How does a contract for the free use of a car differ from other similar contracts?

All agreements for disinterested use are regulated by Chapter 36, Part 2 of the Federal Law-14 of the Civil Code of the Russian Federation, which provides for the absence of remuneration for use. However, agreements for the disinterested use of a car have some features:

- First of all, these agreements are marked by the high responsibility associated with driving a vehicle, as an object of high danger. In addition, the car owner has many responsibilities.

- The next feature of motor transport, as an object of an agreement for disinterested use, is the completeness of the transport transferred by the owner of the car to the user. A car, in addition to structurally integral components, has components that do not meet the characteristics of the vehicle, that is, when operating a vehicle (for example, tires), their replacement is necessary.

- Among other things, the conditions for using transport vary widely, and the technical condition of the vehicle and its serviceability depend on the conditions of its use. Despite the specific purpose of transport - to travel, it can be used in different ways: for example, a passenger car can be used for personal travel, or it can be used as a taxi. In addition, vehicles wear out over the course of use, both physically and mentally.

Therefore, when concluding such an agreement, it is necessary to provide for all the details of the disinterested use of the car. This will ensure the protection of the rights of the owner of the car and at the same time ensure the fullest use by the recipient of the transferred vehicle.

In what cases is such a document needed?

Today it is rare to find concluded agreements for the disinterested use of transport. The need for this appears when participants see the benefits of such an agreement, especially in the area of paying taxes. The costs of maintaining the vehicle in good condition are borne by the recipient of the vehicle by agreement. The parties to the agreement can write down the following here:

- Replacement, repair of spare parts, tires and other costs associated with the operation of transport.

- Who pays the fines received by the vehicle owner for traffic violations?

- Reimbursement of worn-out components during vehicle operation.

- If the owner of the vehicle uses his car to carry out official tasks, the institution can provide compensation for the costs of fuel and lubricants.

Such an agreement can be drawn up under the following circumstances:

- Transfer of a vehicle for use in a private taxi fleet.

- Use of transport in the interests of the institution.

- Transferring a car to other employees of an institution for a long time.

The main point in the listed options for transferring vehicles is that there is no financial compensation provided, that is, the car is transferred free of charge. This is the difference between renting a car and using it for free.

Documents required for registration

- When concluding an agreement for the disinterested use of a car, you must provide the following documents:

- Certificates confirming the identities of the parties.

- Registration certificate for the car.

- OSAGO – car insurance.

- Driver's license of the recipient of the vehicle.

- The agreement is drawn up in 2 copies, with one copy given to the signatories.

- The text of the agreement displays all the information displayed in the documents, as well as units that are provided for temporary use.

- Motor vehicles should not be mortgaged or be the subject of a lawsuit.

- The text of the agreement must also indicate the mileage of the vehicle and note any identified faults and shortcomings.

- A document confirming the estimated value of the car.

What is better - a contract or a power of attorney?

Both options provide the rights to use a car to a person who is not the owner of the vehicle. At the same time, an agreement for the disinterested transfer of a car has at least two advantages:

- The agreement describes in detail the rights and obligations of the parties to the agreement, assigning operating costs to the user of the vehicle.

- The agreement is the basis for transferring operating costs to the institution's costs.

Agreement for free use in Russian legislation

The possibility of concluding agreements for the gratuitous use of various property is expressly provided for by current Russian legislation. In particular, this issue is addressed in the provisions of Art. 689 of the Civil Code of the Russian Federation. Moreover, such an agreement can be concluded between any legally capable persons, both individuals and legal entities, and affect almost any property, including vehicles.

At the same time, this agreement and the parties involved in it are also subject to certain requirements regarding the rental process. For example, the current provisions of Art. 689 of the Civil Code of the Russian Federation stipulate that only property that is not prohibited to be transferred by law can be transferred for free use, as well as property that has stable generic characteristics - does not lose its basic natural properties during the process of use. However, cars themselves are such property.

Also, from the legislation relating to rentals, standards for improving the car are also taken, which can be done at the request of the temporary user. Thus, possible changes and improvements to a car are recognized by the owner of the person using it only if they are separable without violating the properties of such a car.

Otherwise, if the improvements cannot be separated without causing damage to the vehicle, they are the property of the owner of the vehicle, and the person who used them and carried out such improvements cannot demand compensation.

An agreement for the gratuitous use of a car has significant differences from a power of attorney. At the same time, the conclusion of such an agreement has a large number of advantages in comparison with the confidential nature of the transfer of the right to use a vehicle. These benefits can be important for both individuals and legal entities.

Advantages of a contract for the free use of a car and differences from a power of attorney

First of all, the main difference between a gratuitous use agreement and a power of attorney is that the person receiving the right to use a motor vehicle is granted not only a number of rights, but also certain responsibilities.

Accordingly, in the event of problems with a vehicle that was transferred for use under a contract, and not by proxy, the recovery of compensation and damage from the person managing it is greatly simplified. In addition, the existence of an agreement may be the basis for releasing the owner from fines in the future, or the agreement itself may provide for the obligation to pay all automatically accrued fines for traffic violations by the user of the vehicle. A person driving a car by proxy does not bear any financial responsibility for damage caused to such a car.

In general, the advantages of an agreement on the free use of a car include:

- Financial liability of the person who will use the vehicle.

- The duty to regularly maintain the vehicle - refuel it, change tires, wash and maintain it.

- The ability to include expenses for operating a car for legal entities into accounting expense items. With a power of attorney, this is not possible.

- The person who is the owner of the property receives the right to terminate the contract and compensate for losses if the person disposing of the property under the contract violates the conditions and procedure for its use or uses it for other purposes.

- Full details of any other rights, obligations and responsibilities for the use of property under the agreement.

A power of attorney to drive a car can also significantly expand the rights of the authorized person, including in the interests of the principal. Thus, a power of attorney may allow for technical inspection, registration of a car with the traffic police, its sale, transportation across the border and other actions, while under the contract their implementation will be impossible. Also, the power of attorney can be revoked at any time, but the contract can be terminated unilaterally without consequences only if there are grounds for this, or such a possibility is mentioned in the contract.

How to draw up an agreement on the free use of a car - sample

Like any other agreement, such an agreement must be drawn up in at least two copies - one for each party.

There is no established form at the federal level for gratuitous use agreements. However, there are a number of nuances that must be present in such an agreement. So, these include:

- Passport or installation data of the parties to the agreement.

