Import of freight road transport into the territory of the Russian Federation can be carried out by both individuals and legal entities.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (499) 938-81-90 (Moscow)

+7 (812) 467-32-77 (Saint Petersburg)

8 (800) 301-79-36 (Regions)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

When importing cars, you must go through customs clearance and pay various taxes and duties.

How to properly register freight vehicles when importing into the Russian Federation and how much you will need to pay, read on.

What vehicles are imported to Russia and from where?

Any trucks can be imported into the territory of the Russian Federation: tractors, vans, pickups, and so on, the main condition is that the environmental class of the vehicle should not be lower than Euro 4, which is determined by environmental safety rules.

You can determine the environmental class of a vehicle:

- according to the individual vehicle number assigned by the manufacturer (VIN number);

- according to vehicle documents (this indicator must be indicated in the PTS);

- using unified databases, based on the make, model and year of manufacture of trucks. It is against such databases that the economic safety class of vehicles is checked by customs authorities.

Vehicles whose environmental class is lower than Euro 4 can also be imported into the Russian Federation, but only for dismantling for spare parts.

It should be taken into account that legal entities can transport trucks of any brand and any weight, and individuals can only transport trucks whose weight does not exceed 5 tons.

Vehicles can be supplied to Russia from any countries that are part of the Eurozone, America, China, Japan, and so on. There are no special restrictions regarding the country from which trucks are imported.

Documents for customs clearance of a truck

Before purchasing a car abroad , you must:

- decide on the method of importing the vehicle;

- select the place for processing documents on the vehicle;

- calculate the cost of customs duties.

In order to buy a foreign truck , a Russian citizen can use several options:

- carry out customs clearance yourself;

- contact a customs broker who deals with these issues;

- purchase a vehicle in Russia that has not been cleared at customs, and deal with its customs clearance.

The cost of a customs broker’s work is 10-15 thousand rubles.

In order to independently carry out the vehicle customs clearance procedure , you need to take the following steps:

- contact the customs service with a message about your intention to import a car;

- carry out calculation of customs duties;

- transfer money to a security deposit for customs (as a guarantee of your solvency);

- receive a customs receipt and certificate;

- obtain permission to import cars;

- import the vehicle within the established time frame;

- submit a package of documents for registration to the customs point;

- pick up the truck after completing the documents at the customs warehouse;

- register the car with the traffic police.

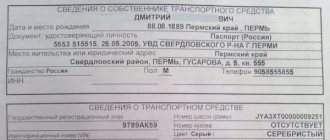

The package of documents that, according to the rules for customs clearance of trucks, must be provided at customs includes:

- passport of a citizen of the Russian Federation;

- international passport;

- guarantee certificate;

- deed of sale and purchase;

- technical passport of the vehicle;

- insurance;

- customs receipt;

- declaration in form TD-6.

While customs officers check the submitted documents, the vehicle will remain in the customs storage warehouse.

Price

When registering an imported cargo vehicle, the owner will have to pay:

- customs duty;

- recycling collection;

- VAT;

- a separate fee charged for processing documents by customs authorities.

The amount of customs duty is set at the state level and depends on factors such as:

- total weight of transported vehicles;

- age of the truck;

- engine type and size.

For the purposes of calculating customs duties, all trucks are divided into the following subtypes:

| car with a mass of no more than 5 tons | engine capacity up to 2,500 m³ (for diesel and semi-diesel cars) or 2,800 m³ (for gasoline engines) |

| vehicles weighing up to 5 tons | engine capacity more than 2,500 m³ (diesel and semi-diesel) or 2,800 m³ (gasoline) |

| machines weighing 5 - 20 tons | — |

| vehicles weighing more than 20 tons | — |

The customs duty rate varies depending on the age of the car. The following age categories are currently in effect:

- less than 3 years;

- 35 years;

- 5 – 7 years;

- more than 7 years.

