – 33 and over 400 l. With. – 37.5. For the same models older than 3 years, the coefficients will be set at 42 for cars with internal combustion engines up to 100 hp. pp., 96 – up to 200 l. pp., 144 – up to 300 l. pp., 198 – up to 400 l. With. and 225 - over 400 liters. With. What we have? For example, the popular Shantui SD16 model has a 178 hp engine. s., which contributes 2,760,000 rubles to the cost of a new car, and 16,560,000 rubles to the price of a three-year-old car.

Mecalac AS900

The changes also affected road rollers. Coefficients for new cars with internal combustion engines with power up to 40 hp. With. will be installed in size 3.2, up to 80 l. With. – 6 and over 80 l. With. – 8. For used rollers with power plants up to 40 liters. With. coefficient is 19.2, up to 80 l. With. – 36 and over 80 l. With. – 48. By the way, in this segment, imported products prevail over domestic ones.

Actually, the same is true among excavators and backhoe loaders, where the coefficient is for new models with engines up to 65 hp. With. will also be set at level 4, and for three-year-olds and older - 24. For new “shrews” up to 160 liters. With. – 11.6 and their used versions – 69.6. New cars with internal combustion engines up to 250 hp. With. will receive a coefficient of 16.2, and used - 97.2. And the most powerful ones – over 250 hp. With. – they will install KUS 18.6 on new ones and 111.6 on used ones.

The increase in recycling collection will also affect other types of road construction equipment.

Required documents

The fee for new special equipment is paid by the manufacturer, which is confirmed in the registration certificate.

After 3 working days after paying the recycling fee, the vehicle buyer submits to the tax office a calculation of its amount. Attached to it:

- technical passport forms;

- duplicates of certificates, declarations of conformity, or the conclusion of the certification body that such equipment does not require mandatory conformity assessment; if available, copies of shipping documents;

- duplicate passports for self-propelled vehicles for which the recycling fee had already been paid, but they were converted into forms for which new passports are issued;

- duplicate receipts for payment of the fee.

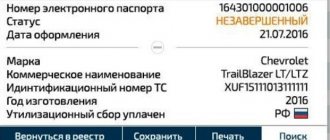

If all rules are observed, the corresponding mark is placed in the technical passport.

When importing a motor grader, combine harvester, bulldozer, excavator, loader, road roller, loader, crane, pipe layer, trailer, tractor, ATV, snowmobile, dump truck, self-propelled vehicle from abroad with payment, you must meet the deadline for customs clearance. This can be done at customs. For the procedure you need:

- completed fee calculation form;

- passport of the technical device used to make the payment;

- copies of documents confirming the identity of the machine characteristics with the data given in the calculation;

- contract of sale;

- documents confirming payment.

After checking, the PTS notes that the recycling fee has been paid.

You need to take the preservation of the payment document seriously - in controversial situations, it will confirm both the fact and the amount of the payment. The recycling fee for special equipment cannot be offset against other payments.

Calculation and payment of the fee by the largest producers

According to the new rules, the largest manufacturers of wheeled vehicles and (or) chassis (recognized as such and included in a special register of the largest manufacturers) are given the opportunity to put a mark on the payment of the recycling fee on the form of passports issued for the vehicle.

Who can be recognized as the largest producer?

The procedure for recognizing the payer of the recycling fee as the largest manufacturer was approved by Order of the Ministry of Industry and Trade of the Russian Federation dated January 13, 2014 No. 6 . An organization that meets one of the following criteria can be recognized as the largest manufacturer:

1) the organization produces wheeled vehicles of category M1, including all-terrain vehicles of category G:

- in industrial assembly mode;

- in the mode provided for in paragraph. 6 paragraph 2 art. 10 Agreement on free (special, special) economic zones in the customs territory of the Customs Union and the customs procedure of the free customs zone ;

2) the organization produces wheeled vehicles of categories N, M2 and (or) M3, the design of which does not provide for the use of a base vehicle (chassis) from another manufacturer, subject to one of the following conditions:

- in industrial assembly mode;

- according to technology, including welding, painting and body assembly - in relation to vehicles of category M2, including all-terrain vehicles of category G;

- by technology, including welding, painting and body assembly - in relation to vehicles of category M3, including all-terrain category G;

- according to technology, including welding, painting and assembly of the cabin (body - in the case where the cabin is a permanent element of the body) - in relation to vehicles of categories N1, N2, including all-terrain vehicles of category G;

- according to technology, including welding, painting and assembly of the cabin and manufacturing of the chassis, including chassis frame spars, - in relation to vehicles of category N3, including all-terrain vehicles of category G;

3) the organization, as of January 1, 2014, is a subsidiary of an organization that meets the above criteria (clause 1 and (or) 2).