- Description of the subject of the contract - a car.

- Description of all components of the vehicle and documentation transferred for use of the vehicle under the contract.

- Indication of the rights and obligations of the parties, including reimbursement of operating costs.

- Date of conclusion of the agreement, as well as details and signatures of the parties.

Specifying the duration of the contract is not mandatory. So, if the contract does not have an exact indication of the validity period, it is considered to be concluded for one year. And the person using it under a gratuitous use agreement can continue to operate after the expiration of the agreement, if there are no actual objections from the owner.

note

If the obligation to bear operating costs is not stipulated in the text of such an agreement, it is assigned to the person to whom the vehicle is transferred for use.

Usual terms and conditions of the Agreement for the free use of a vehicle:

(conditions that the parties, in order to prevent possible risks and disagreements, by virtue of the right granted by law and (or) business customs, independently determine in the Agreement for the gratuitous use of a vehicle):

conditions defining in detail the characteristics and description of the vehicle, which allows the requirements for the quality, quantity and range of the vehicle transferred for use to be agreed upon by contract;

- information about the presence or absence of rights of third parties to the vehicle (encumbrances and (or) restrictions) and, if there are rights of third parties, execution of the necessary consents, according to the forms provided;

- for the Lender who is an individual - a guarantee of the absence of marital relations or registration of the necessary consent of the spouse to transfer the common property of the spouses for a loan in accordance with the submitted form;

the purpose and (or) purpose of the Borrower’s use of the vehicle;

- period of free use;

- procedure for acceptance and transfer of a vehicle according to the Transfer and Acceptance Certificate;

the procedure for transferring a vehicle for free use to third parties, if it is not specified in the agreement, then the Borrower has the right to transfer the vehicle for free use to third parties only with the consent of the Lender;

procedure for payment of vehicle maintenance costs;

- liability of the parties;

- settlement of disputes;

- procedure for changing or terminating the contract;

conditions allowing the conclusion of an agreement either in simple written form, or the decision of the parties to notarize the Agreement for the gratuitous use of a vehicle;

- other conditions that the parties, by virtue of the right granted by law and (or) business customs and (or) agreement of the parties, can independently determine in the contract.

According to the Federal Law “On Information, Information Technologies and Information Protection”, when providing confidential information, it is necessary to obtain consent to access such information.

Between whom can it be concluded?

A free car rental agreement is concluded between the lessor (lender), who is the owner of the movable property, and the lessee (borrower), the party receiving the vehicle for temporary use. There is no charge for using the car in this situation.

The lender and borrower can be both private individuals and individual entrepreneurs and enterprises and organizations registered as legal entities.

An exception is a commercial organization when transferring property for free use to the founder of the company, participant or member of the organization, as well as its director (Article 690 of the Civil Code of the Russian Federation).

Sample contract form

The free use agreement must contain:

- Details of the document, which include the date and place of drawing up the document.

- Full name and details of the parties.

- Description of the subject of the contract (car). The following must be indicated:

- vehicle make and model

- registration number and individual (VIN) number

- Year of manufacture

- color

- PTS details

- assessed value

- car condition. The vehicle must be delivered in good condition. Additionally, existing external defects (scratches, dents, etc.) are reflected.

- Rules for the maintenance and servicing of motor vehicles.

- Rights and obligations of the parties.

- Procedure for transfer of movable property. Rules for drawing up a transfer and acceptance certificate.

- Rental period.

- Possibility of sublease or further purchase of the vehicle.

- Responsibility of the parties.

- The procedure for compensation for damage if it occurs outside the scope of the insurance policy.

- Reasons and procedure for early termination of the agreement.

- The procedure for resolving disputes.

- List of applications. As a rule, the following is attached to the contract:

- deed of transfer

- act confirming the estimated value of movable property

The agreement is drawn up in simple written form in two copies. The document is not subject to mandatory notary certification and state registration.

Filling example

To conclude a free car rental agreement you will need:

- Documents confirming the identity of persons authorized to sign:

- if one of the parties to the agreement is an individual, then a passport of a citizen of the Russian Federation will be required

- if the party to the transaction is an individual entrepreneur or a legal entity, then a passport of the manager or legal representative acting on the basis of a power of attorney from management, an extract from the register of legal entities, the company charter, an order or other document appointing a director are provided

- Documents for the car:

- PTS

- registration certificate

- diagnostic card

- OSAGO insurance policy

- An examination indicating the estimated value of the vehicle.

Features for trucks

Both a passenger car and a cargo vehicle can be transferred for temporary use free of charge.

When concluding a freight transport agreement, it is recommended to take into account:

- area of use of the vehicle. To prevent severe wear and tear, it is recommended to clearly indicate for what purposes the machine will be used, how much cargo it can transport in one trip, and so on.

- which party will pay the running costs and in what quantity. It is especially important to determine the costs of the Plato system and transport tax

Since a truck is most often used by legal entities, it is important to take into account the nuances of taxation of this transaction. Unlike a lease agreement, the lender does not make a profit, which means there is no need to pay income tax.

Under the current agreement, the borrower can classify the money spent on repairs and maintenance as other expenses, which will reduce the amount of taxable profit.

What to pay attention to when signing

Before signing a free rental agreement, it is important:

- Check the details of the parties to the agreement, since most disputes are resolved exclusively in court.

- Check vehicle details to clearly identify the vehicle. An error (typo) in even one letter/number can result in a vehicle with completely different technical parameters.

- Indicate the complete set of vehicles, including installed additional equipment (alarm, radio, etc.).

- Confirm that the vehicle is in good condition.

- Indicate in what condition the vehicle should be returned. You can indicate that the car is transferred to the lender in its original technical condition or with some wear and tear.

- Check what costs are borne by each party and who is responsible in case of damage.

When may a contract be required?

Situations involving the conclusion of an agreement on the transfer of a vehicle for temporary use are few. They are mainly related to the benefits that signing the agreement provides.

Maintenance costs are borne by the person using it under the contract. This may include the replacement of consumables (filters, oils), seasonal tires, washing and other costs associated with operating the vehicle.

The fines that come to the owner must be paid by the driver who actually owned the vehicle and violated the traffic rules.

The agreement may provide compensation for wear and tear resulting from heavy use, such as in a taxi.

If the owner of a car uses it for business purposes, the company can compensate him for the costs of fuel and lubricants and take them into account in its expenses.