The current rates are presented in the following table:

The need to pay a recycling fee was introduced by Federal Law No. 89. In accordance with established rules, the collected funds must be used to increase the level of environmental safety when disposing of vehicles.

Currently, the fee is paid by the manufacturer when issuing a car passport or by the person importing vehicles into the Russian Federation. A note on payment of the recycling fee must be included in the vehicle title.

The size of the recycling fee payable when importing a truck into the territory of the Russian Federation depends on factors such as the age of the vehicle (up to 3 years and more than 3 years), as well as the gross weight of the vehicle.

The amount of VAT does not depend on any characteristics of the vehicle and is 18% of the indicated cost. The amount of the fee charged for registration depends on the cost of the car.

Recycling fee for trucks

| Vehicles used for the transportation of goods, trucks and their chassis | ||

| car age | up to years | more than 3 years |

| trucks with a gross weight of not more than 2.5 tons | 75,000 rub. | 132,000 rub. |

| trucks with a gross weight of over 2.5 tons, but not more than 3.5 tons | 120,000 rub. | RUB 187,500 |

| trucks with a gross weight of over 3.5 tons, but not more than 5 tons | 150,000 rub. | 240,000 rub. |

| trucks with a gross weight of over 5 tons, but not more than 8 tons | 165,000 rub. | 684,000 rub. |

| trucks with a gross weight of over 8 tons, but not more than 12 tons | 201,000 rub. | RUB 1,036,500 |

| trucks with a gross weight of over 12 tons, but not more than 20 tons | RUB 220,500 | RUB 1,509,000 |

| trucks with a gross weight of over 20 tons, but not more than 50 tons | 435,000 rub. | RUB 1,770,000 |

How to calculate delivery and customs clearance of a truck

So, you can make a preliminary calculation of the customs duty, determine the amount of the recycling fee and VAT yourself.

To carry out calculations, you can use the tables presented above or an online calculator.

It is easier to make the calculation using a calculator, since you do not need to independently determine the starting rates applicable for a particular vehicle.

We will calculate the customs clearance of a Volkswagen Crafter truck using a calculator located on the Avtopoisk 24 website.

Initial data:

| year of manufacture of the vehicle | 2011 |

| engine's type | petrol |

| engine capacity | 2,000 m³ |

| full mass | 2,840 kg |

| price | $160,000 |

For calculation the following are accepted:

| bid | at 20% (not less than 0.2 euros per 1 cm³) |

| 18% | VAT rate |

| recycling fee rate | 150,000 rubles |

| recycling rate | 1,25 |

As a result of the calculations we get:

| customs duty | 1,981,728 rubles |

| VAT | 2,140,266.24 rubles |

| recycling collection | 221,250 rubles |

| processing fee | 20,000 rubles |

Total – 4,363,244.24 rubles. That is, for customs clearance of a car with the specified parameters you will have to pay 4,363,244 rubles 24 kopecks.

It should be borne in mind that after independently carrying out calculations using both a calculator and tables, the cost of the operation is approximate. More accurate data can only be obtained from the customs service.

How to calculate customs clearance of a car from Japan is explained in the article: customs clearance of a car from Japan. Read about customs clearance of ATVs from China here.

Customs duty calculator for cars

When entering the territory of Russia, you must present a considerable package of documents:

- original documents for the car and their copies (it is important that the data in the passport and on the body, engine, etc. completely match);

- customs receipt with a certificate issued before departure abroad;

- car insurance contract;

- GLONASS security certificate;

- customs declaration, which can be prepared in advance using the online form for pre-filling the passenger customs declaration

Insurance is important. The lack of compulsory insurance can be a significant argument for refusal to cross the border, and in some cases even threatens with a fine.

customs duty

Customs duty is a mandatory payment when moving goods across the border, which is determined by the parameters of this product. According to current legislation, when calculating this indicator, the type of fuel used by the car, the year of manufacture of the vehicle, the volume and power of the engine are taken into account. If you have this data, you can easily find out how much customs clearance of a car will cost.