Moreover, the share of participation of such an organization must be at least 50%. For your information

A preliminary list of organizations - the largest manufacturers of wheeled vehicles and (or) chassis is given in the appendix to the Letter of the Ministry of Internal Affairs of the Russian Federation dated January 21, 2014 No. 13/4u-262 .

How to become the largest manufacturer?

The initiator is the organization itself. To do this, she needs to submit an application to the Ministry of Industry and Trade (drawn up in any form), which indicates the name of the company, legal form, location, as well as the name of the organization’s website on the Internet and email address. The documents listed in clause 3 of the Procedure .

In turn, the Ministry of Industry and Trade sends the received documents to the Department of Transport and Special Mechanical Engineering, based on the results of which (for which 15 days are allotted) an order should be issued to recognize the organization as the largest manufacturer of wheeled vehicles and (or) chassis and to include it in the register or refusal to recognize the organization as the largest manufacturer.

It must be taken into account that in order to update the register and prevent the presence of unreliable information in it, the Department of Transport and Special Engineering will annually from October 1 to December 1 inclusive request from the largest manufacturers the same documents that were submitted along with the application. If inconsistencies are identified or documents are not submitted, the organization will lose its status as the largest manufacturer.

How to report to the largest manufacturer?

As we have already indicated, an organization recognized as the largest vehicle manufacturer is given the right to independently affix a mark on the payment of the recycling fee on the passport form. However, this does not mean that she does not need to report to the tax authority, and in a special manner established by Section. IV Rules ( paragraphs 19 – 23 ).

For your information

Considering that maintaining the register of organizations - the largest manufacturers of wheeled vehicles (chassis) is entrusted to the Ministry of Industry and Trade, tax officials propose to bring to these manufacturers a recommended sample stamp (attached) for affixing (see Letter of the Federal Tax Service of the Russian Federation dated December 26, 2013 No. GD-4-3 / [email protected] ).

By virtue of clause 19 of the Rules, the designated organization, within five working days (from July 1, 2014 - two working days) following the day of issue of the passport (on which a note on payment of the recycling fee was made), to the tax authority at its location must introduce:

- calculation of the recycling fee (before July 1, 2014 is drawn up on paper, from the specified date - in electronic form and sent via telecommunication channels). With the submission of the Federal Tax Service, the said calculation can be submitted electronically using telecommunication channels even now ( Letter dated January 22, 2014 No. GD-4-3/ [email protected] );

- copies of vehicle (chassis) type approvals, copies of certificates of conformity and (or) declarations of conformity;

- copies of passports issued for vehicles for which a recycling fee was previously paid, on the basis of which the payer manufactured (completed) vehicles (if new passports are issued for such vehicles in accordance with the legislation of the Russian Federation).

Please note:

The largest manufacturer will be refused to accept the calculation of the recycling fee submitted in electronic form via telecommunication channels (within a working day he will be sent a notice of refusal to accept) if:

- the calculation is presented in a format that does not correspond to the format determined by the Federal Tax Service;

- there is no electronic signature or it does not meet the requirements established by the legislation of the Russian Federation;

- the calculation is sent to the tax authority located in a location different from the location of the largest manufacturer.

Based on the provisions of paragraph 20 of the Rules, this norm should begin to work in relation to calculations that will be submitted to the tax authority from July 1, 2014, that is, when the requirement for mandatory submission of calculations in electronic form via telecommunication channels comes into force.

However, taking into account the recommendations of the Federal Tax Service on submitting calculations in electronic form before July 1, 2014, we can say that the stated rules are already relevant. If errors in the calculation of the amount of the recycling fee are detected in the submitted calculation, the tax authority will send information about this to the payer within 30 days. In turn, the latter is given the opportunity to correct errors within five days and re-send the calculation of the recycling fee. The largest manufacturer is given 45 calendar days following the quarter in which the calculation was submitted to pay the recycling fee.

If payment of the recycling fee is not made within the established time frame, the tax authority will collect the fee in a manner similar to the procedure established by Chapter. 8 , 10 , 11 Tax Code of the Russian Federation . There is another way out: if payment is late, the largest taxpayer can calculate and pay the recycling fee as an ordinary manufacturer ( clause 23 of the Rules ).

note

If the payer of the recycling fee, who is not classified as a major manufacturer, submits a calculation of the recycling fee in the manner established by Section. IV of the Rules , the tax authority must accept such a calculation, notifying the payer that there are no grounds for classifying it as the largest for the purposes of calculating and paying the recycling fee. This is due to the fact that the Rules do not contain grounds for the tax authority to refuse to accept the calculation of the recycling fee from a payer who is not the largest ( Letter of the Federal Tax Service of the Russian Federation dated January 22, 2014 No. GD-4-3 / [email protected] ).