Thus, it is recommended to use the contract:

- when transferred to work in a taxi;

- when used for official purposes;

- when transferred to third parties who will use the car for a long time.

Free use differs from car rental in that in the first case there is no charge for use. In other words, the vehicle is transferred free of charge.

When is an agreement to use a car without payment drawn up?

Let's say you are an owner who, for certain reasons, does not plan to charge a fee for using the car. Or you are a company that wants to legally give part of your fleet to another friendly company for use. Or you need to insure yourself so that if something happens you are not responsible for other people’s mistakes, or you need to be confident in the safety of your property.

The law provides for gratuitous rent or "loan". This is much more profitable and simpler than renting for 0 rubles 00 kopecks. The last option is also not entirely correct from a legal point of view.

And if everything is clear with individuals, then organizations prefer such an agreement because of tax and material advantages. The maintenance of the vehicle under such an agreement is the responsibility of the person who uses it. The person who operates them also bears responsibility for the machine. Such agreements are often found in the field of passenger and cargo transportation, as well as under a mutually beneficial agreement between the employee and the company in which he works. There is no talk of any fee for the service.

Risks

In terms of possible risks, a gratuitous loan is no different from a regular lease for a monetary reward. And in this regard, free rent is much better than rent for money. After all, according to the contract, the user of the car is not obliged to do anything at all. However, the user will also not be able to claim reimbursement for the vehicle used. But in the event of a negative outcome, it will be easier for the landlord to demand compensation from the recipient for causing damage to property.

In the case where there is a correctly executed document, the person who received the car is responsible for fines. And although there is a great risk of evading one’s duties, the rights and interests of the owner are protected by the Civil Code of the Russian Federation.

However, as in the case of regular rentals, no one can guarantee the careful and responsible maintenance of the entrusted vehicle. Here, alas, you either need to come to an official agreement or carefully select the people with whom you should deal.

Documents for registration

As in the case of registering a lease, the process of a grant loan must be approached responsibly. Despite the simplified relationship, you need to be safe so as not to lose your property. What documents are needed:

- Identification document (preferably a passport).

- Vehicle technical passport.

- MTPL insurance policy.

- A driver's license with a category obtained for a specific type of car.

You also need to indicate the duration of the contract, the procedure for resolving controversial issues and early termination.

It is worth indicating who and to what extent is financially responsible for the condition of the vehicle.

Procedure and transaction registration

The document is drawn up in written form, there is no specific structure. The above-mentioned papers are attached to the agreement, the essence is stated on paper and sealed with their signatures. The contract is ready.

There is no need to notarize or register the document; it already has legal force. Presence is required only for the lessor and the recipient. Then, upon receipt of the car, a deed of transfer of movable property is drawn up. When returning the vehicle, an acceptance certificate is drawn up, and the owner signs in the document that he received the car back and has no complaints.

Drawing up and essential terms of the vehicle use agreement

The contract must indicate:

- description of the car and its components, body and engine numbers, characteristics, condition;

- list of obligations of the parties, rights and other agreements;

- date of drawing up the agreement, details and addresses, signatures of the parties;

- purpose of operation, market value of the car.

This data is needed in case of force majeure and to protect against fraud. If something happens, you can go to court and demand compensation for car repairs.

Following certain wording is desirable, but not required, since there is no statutory form here. They are an example on which you can draw up your own wording or the entire agreement:

- The property belongs to the Lender as a property and is not encumbered by the rights of third parties.

- The borrower will use the property in business activities for freight transportation.

- The lender transfers it to the borrower for temporary free use, and the borrower undertakes to return this property in the condition in which it was received, taking into account natural wear and tear.

- The property is transferred to the borrower and returned to the lender on the basis of acts of acceptance and transfer of property. These acts are drawn up and signed by the lender and the borrower.

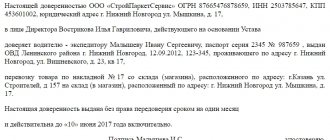

AGREEMENT N ____ FOR FREE USE OF A CAR

g.___________ "___" __________ _____ g.

The Borrower: _________________________, represented by _______________________, acting on the basis of _____________________________, on the one hand, and the Lender: _________________________________, on the other hand, have concluded (last name, first name, patronymic) this Agreement on the following:

SUBJECT OF THE AGREEMENT

1.1. The Lender transfers and the Borrower accepts for free use a car _________________________________, engine capacity: (make, state license plates) ________, technical passport ________, (option: mileage as of the date of conclusion of the agreement ________ km), for a period of _________: from “____” _____________ _____ according to “____” _____________ ___ The cost of the car, determined by agreement of the parties: _____________ _____________________________________________________ rubles. 1.2. The ownership of the car by the Lender is confirmed by the technical passport _________________________________. 1.3. The borrower uses the car for the following purposes: ________ __________________________________________________________________________. (for example: for own needs, for business trips, etc.) 1.4. The lender guarantees that the car is not subject to collateral and is free from the rights of third parties.

RIGHTS AND OBLIGATIONS OF THE PARTIES

2.1. The Lender undertakes:

2.1.1. Provide the car for free use to the Borrower in technically sound condition within _______ days from the date of signing the Agreement.

The fact of transfer of the car is documented by the Acceptance Certificate signed by the Lender and the Borrower.

2.1.2. Provide the Borrower with all accessories and documents related to the vehicle.

For reference. It may be stipulated that during the term of the agreement the Lender has no right to use the car for personal purposes or has the right to do so with the prior consent of the Lender on weekends and non-working hours.

2.2. The borrower undertakes:

2.2.1. Accept and use the car in accordance with its purpose and purposes specified in subparagraph. 1.3 clause 1 of this Agreement.

2.2.2. Ensure the safety of the vehicle. (Option: ensure the safety of the car during working hours - if the agreement provides for the possibility of the Lender using the car at other times.)

2.2.3. Maintain the car in good condition, carry out current and major repairs at your own expense, and bear other expenses for its maintenance.

2.2.4. Make separable improvements to the vehicle with the written consent of the Lender. Such improvements are the property of the Borrower.

2.2.5. Upon expiration of the Agreement, return the car to the Lender in technically sound condition.

The fact of return of the car is documented by the Acceptance Certificate, which is signed by the Lender and the Borrower.

2.3. If the Borrower does not use the car in accordance with the terms of this Agreement (provided for in subclause 1.3 clause 1), the Lender has the right to demand termination of the contract and compensation for losses.