Payment of duty

The customs duty rate is fixed for each type of vehicle, approved by the Unified Customs Tariff and other regulations. However, the registration procedure is a responsible and troublesome matter. Therefore, most often, vehicle owners and people who conduct foreign economic activity resort to the services of customs representatives. And the concern about how to calculate customs clearance of a car rests with specialists.

Recycling collection

Customs officers collect a fee for the disposal of goods from wheeled vehicles. The payer independently makes the calculation, pays it to the current treasury account and provides a package of documents to the authorized body (to confirm the correctness of the calculation). It should be noted: if the car that is imported into Russia is more than 3 years old, then the payment will be higher than the same rate for a new car.

VAT

Unlike customs duty, its amount may vary depending on the type of fuel, age of the vehicle, etc. VAT is calculated based on the total amount of all payments: customs duty, duty and recycling fee.

Excise tax

Despite its ambiguity, for imported cars there is a fixed rate and depends directly on the customs value of the vehicle.

The car is not registered on the territory of the Russian Federation in case of temporary import. In this case, the driver has the right to travel on Russian roads for 6 months. If he is a foreigner, then the period of legal use of an uncleared Japanese car increases to 1 year. In other cases, driving a car that has not passed customs control is subject to administrative or criminal liability:

- If the information in the documents does not correspond to the vehicle data, a fine of 2,500 rubles is imposed.

- In case of illegal import of a car into the territory of the Russian Federation, the owner will be fined an amount equal to three times the cost of the car.

- If a car owner has evaded paying customs duties on a large scale (more than 1 million rubles), he will pay a fine of 500 thousand rubles.

- Evasion of payment on an especially large scale (more than 3 million rubles) is punishable by imprisonment for up to 2 years.

September 25, 2019 September 25, 2021 9.9K 11

The passage of customs procedures is regulated by:

- Chapter 12 of the Customs Code of the Customs Union (contains a list of necessary documents, a description of the procedure and requirements for the car);

- Article 16 of the Code of Administrative Offenses (describes fines for violating the procedure and deadlines for registration);

- Technical regulations of the CU (fifth appendix).

The following requirements apply to imported vehicles:

- The environmental class of the car is not lower than EURO-5;

- Payment of customs duties and fees is carried out in rubles (how much customs clearance of a car in Russia costs in each specific case can be found out using a calculator on specialized websites);

- An individual for his own needs can purchase abroad no more than 1 car per year;

- The vehicle must be equipped with an ERA-GLONASS receiver and transmitter.

The procedure consists of several steps:

- Making an insurance payment. Knowing the price of the car and its technical characteristics, you can calculate the deposit amount. Without this step, the customs clearance process will not begin.

- Filling out the declaration. You will need to indicate the numbers of the main units, information about the owner and other necessary information.

- Vehicle inspection. The inspector checks the unit numbers and checks that the documents are filled out correctly. If everything is filled out correctly, import is allowed.

- Write-off of funds from the deposit to pay off duties and fees. Entering data into the database.

Since electric cars practically do not harm the environment, their owners are provided with benefits: no transport tax, the ability not to pay a fee when driving on toll roads. They may be allowed to use bus lanes.

Purchasing an electric car abroad frees the owner from paying customs duties, but he will have to incur other expenses:

- Registration payment;

- VAT;

- Excise tax;

- Single tax depending on the price of the vehicle;

- Recycling collection.

This payment is required only for legal entities. Its size is determined by the power of the power unit. Only small cars with a power of less than 90 hp are not subject to excise tax. When buying a standard passenger car you will have to pay 45 rubles. for 1 hp, for a jeep - from 437 to 1260 rubles. for 1 hp Thus, the state, on the one hand, protects local producers, and on the other, imposes an additional tax on owners of expensive cars.

The amount of payments is fixed and depends on the estimated value of the vehicle specified in the purchase documents. If the car costs less than 200 thousand rubles, you will only need to pay 500 rubles for registration. Customs clearance of expensive cars will require more significant expenses - from 20 to 100 thousand rubles.

Recycling collection

To determine the amount of costs you need to know:

- The basic fee rate (for imported vehicles for personal use it is 20 thousand rubles, and for commercial vehicles - 150 thousand rubles);

- A coefficient depending on the age of the car (for cars no older than three years it will be 0.17, for others – 0.26).

Thus, knowing the age of the vehicle and the purpose of its import, you can calculate the amount to be paid without using a car customs clearance calculator in Russia.

The amount of payment for individuals is determined by the age of the car:

- If it is less than 3 years old, then if its price is up to 8,500 euros, the duty will be 54% of the price. For more expensive cars you will need to pay 48% of the cost.

- If the vehicle is aged from 3 to 5 years, the duty amount will be fixed (from 1.5 to 3.6 euros per 1 cm3 of power unit volume) and depends on the engine size.

- If the car is older than 5 years, then you will have to pay from 3 to 5.7 euros per 1 cm3.

For legal entities, the duty amount is set as a percentage of the price. Those who import gasoline-powered vehicles will have to pay 23% of the price of the car if it is less than 3 years old and 25% if it is between 3 and 7 years old. For the import of older cars you will have to pay from 1.4 to 3.2 euros per 1 cm3 of engine volume.

To import a car, you must prove your financial solvency to pay all the necessary payments. You will need to make a deposit in the amount of customs duties into a special account. If during the purchase process the buyer purchases a cheaper or less powerful vehicle, the unspent amount of the deposit will be returned.

Also important is the presence of an ERA-GLONASS receiver and transmitter on the car. It can be purchased at a specialized center, which will issue a safety certificate. Without it, it will be impossible to bring the car to the Russian Federation.

Our customs broker (representative) offers you the services of prompt customs clearance (customs clearance) of cars of any types and brands imported from Japan at any excise customs posts in Russia:

- at airports

- in seaports

- at automobile checkpoints (MAPP, DAPP)

- at railway checkpoints

We work with any participants in foreign trade activities:

- Individuals

- Legal entities

- Individual entrepreneurs

On average, customs clearance of a car from Japan to Russia takes 1 day!

In our company, the price or cost of “customs clearance of cars” imported from Japan to Russia is discussed individually depending on the tasks and place of customs clearance and is the minimum on the market. On average it is:

- for individuals: from 5,000 rubles;

- for legal entities or individual entrepreneurs (IP): from 10,000 rubles.

We are confident that we will become your reliable partner at customs!

Financial costs after the abolition of the transport tax on electric vehicles in Russia until the end of 2021 will decrease, however, there are other mandatory payments that are worth taking into account.

It is important to understand the following difference: the customs clearance process consists of several stages, and therefore payments. There are terms: customs duty and customs fee. Many will say that they are the same thing, but they are not.

Japanese cars have always been in price; their admirers would not exchange a real “Japanese” for any other foreign car.

Moreover, the popularity of customs clearance of cars from Japan has not changed even after a significant increase in import duties. Many vehicles were imported from this country before and are still being imported from this country.

The procedure for purchasing a vehicle in Japan and registering it legally in Russia is not difficult in itself, although you cannot avoid bureaucratic procedures. The main point is the payment of the fee. (tax) on a car from Japan is formed by the following key parameters:

- Price. Release date, or rather age. Volume, power, engine type. Who is the applicant for the registration procedure: an individual or a legal entity.

Rates change regularly once every 6-12 months, these changes need to be monitored.

Key points: Before you go to pick up the car, you must provide financial security to the customs authority.

Connoisseurs of Japanese cars did not change their preferences even after the state decided to “tighten the screws” by significantly increasing the cost of customs clearance of used Japanese cars. - an expensive pleasure, but despite this, they have been carried and will continue to be transported - worthy competition in the form of the Russian automobile industry is not yet in sight. To bring a Japanese car to Russia, it must, naturally, be cleared through customs.