2.4. The borrower bears the risk of accidental destruction of the car while using it for his needs.

ADDITIONAL TERMS

3.1. If the Lender fails to provide the car for use, the Borrower has no right to demand the transfer of the car for free use. In this case, this Agreement is terminated. In this case, the Borrower has the right to demand compensation for actual damage suffered by him.

3.2. The agreement comes into force from the moment it is signed by the parties and is valid until “____” _____________ _____.

3.3. Each party has the right to terminate this Agreement early by notifying the other party one month in advance.

3.4. All changes and additions to this Agreement are drawn up in the form of additional agreements, signed by the parties and are an integral part of this Agreement.

3.5. In cases not provided for in this Agreement, the parties are guided by the current legislation of the Republic of Belarus.

3.6. The agreement is drawn up in two copies having equal legal force, one for each of the parties.

ADDRESSES AND SIGNATURES OF THE PARTIES

Lender Borrower Name: ______________________ Address: _____________________________ Address: _____________________________ Passport data___________________ UNP ________________________________ Account ________________________________ in ___________________________________ Bank code __________________________ Bank address:________________________ Bank address ________________________ tel.: ______________________________ tel.: ______________________________ Lender: On behalf of the Borrower ________________ (_________________) ________________ ( _________________) M.P. M.P. ACT OF DELIVERY AND ACCEPTANCE OF THE CAR TO THE AGREEMENT OF FREE USE N ____ FROM _________ ___________ “____” ___________ _____ Borrower: _________________________, represented by __________________, acting on the basis of _________________, on the one hand, and the Lender _________________________, on the other hand, have drawn up this An act stating (last name, first name, patronymic) that the Lender, under the gratuitous use agreement N ____ dated __________, transferred and the Borrower accepted the car _____________________________, (make, state license plates) technical passport __________________________________________. The car was delivered in technically sound condition. The Borrower has no claims against the Lender regarding the quality and serviceability of the car. This Act is drawn up in 2 (two) copies, one of which is kept by the Lender, the other by the Borrower. ADDRESSES AND SIGNATURES OF THE PARTIES: Lender Borrower Name: ______________________ Address: _____________________________ Address: _____________________________ Passport data_____________ UNP ________________________________ Account ________________________________ in ___________________________________ Bank code __________________________ Bank address:________________________ Bank address ________________________ tel.: ______________________________ tel.: ______________________________ Lender: On behalf of the Borrower ________________ (_________________) ________________ (_________________) M.P. M.P.

Contents of the agreement

Typically, these types of agreements are not extensive. They contain no more than 10 articles reflecting the most important conditions.

Item

Without identification of the transferred object, the agreement is considered not concluded. Information about transport should be as detailed as possible; their purpose is to identify the vehicle. If the information is vague or incomplete, then instead of giving away a new Mercedes, you can get an old and battered one back. Therefore, in the relevant article it is necessary to indicate:

- brand;

- registration number plate;

- year of issue;

- body number;

- VIN number;

- PTS details.

The contract must indicate the authority of the owner and a document confirming it. In other words, include an article containing information about the vehicle registration certificate and its details.

To protect yourself from the demands of bailiffs or other persons, officials or civilians, you need to include a condition that the car is not pledged, under arrest or is not the subject of a dispute. If someone makes demands, the contract may be terminated.

It is recommended that the contract for the gratuitous use of a vehicle indicate the purposes for which it will be used.

Special attention should be paid to the cost of the subject of the agreement. The fact is that during operation the car can be destroyed or significantly lose in value. To save yourself from unnecessary price determination, you need to immediately include in the contract a price that the parties agree on. This cost will be taken as a basis for possible calculations.

Rights and obligations of the parties

This section is important because it regulates important things regarding operation. So, for example, you can determine that the recipient of the transport must:

- repair;

- maintain working condition;

- carry out maintenance;

- return in working order.

In the same section it is possible to provide for the period during which the car must be transferred.

The provision for incurring operating costs can be included in this section or made as a separate one. Since this is one of the most important parts of the agreement, it is better if these provisions are structured separately.

Operating costs

The costs associated with the use of the vehicle are borne by its recipient, not the owner.

To avoid confusion and misinterpretation, you need to list the types of expenses that the recipient pays. They are usually divided into two categories: operational and maintenance.

Operating costs consist of:

- expenses for fuel and lubricants;

- washing;

- interior cleaning;

- air conditioner maintenance.

- To ensure normal operation of the car you need:

- maintenance;

- replacement of parts with a short service life;

- tire replacement, seasonal or as needed;

- elimination of breakdowns and malfunctions.

The MTPL, DSAGO or CASCO policy is paid for by the recipient. The type of insurance is agreed upon by the parties.

Responsibility

A contract for the free use of a car must include this section. It is recommended to provide for as many incidents as possible in order to avoid disagreements.

The provisions of this section may vary. For example, it can be established that if deficiencies are found, the car must be replaced. The defects may have been unknown to the parties before the transfer of the transport, so the time of their discovery does not matter.

It is imperative to indicate that the recipient is responsible for the death or damage of the vehicle. If such a case occurs, he compensates the owner for expenses or the cost of the subject of the contract.

Validity of the agreement

This section specifies the period during which the vehicle will be used by the counterparty and the conditions for its extension. If you plan to use it for a long time, it is recommended to provide automatic renewal. It lies in the fact that if no one notifies of their desire to terminate the contract, then it is extended for the same period and on the same conditions.

If the parties do not specify a term, the agreement will be considered unlimited. It will be terminated upon prior notification of one of the parties to the contract for the free use of the car. You can also provide conditions for early termination.

Legislative regulation

From a legislative point of view, this agreement is regulated by the Civil Code of the Russian Federation of January 26, 1996, Federal Law No. 14-FZ. According to this legislative act, it is prohibited to transfer any type of property, including a vehicle, for rent if any sanctions are imposed on it by government agencies.

Article 689 of the Civil Code defines what constitutes a contract for gratuitous use; it specifies what may be the subject of this contract. For example, according to paragraph 1 of this article, the borrower undertakes to return the vehicle in the condition in which he received it.

What does it give

Signing a free use agreement can be called an alternative to providing physical services. person with a general power of attorney for the right to use a car. However, unlike the latter, the agreement allows the owner of the vehicle to detail the obligations of the borrower and, therefore, protect his rights. Specifically, the advantages of such an agreement include the following provisions, which can be written down in the text of the agreement:

- financial liability of the vehicle user;

- the obligation of regular maintenance (for example, changing tires);

- the possibility of terminating the agreement in the event of failure by the borrower to fulfill its obligations under the agreement;

- for legal entities - the ability to enter vehicle costs into accounting items;

- specification of other rights and obligations of the borrower.