Customs duties for certain categories of persons may differ significantly. First of all, you need to remember that if you buy cars for subsequent sale in our country, you will have to pay significantly more than if you import a car for personal use. The cost of customs clearance will depend on a number of technical factors, including:

- Car type.

- Year of issue.

- Power plant volume.

An auction differs from regular sales primarily in the absence of a fixed price. As soon as the seller receives an offer that suits him, the car is sold. Naturally, the seller dreams of the maximum price, but he always imagines the price corridor in which his car is located, so that when the minimum threshold is reached and there are no other offers, a deal occurs.

The procedure for customs clearance of a car from the Land of the Rising Sun cannot be called complicated. Let's briefly consider the main points.

Customs clearance of vehicles, in fact, begins before the planned date of your trip to Japan (if you buy a car yourself). While still in your home country, you should decide on the model and make of the car, and then pay a customs deposit. Its sum is a value derived from a combination of factors:

- the price of the purchased vehicle;

- the costs of its transportation;

- load capacity and engine volume of the vehicle;

- year of issue;

- the amount of mandatory fees collected at customs;

- customs duty, excise tax and VAT.

Documentation for car registration

After determining the cost of customs clearance and the feasibility of importing the selected vehicle into the Russian Federation, for further registration it is necessary to prepare a number of documents, which includes:

- civil and foreign passports of the person importing vehicles;

- car passport The document must include a note indicating that the vehicle has been deregistered in the country of export and marks from all customs services of the countries through which the transportation was carried out;

- compulsory car insurance policy (can be issued in advance or directly upon crossing the border);

- a vehicle purchase and sale agreement, as a document that confirms the right to ownership;

- certificate;

- customs receipt;

- customs declaration.

A customs receipt and certificate are issued after a certain amount of money is deposited.

After completing customs documents, it is in this deposit account that funds will be debited to pay fees and duties provided for by current legislation.

The form and procedure for filling out the customs declaration are established by Decision of the Customs Union Commission No. 422.

The document must indicate:

- name of the operation performed (import or export);

- car registration number (if available);

- technical data of the vehicle (make, model, type, registration and VIN numbers, country of registration);

- Full name or name of the company and full name of the representative transporting the car;

- country (specific point) of destination;

- data of all vehicle crew members who take part in the transportation of vehicles;

- data of all passengers (if available);

- availability/absence of supplies;

- presence/absence of additional products;

- presence/absence of certain types of spare parts or additional equipment for the imported vehicle;

- purpose of import/export;

- Additional Information;

- signature of the applicant and date of filling out the document.

These sections are filled out by the person who imports the transport. The remaining columns of the document (date of customs clearance, name of the customs authority that carried out the clearance, and so on) are indicated by customs officers.

Car customs clearance calculator

People who are interested in customs clearance of a car, in pursuit of savings or better quality, buy a car outside the Russian Federation. There is a need to import cars into Russia and undergo customs clearance. From January 1, 2021, the Customs Code of the Eurasian Economic Union became the main document regulating the movement of goods across the customs border of Russia. Federal legislation (Chapter 16 of the Code of Administrative Offenses of the Russian Federation and Article 194 of the Criminal Code of the Russian Federation) provides for strict liability measures for vehicles imported without customs clearance. Let us highlight the main points of regulation of customs clearance of imported cars:

- import is carried out by individuals and legal entities;

- The cost of customs clearance is influenced by such criteria as: the status of the person (individual or legal entity),

- purpose of import (personal or commercial use),

- car price,

- engine capacity,

- engine power,

- availability of special equipment,

- environmental class,

- some other factors.

Individuals enjoy preferential customs clearance under the Unified Customs Rate (UCR). Legal entities are required to pay the total customs payment (CTP), which includes duty, excise tax and VAT.

Customs clearance of a car is a procedure that requires a lot of time, effort and money. If a person does not want to do this on his own, you can use the services of a brokerage company, which will cost about 10–15 thousand rubles. It is also possible to buy a car that has not been cleared through customs and has already been imported into Russia, thereby saving on transportation costs to the country.

When calculating the duty, a parameter is used that should not be ignored. We are talking about the customs value of the car. The fact is that it does not mean the real price at which the vehicle was purchased, but the estimated price of a car in perfect condition, determined using special customs directories.

| 2. 5 | |

| 325000 — 650000 | 3.5 |

| 650000 — 1625000 | 5.5 |

| 1625 000 — 3250000 | 7.5 |

| 3250000 — 6500000 | 15 |

| > 6500 000 | 20 |

Also, the duty can be calculated as 54% of the customs value (for cars up to 325,000 rubles) or 48% (for other price categories). In this case, the amount of the duty should not be lower than the similar one calculated according to the table.

Customs duty is a mandatory payment collected by customs authorities for actions related to the release of goods. Payment of customs duties occurs simultaneously with the submission of the customs declaration.

If a citizen imports any goods into the territory of the Russian Federation, he is obliged to pay a fixed amount, which will act as a kind of compensation for the state’s expenses incurred at customs. This fixed amount—customs duty—depends on the customs value of the goods, including transportation and insurance costs.

Currently, in Russia, rates of customs duties are calculated in accordance with Decree of the Government of the Russian Federation of December 28, 2004 N 863 “On rates of customs duties for customs operations.” Today they range from 500 to 30,000 rubles.

The recycling fee is a one-time payment to the state budget that citizens make when purchasing a vehicle. The purpose of this collection is to ensure the safety of the environmental situation and the protection of human health and life. The funds received into the budget will subsequently be spent on recycling the car in accordance with current environmental standards.

The introduction of this fee for motorists is not accidental and seems reasonable to all citizens concerned about environmental protection. Recycling a car without causing significant harm to the environment requires costs, which the recycling fee is designed to provide. Even if the car was purchased secondhand from another owner, who for some reason did not pay the fee, the new owner is obliged to contribute it to the state budget. To calculate the size of the SS, you need to know the base tariff and the calculated payment ratio.

The recycling fee is calculated according to the formula: US = BT x RK, where BT is the taxable base tariff, RK is the calculated payment coefficient. The base rate (BT) for personal cars is 20,000 rubles, for commercial vehicles - 150,000 rubles. The value of the calculated coefficient (RC) is influenced by the individual technical characteristics of the car: year of manufacture, dimensions, total weight, engine type.

The disposal fee is not paid in the following cases:

- vehicles are imported that are not listed in the legally approved current Lists regulating the payment of the recycling fee;

- the car is over 30 years old, it is not a subject of commercial use, it contains production parts or is restored to its original condition;

- the car is imported into Russia by persons participating in the State Program to Assist the Voluntary Resettlement of Compatriots Living Abroad to the Russian Federation;

- subjects of import are forced migrants or refugees.

Registration procedure

You can carry out customs clearance of special equipment or freight transport:

- with the help of a customs broker. B. In this situation, specialists will handle the collection of documents, payment of duties and customs clearance, which will significantly reduce the time required to complete the work. But you will have to pay extra for these services. Customs brokers charge on average from 10,000 rubles to 15,000 rubles ;

- on one's own.

To carry out the customs clearance procedure for a truck yourself, you must proceed according to the following scheme:

- Contacting the customs service. During the preliminary stage of customs clearance, the following is required:

- make calculations of customs duties;

- deposit the amount of customs duties and receive a certificate and receipt as security for solvency;

- obtain a special permit to import motor vehicles of the specified model and cost.

- Import vehicles and complete customs documents by submitting a customs declaration and attached documents.

- Register the car with the traffic police.

Customs clearance of a car in 2021

[yop_poll id=”11"]

What documents are required for customs clearance of a Japanese car?