Since the vehicle is not re-registered with the traffic police, receipts for administrative fines are sent to the owner

However, signing such an agreement is beneficial not only to the owner of the car, but also to the person who will use it. Unlike a power of attorney, which can be revoked at any time at the request of the owner, the agreement provides for its early termination:

- if its conditions are not met;

- upon expiration;

- at the request of one of the parties, if provided for in the terms of the agreement.

Based on this, we can say that a free use agreement is a more streamlined form of providing a vehicle for use by another person.

Filling Features

Like any document, a contract for the free use of a vehicle has its own characteristics. It can be composed:

- between individuals;

- individual and organization;

- between a private person and an individual entrepreneur.

Between individuals

The standard contract specifies the wallpaper data of individuals:

- passport series and number;

- registration address.

The party that leases the car is called the lender, and the party that accepts the car is called the borrower. The main thing when filling out the contract is to correctly indicate the vehicle data from the car documents. The standard agreement states:

- series and number of the vehicle registration certificate;

- brand;

- year of issue;

- engine number;

- body number.

Transfer deadline. One of the clauses of the agreement on free use stipulates the period for transferring the car. According to the Civil Code, this paragraph may not be indicated. In this case, the lease is considered unlimited.

Responsibility of the parties. Equally important is filling out the clause on the responsibility of the parties. It stipulates the conditions under which the borrower takes upon himself the safety of the car at any time of the day, obliging to reimburse it within the period specified in the agreement.

One of the subparagraphs of the “Other conditions” clause indicates the estimated cost of the vehicle in case of any damage or breakdown. At the end of the agreement, the details of both parties are indicated. By mutual agreement, it can be extended for an indefinite period. It does not need to be certified by a notary or other registration authorities. It can be in simple written form indicating all the necessary information.

Between an individual and an individual entrepreneur, LLC

Russian legislation provides for the option of concluding a free use agreement between an individual and an individual entrepreneur (IP), as well as with legal entities (LLC).

Unlike the previous type, the details of the company must be indicated here, and if there is a seal, its imprint is left on the contract form, in the “Details” section.

The official who carries out the transaction is indicated if the car belongs to a legal entity.

Contract for free use of a car and MTPL insurance

When transferring a car under a contract for free use, certain circumstances of its operation arise that are related to the compulsory insurance policy. If the MTPL policy is issued for an unlimited number of persons, then when registering a lease there is no need to indicate the borrower in the insurance policy.

In a situation where the policy is issued to specific persons, it is mandatory that the car owner enter information about the renter into the insurance policy, otherwise he may receive a fine.

Even if the owner of the car is sitting next to you, this does not give you the right to drive without a policy.

Essential terms of the Agreement for the free use of a vehicle without a crew:

(conditions without which, by virtue of legal requirements, the Agreement for the free use of a vehicle is considered not concluded):

- compliance with the established form of the contract, i.e. its conclusion in writing, its signing by the parties or their representatives and, as a rule, if the transaction is carried out by legal entities and (or) individual entrepreneurs, sealed, if this person, in accordance with the legislation of the Russian Federation, must have a seal. Agreements must be made in writing:

- if both parties to the agreement or only one of them is a legal entity, regardless of the term;

- condition on the subject of the contract, i.e. data allowing to establish which vehicle is subject to transfer for free use.

Why apply for free use of a car?

The fact of transferring a car for use to another person can be confirmed by a simple power of attorney, a general power of attorney or an agreement for gratuitous use (loan agreement - Chapter 36 of the Civil Code of the Russian Federation). In such cases, the car is not re-registered by the traffic police, which means that receipts for administrative fines are sent to the owner, and in the event of an accident (if the car escapes), he will become the main suspect. If a written agreement on the free use of a car was not concluded, will there be problems with the person driving such a vehicle?

In addition, concluding an agreement allows the owner to legally resolve issues: who is responsible for maintaining the car, current and major repairs, and in what condition the car was handed over and returned. Very often, the conclusion of such an agreement is beneficial to legal entities and individual entrepreneurs, who will have the right to include the costs of maintaining a car as part of the expenses of such a business entity. And, therefore, reduce the tax amount.

A well-drafted written loan agreement in the event of litigation will become significant evidence in a civil case in the field of protection of civil rights.

What documents should be drawn up in case of free use of a car?

The fact of transferring the car for free use must be documented in a loan agreement. Under such an agreement, the lender (the owner of the car) transfers the item for free use to the borrower. The borrower, who received the property free of charge, undertakes to return such thing in the same condition, taking into account normal wear and tear or in accordance with the terms of the agreement (Article 689 of the Civil Code of the Russian Federation).

A car loan agreement is concluded in simple written form and does not require notarization or state registration. By the way, it is not necessary to use the term “loan” in the name of the agreement; “gratuitous use” can also be used. Please note that if a third party acts on the side of the car owner, a notarized power of attorney is required. At the same time, the text of such a document must necessarily reflect the right to transfer the thing for use to third parties free of charge.

Draw up an Acceptance and Transfer Certificate for the car and its accessories, including the registration certificate, MTPL policy, diagnostic inspection card (if available), radio, keys, first aid kit, fire extinguisher, etc.

After returning the car, you can draw up an inspection report of the vehicle for any identified damage or deficiencies. If everything is in order, the person driving the car can ask the owner to draw up a receipt stating that there are no claims.

Preparation for concluding a contract

To conclude an agreement, you will need passport data of both parties, verification of authority in the case where one of the parties acts under a general or other power of attorney (independently or with legal assistance), a title, a CP for a car. Decide on a list of things that will be given for free use along with the car. Please note that those things without which it will be impossible to use the car must be handed over (CP, for example). The rest are by agreement between the parties.

When concluding a loan agreement, the new owner is not afraid of a ban on registration actions. Unlike an arrest, a wanted notice. Check the car via the Internet so as not to be afraid of its unexpected seizure and “showdown” if stopped by an inspector.