You can register a car imported from Japan to Russia in the city where the cargo ship arrives. At the customs point in charge of control issues, the future car owner must present:

- A package of documents for the vehicle. It includes: originals and copies of foreign registration certificates;

- confirmation of ownership;

- certificates allowing you to identify the car.

Japanese vehicles attract the attention of domestic car enthusiasts due to their high build quality and affordable prices. Both new and used cars are in demand.

One of the mandatory conditions for importing a vehicle is that the future car owner must make a customs deposit. You can also search for a car from the Land of the Rising Sun in the states of the Customs Union - Armenia, Kyrgyzstan, Kazakhstan and Belarus.

The cost of registration for individuals and legal entities is different: the latter pay more, including due to a higher recycling fee.

Everything changes

In the summer of 2021, the decision of the board of the Eurasian Economic Commission No. 219 “On the list of international and regional (interstate) standards” came into force. The document included new rules of the technical regulations of the Customs Union “On the safety of wheeled vehicles”. From July 2021, all cars imported into Russia must undergo individual certification to obtain a vehicle design safety certificate (VSCTS).

You can undergo the examination only in accredited testing laboratories, and many owners of Japanese cars have already encountered difficulties in registering imported cars. From 2021, in addition to new examinations, the lives of those who have been driving right-hand drive cars for a long time and do not plan to switch to European versions will change. In total, according to analysts, almost 3.5 million right-hand drive cars are registered in Russia - 7.7% of the country’s entire vehicle fleet, but this number may significantly decrease in the next few years - the import of foreign cars with right-hand drive will be limited starting in 2021.

About 10–12 years ago, when the Russian market was not as saturated as it is now, Japanese-made right-hand drive cars were considered a good alternative to new cars from VAZ. Drivers (not without reason) believed that it was better to take a 5-10 year old Japanese car than to drive a new, but domestic car. Russian drivers were captivated by the good equipment in the “Japanese”: heated seats, automatic transmission, climate control and a reliable engine, which could only be broken with certain skills.

Peter Shkumatov

Owners of “samurai” may not agree with these conclusions, but driving a right-hand drive car in Russia was not very easy, and now, when traffic jams form even in small settlements due to the huge number of cars, driving a right-hand drive car is even more difficult.

Due to the lack of a normal alternative, from the beginning to the mid-2000s, owners of right-hand drive vehicles perceived any attempt to bring Japanese cars under general rules almost as discrimination. Although in reality, of course, everything was different. The last time the rules for passing technical inspection changed radically was in 2021. In particular, according to the new rules, any contamination on “the diffusers of external lighting devices and the installation of colorless or colored optical parts on them” is not allowed.

To put it as simply as possible, any lighting fixtures built to Japanese rules were equated to a death sentence for a car in Russia. And this is perhaps the only problem for right-hand drive drivers under the new rules. It is not difficult to rebuild the optics of a right-hand drive car to comply with European rules and right-hand traffic, but if the company that carries out these procedures does not have a certificate and license, then such modifications will not be accepted at the technical inspection.

Until May 4, 2021, for legal entities and individuals in the EAEU countries, rates for the import of electric vehicles were 15% of their cost. Many transported cars themselves, while those who did not want to deal with paperwork preferred to go to dealers.

For dealers, that is, legal entities, duties have already been canceled twice, but each time temporarily. But so far this has not had a serious effect, except that the representative offices tried to import new electric cars to Russia. By the way, let us remind you once again that the majority of electric vehicles in Russia were imported used. The main electric car on our market is the right-hand drive Nissan Leaf of the first generation from Japan, and their number continues to increase.

So, on May 4, new EAEU rules came into force, according to which customs duties are abolished. Unfortunately, temporarily: until December 31, 2021. As they say, remember this date, it, alas, can be of fundamental importance.

No. In Russia, unfortunately, such a concept as STP has developed - aggregate customs payment. This abbreviation hides a whole series of payments, and dealers and enthusiasts tend to include in it everything that will have to be paid to the state if they want to introduce an electric car in Russia.

So, bend your fingers. Customs clearance fee. No, this is not a duty. This is separate. But please give me about 100 dollars.

The fact of the matter is that there is little of anything. In theory, new Teslas, but they still remain inaccessible to the majority of the population. Even if customs duties and VAT are abolished, taking into account the fall of the ruble, the minimum cost of Model 3 will still be four million for a completely empty rear-wheel drive car with a 55-kilowatt battery.

Used Teslas? Their cost is not that low - thanks to Elon Musk for the eight-year warranty on the batteries. The editor of the Canadian publication Elektrek.co, Frederic Lambert, recently bought himself a Model X with a mileage of about 700 thousand kilometers! No joke, I picked it up at a rental office. So here it is. For some Porsche Cayenne or BMW X5 in Western countries with such mileage they would ask you three thousand dollars or euros. And the Tesla Model X, which was the cheapest on the market, cost Lambert 30 thousand (!). Plus delivery, plus customs clearance, plus Era-Glonass, plus recycling fee... and you get a car for five or six million with the nearest official service in Finland with a mileage of 700 thousand kilometers. “Well, that’s it,” as many people said recently.

What remains is what they are bringing now: used electric cars from mass brands of previous generations. Volkswagen e-Golf, Nissan Leaf, Renault Zoe, BMW i3... this is not what you dreamed of, although if dad gives the go-ahead, the cost of such equipment will really decrease.

What is unit-by-unit customs clearance of a truck?

To reduce the cost of customs clearance, a method of aggregate customs clearance was introduced.

When using this method, the following scheme is performed:

- abroad, a car is selected that satisfies the client’s needs;

- the vehicle is dismantled;

- the car body and engine are imported into the territory of the Russian Federation alternately, which significantly reduces customs duties, since the engine is a related product;

- The car is assembled in the Russian Federation and subsequently registered.

It should be noted that the method considered is not entirely legal and can only be used in exceptional cases.

Before customs clearance of a truck, you should familiarize yourself in detail with the current rules, since the import and clearance of motor vehicles from different countries may differ slightly from each other.

The timing of customs clearance of goods is described in the article: customs clearance of goods. See the page for the cost of customs clearance of cars from the USA.

Find out the rules for customs clearance of cars from Germany from this information.

Features of the procedure for customs clearance of trucks by individuals

When clearing a truck at customs by individuals, the following factors should be taken into account:

- environmental control, which is sure to await you at the Ukrainian border;

- mandatory deregistration of a vehicle;

- the age limit for an imported car is eight years;

- payment of VAT and duties on imported cars;

- the mandatory presence and correct execution of a deed of gift or deed of sale, subject to the purchase of a car from private individuals;

- invoice with the appropriate stamp, if the car was purchased from a legal entity. faces;

- permission from customs to supply vehicles for registration already on Ukrainian territory.

In order to identify a car as a truck, for the purpose of its subsequent customs clearance according to truck standards, the following conditions must be met:

- mandatory separation of the habitable part from the cargo part;

- absence in the cargo compartment of such elements as windows, seats, fastenings for installing seats, seat belts.

These factors mainly concern freight vehicles imported from Europe. If you are going to clear customs of a pickup truck from the States, the main condition will be the dimensions of the body. The calculation formula is simple: the body must be longer than half the distance between the axles of the car.

More detailed information on truck identification can be obtained by contacting our company consultants.

Customs value of a truck

If customs clearance is carried out independently, then you will need to make several types of payments:

- import customs duty;

- value added tax (VAT);

- recycling collection;

- fee for customs clearance services.

Payment of customs duties and taxes is made from the deposit account to which the money was credited before purchasing the truck. If the amount for customs clearance turns out to be less than what was transferred to the deposit account, the service employees will return it.