Sources

- https://DocInfo.net/dogovor-bezvozmezdnogo-polzovaniya-avtomobilem/

- https://pravo.moe/dogovor-bezvozmezdnogo-polzovaniya-avtomobilem-obrazec/

- https://yurzone.ru/zaklyuchenie-dogovora-bezvozmezdnogo-polzovaniya-avtomobilem.html

- https://UrAvto.com/sdelki/arenda/vidy-dogovora/bezvozmezdnaya.html

- https://belforma.net/%D0%B4%D0%BE%D0%B3%D0%BE%D0%B2%D0%BE%D1%80%D1%8B/%D0%94%D0%BE% D0%B3%D0%BE%D0%B2%D0%BE%D1%80_%D0%B1%D0%B5%D0%B7%D0%B2%D0%BE%D0%B7%D0%BC%D0% B5%D0%B7%D0%B4%D0%BD%D0%BE%D0%B3%D0%BE_%D0%BF%D0%BE%D0%BB%D1%8C%D0%B7%D0%BE% D0%B2%D0%B0%D0%BD%D0%B8%D1%8F_%D0%B0%D0%B2%D1%82%D0%BE%D0%BC%D0%BE%D0%B1%D0% B8%D0%BB%D0%B5%D0%BC_2

- https://rulipozakonu.ru/registracija/dogovor-bezvozmezdnogo-polzovanija-avtomobilem-obrazec/

- https://iskiplus.ru/bezvozmezdnoe-polzovanie-avtomobilem/

Expenses for operating a car received for free use

Current issues of accounting and taxation

An agreement for the gratuitous use of property is one of the types of business agreements widely used in the activities of enterprises. At the same time, this agreement has a number of features and raises many questions among accountants, namely: is it legal to reduce the income received by the organization by the amount of expenses for operating such a car?

An agreement for the gratuitous use of property is one of the types of business agreements widely used in the activities of enterprises. At the same time, this agreement has a number of features and raises many questions among accountants, namely whether it is legal to reduce the income received by the organization by the amount of expenses for operating such a car. This is what will be discussed in this article?????.

The procedure by which an organization enters into a free use agreement is determined by Chapter 36 of the Civil Code of the Russian Federation.

Under an agreement for gratuitous use (loan agreement), one party (the lender) undertakes to transfer or transfers an item for gratuitous use to the other party (the borrower), and the latter undertakes to return the same item in the condition in which it received it, taking into account normal wear and tear or condition stipulated by the contract ( Article 689 of the Civil Code of the Russian Federation ).

The right of ownership to property transferred for free use remains with the previous owner.

The parties to this contractual legal relationship can be legal entities and individuals, including those registered as entrepreneurs without forming a legal entity. It must be borne in mind that clause 2 of Art. 690 of the Civil Code establishes a restriction, which is expressed in the fact that a commercial organization does not have the right to transfer property for free use to persons who are its founders, managers or members of management and control bodies. The opposite situation is not prohibited by law.

An agreement for gratuitous use, in which one of the parties is a legal entity, must be drawn up in writing (Article 690 of the Civil Code of the Russian Federation) .

The essential terms of the contract are information about the property provided for free use and the period of use. If the terms of the agreement do not contain data about the property that allows it to be clearly identified, then even the agreement signed by the parties will not be considered concluded.

When receiving property for free use, an organization must take into account the position of the tax authorities that such an operation gives rise to certain tax consequences.

Namely: with the commencement of Ch. 25 of the Tax Code of the Russian Federation, the “free” use of property has acquired a very conditional character. And although the property does not belong to the borrower, he has one of the types of property rights (the right to use the service). In the tax accounting of an organization that receives property rights free of charge, such an operation is reflected as non-operating income ( clause 8 of Article 250 of the Tax Code ) with subsequent taxation on profits. Income is determined based on market prices in accordance with the rules of Art. 40 NK .

This should be data on the cost of renting similar property in the region (the cost of renting a car). However, many organizations are ready to challenge the opinion of tax authorities using the following arguments.

Taxable income should include only those incomes that are clearly formulated in Chapter. 25 NK . But Code of the Russian Federation for tax purposes does not provide its definition of property rights. There is no clear definition of this term in the Civil Code . Therefore, it is not clear what taxes should be paid on. And the fact that the provision of property for free use is a service is also not established by either the Civil or Tax Codes.

So, an organization that has received property for free use does not form a tax base for income tax. And if the organization has to defend itself in court, then the norm of paragraph 7 of Art. 3 of the Tax Code , which states that all doubts are interpreted in favor of the taxpayer.

Hence the conclusion: having received a car for free use, the organization must determine its position regarding the taxation of the operation:

— or pay income tax (clause 8 of Article 250 of the Tax Code) ;

- or not pay tax, but at the same time defend your interests in court.

So, an agreement on the free use of a car has been concluded. As already mentioned, the contract must describe the car in detail, indicate its registration number and engine number, body, make, year of manufacture, etc. (data from the registration certificate). It is also necessary to indicate the cost of the car agreed upon by the parties to the contract. Then the amount that must be taken into account on the balance sheet will be determined, and the amount of liability of the borrower in the event of a car accident will be determined, as a result of which the car cannot be restored (this amount will need to be returned to the lender).

The documents confirming the completion of this business transaction are the acceptance and transfer certificate of the fixed asset. Since the form of the act is not provided for in the albums of unified forms of primary accounting documentation, the parties to the agreement have the right to develop it independently, but it must contain the mandatory details in accordance with Art. 9 of the Federal Law of November 21, 1996 No. 129-FZ “On Accounting”.

In accounting, a vehicle received for free use is reflected in the debit of off-balance sheet account 001 “Leased property” (it is better to open your own sub-account “fixed assets received for free use”) at the cost of the vehicle assessed in the contract ( clause 87 of the Guidelines for accounting of fixed assets funds [1] ). This posting is done on the day when the acceptance certificate of the rented car is signed.

In accordance with the gratuitous use agreement, expenses associated with current and major repairs, as well as operation, may be borne by the lender (either in full, or responsibilities may be redistributed between the parties to the agreement). However, this approach is rarely used, since in this case these expenses cannot be taken into account by the lending organization for profit tax purposes, since the transferred car ceases to participate in the production process, that is, activities aimed at generating income.

Typically, the cost of maintaining a car received for free use is borne by the borrower. This is also stated in Art. 695 Civil Code . After all, the property will need to be returned to the owner in the same condition in which it was received, of course, taking into account normal wear and tear ( Clause 1 of Article 689 of the Civil Code of the Russian Federation ). The Tax Code does not establish any restrictions on the recognition of costs associated with the operation of a car received for free use. It is only important that the car is used for production purposes, the costs are documented and economically justified ( Article 252 of the Tax Code of the Russian Federation ). Then such costs can be included in expenses for ordinary activities ( Articles 253–254 of the Tax Code ), reducing taxable profit.

Let’s take a closer look at what expenses an organization bears for vehicles received for free use.

The cost of purchasing fuel and lubricants is the main part of the costs associated with operating a car.

In accounting, fuels and lubricants represent inventories ( clause 2 of PBU 5/01 ) [2] and are accounted for in account 10 “Materials” subaccount 3 “Fuel”. The initial cost of inventories does not include VAT and other refundable taxes ( clause 6 of PBU5/01 ). An organization has the right to take the amount of VAT paid as a deduction if this car is used in carrying out operations subject to VAT ( clause 1, clause 2, article 171 of the Tax Code of the Russian Federation ).

To avoid problems with tax deduction, enterprises often purchase gasoline by bank transfer, receiving from the gas station coupons or plastic cards for a certain amount and quantity of gasoline, as well as documents (way bills, invoices) that allow VAT to be offset. In this case, fuel and lubricants are accounted for in material cost accounts and are written off as the cost of products (works, services) without taking into account value added tax. The situation is completely different with VAT paid when purchasing gasoline for cash. Indeed, in this case, the buyer only has a gas station receipt, and in such cases the gas station does not issue an invoice ( Clause 7, Article 168 of the Tax Code ). And if the gas station receipt simply states the amount and does not indicate that it includes VAT, then all of it is included in expenses when calculating income tax. If the gas station receipt contains information that VAT is included in the sales price, then the entire amount of fuel and lubricants cannot be accepted as tax expenses.

Should purchased fuel be reflected in accounting at the price indicated on the cash receipt? regardless of whether VAT is included in this price or not (clause 147 of the Guidelines for accounting of inventories [3]) .

In tax accounting, the amount of VAT not accepted for deduction on the basis of clauses 1 and 2 of Art. 170 cannot be taken into account in reducing expenses, including as part of the cost of material assets. In such cases, VAT amounts must be taken into account at the expense of the taxpayer’s own funds.

However, this situation is not clearly stated in the Tax Code and is essentially controversial. Therefore, organizations will be interested to know that in the summer of this year, court cases appeared, the decisions of which concluded that it is possible to offset VAT on the basis of only a gas station receipt (of course, if the seller of fuel and lubricants is not exempt from paying VAT) (see resolutions of the Federal Antimonopoly Service of the Ural District dated 07/08. 03 in case No. F09-1961/03-AK and dated 07.10.03 in case No. F09-1990/03-AK). If the Tax Code does not provide for the issuance of an invoice and a settlement document with the allocated amount of tax ( clauses 6, 7 of Article 168 of the Tax Code ), the tax authorities do not have the right to require the taxpayer to submit such documents and confirm the right to deduct (see also the resolution of July 14 .03 No. 12-P of the Constitutional Court, which states that the norms of tax legislation must be correlated with the norms of civil legislation).

Write-off of fuel and lubricants as expenses occurs on the basis of primary accounting documents filled out in accordance with the legislation of the Russian Federation ( clause 1, 9 of Law No. 129 - Federal Law [4]). Such documents are waybills, the forms of which are approved by Decree of the State Statistics Committee of Russia dated November 28, 1997 No. 78. The waybill must include the serial number, date of issue, make and state number of the car, time of departure and return to the garage, speedometer readings before and after return, remaining fuel in the tank at the beginning and end of the day, fuel consumption, and route. Incomplete (incorrect) waybills can lead to disagreements with tax authorities regarding the validity of costs.

In tax accounting of fuels and lubricants based on paragraphs. 5 p. 1 art. 254 Tax Codes are included in material costs. At the same time, the Tax Code does not limit the amounts that an enterprise can spend on fuel and lubricants ( clause 11, clause 1, article 264 , clause 1, article 254 of the Tax Code ). However, Art. 252 of the Tax Code requires that all expenses be economically justified. Therefore, the enterprise should independently calculate fuel consumption rates. This can be done on the basis of the “Standards for the consumption of fuel and lubricants in road transport” [5], which the Russian Ministry of Transport approved on April 29, 2003.

Repair of a vehicle is divided according to the volume and nature of production work into current, medium and capital.

In turn, these types of repairs can be performed in-house or by third parties. In any case, repair costs must be documented (Article 252 of the Tax Code) .

Such documents may be: a defect sheet, which indicates the work to be performed, the timing of the work, the parts scheduled for replacement and the estimated cost of repairs; acceptance certificate for repaired fixed assets (form No. OS-3 [6]). For minor repairs, often performed by the driver himself, the purchased spare parts are immediately used, that is, they are installed on the vehicle and debited from accounting to cost accounts according to an act approved by the manager and signed by the driver and the accounting employee. In tax accounting according to clauses 1 and 2 of Art. 260 of the Tax Code, expenses for repairs of leased property made by the taxpayer are considered as other expenses and are recognized for tax purposes in the reporting (tax) period in which they were incurred in the amount of actual expenses. However, it is necessary to note that Article 260 of the Tax Code allows you to take into account the costs of repairing leased depreciable fixed assets. Therefore, if the owner of the car (lender) is an individual or organization on a “simplified” or “imputed” basis, then such a car does not belong to depreciable property. Therefore, an enterprise that has received a car for free use in such cases will not be able to take into account the costs of repairs under Art. 260 of the Tax Code and reflect them in the declaration on line 080 of Appendix 2 to Sheet 02 “Costs associated with production and sales”, but should be taken into account as “other expenses” ( clause 49, clause 1, article 264 of the Tax Code ). Repair expenses not related to depreciable property and recorded on line 264 are reflected in the same Appendix of the income tax return, only on line 170.

In accounting, funds spent on repairs are included in expenses for ordinary activities ( clause 7 of PBU 10/99 [7] ). But you can collect these costs into the formed “repair fund” in account 96 “Reserves for future expenses” or in account 97 “Future expenses” (depending on the chosen method recorded in the accounting policy).

Expenses for repairing a car received for free use are reflected in the following entries:

| Content | Debit | Credit |

| The costs of repairs performed by a third party are reflected (excluding VAT) | 20, 23, 25, 26, 44 | 60, 76 |

| The costs of unevenly performed repairs throughout the year are reflected. | 97 | 60, 76 |

| Repair costs are reflected at the expense of the reserve for repair costs created in the organization. | 96 | 60, 76 |

| VAT on work performed by third parties | 19 | 60, 76 |

| Costs for repairs carried out independently are reflected | 20, 23, 25, 26, 44 | 70, 69, 10 |

| The expenses for repairs carried out on an economic basis are reflected at the expense of the reserve for future expenses created in the organization. | 96 | 70, 69, 10 |

| Costs for repairs carried out on a self-employed basis were included in deferred expenses. | 97 | 70, 69, 10 |

It should be noted that if an organization takes into account the amounts spent on car repairs in account 97 “Deferred expenses”, then in accounting they will be written off in parts ( clause 65 of the Regulations on accounting and financial reporting in the Russian Federation [8]). in tax accounting - immediately ( Article 260 of the Tax Code ). As a result, income tax calculated based on accounting data will differ from that calculated based on tax accounting data. That is, the organization needs in this case to apply PBU 18/02 [9] and make accounting entries for the deferred tax liability ( clause 18 of PBU 18/02 )

| Contents of operations | Debit | Credit |

| Repair costs reflected | 97 | 60, 76 |

| VAT included | 19 | 60, 76 |

| Money transferred for repairs | 60, 76 | 51 |

| Submitted for deduction of input VAT | 68/ vat | 19 |

| Tax liability reflected | 68/ profit | 77 |

| Partially written off repair costs | 20, 23, 25, 26, 44 | 97 |

On July 1, Federal Law No. 40-FZ [10] came into force, according to which all vehicle owners must insure their liability to third parties. Moreover, not only the owners of vehicles, but also those who own them under the right of economic management, operational management, under a lease agreement, including under an agreement for free use, must insure liability. And from January 1, 2004, Art . 12.37 Code of Administrative Offenses of the Russian Federation [11], which provides for liability for non-compliance with the requirements for compulsory motor insurance.

Therefore, when receiving a car for use, the organization must take into account the presence (or absence) of motor vehicle liability insurance, provide (if necessary) for possible additional costs and fix in the free use agreement at whose expense they will be incurred.

Also, the party acting as the borrower (car user) has the right, independently or at the request of the lender (car owner), to insure the received property to ensure reimbursement of its value (part of the cost) in the event of unfavorable insured events. This type of insurance is called voluntary insurance, and this must also be included in the contract for the gratuitous use of a car.

Thus, if the agreement stipulates that insurance costs are borne by the borrower, then the organization must keep in mind that in accounting, contributions for compulsory and voluntary car insurance are classified as expenses for ordinary activities as part of other costs (clauses 5, 7 , 8 PBU 10/99 ). According to clause 18 of PBU 10/99, expenses are recognized in the reporting period in which they occurred, regardless of payment. Since the insurance premium is paid at a time, insurance costs are initially reflected in account 97 “Deferred expenses” and will subsequently be written off to the organization’s expenses gradually during the term of the contract ( clause 65 of the Regulations on accounting and financial reporting in the Russian Federation ).

| Contents of operations | Debit | Credit |

| Insurance premium transferred | 76-1 subaccount “calculations for property insurance | 51 |

| The insurance premium is taken into account as part of deferred expenses | 97-1 subaccount “property insurance expenses” | 76-1 subaccount “calculations for property insurance |

| Partially written off car insurance costs | 20, 25, 26, 44 | 97-1 |

The amount of insurance costs must be distributed over periods in proportion to the number of days the contract is valid.

Example

Dialog LLC, under a free use agreement, uses a VAZ-2109 car for management needs. By agreement of the parties, Dialog LLC assumes the costs of compulsory insurance of civil liability of the car. The contract with the insurance company was concluded for seven months (from September 1, 2003 to April 1, 2004). The insurance premium is paid at a time in the amount of 2,835 rubles. The organization makes quarterly advance payments for income taxes.

We will distribute the amount of contributions over periods in proportion to the number of days the contract is valid in each period. The validity period is 212 days, of which 30 days account for the third quarter of 2003, 92 days for the fourth quarter of 2003, and 90 days for the first quarter of 2004.

The amount of accepted contributions for profit taxation by period will be:

— for nine months of 2003: 2835: 212 * 30 = 401.18

— for 2003: 2835: 212 * 92 = 1230.28

— for the first quarter of 2004: 2835: 212 * 90 = 1203.54.

The following entries will be made in accounting:

| Contents of operations | Debit | Credit | Amount, rub. |

| Costs under the contract of compulsory civil liability insurance are reflected | 97 | 76/1 | 2 835 |

| Insurance premium paid | 76-1 | 51 | 2 835 |

| Part of the insurance premium is included in general business expenses in the third quarter (2835 : 212 * 30) | 26 | 97-1 | 401,18 |

In tax accounting, expenses for compulsory and voluntary insurance (subject to the conditions stipulated by Article 252 of the Tax Code ) are included when calculating income tax as expenses associated with production and sales, and are other expenses ( clause 5, paragraph 1, Article 253 Tax Code of the Russian Federation ). At the same time, expenses for compulsory civil liability insurance for profit tax purposes are taken into account within the limits of insurance tariffs ( clause 2 of Article 263 of the Tax Code ) approved in accordance with the legislation of the Russian Federation (Resolution of the Government of the Russian Federation dated May 7, 2003 No. 264). Costs for voluntary insurance of civil liability in accordance with Art. 263 of the Tax Code are not taken into account for profit tax purposes. Exceptions are cases when liability insurance is a condition for carrying out activities in accordance with the requirements of international law ( clause 8 of Article 263 of the Tax Code ). Expenses for voluntary insurance of vehicles (against theft, natural disaster, etc.) are included in other expenses in the amount of actual costs (clause 3 of Article 263 of the Tax Code of the Russian Federation ).

As a rule, under the terms of the contract, the insurance premium is paid at a time and written off as expenses depending on the period for which the insurance contract was concluded. For contracts concluded for more than one reporting period (namely: when the contract comes into force in one reporting period and terminates in another), the amount of contributions (using the accrual method) must be distributed evenly between periods ( clause 6 of Article 272 of the Tax Code RF ). With the cash method, an organization can exclude insurance premiums from taxable profit on the day they are transferred to the insurer ( clause 3 of Article 273 of the Tax Code ).

If the contract is concluded for a period equal to or less than the reporting period , then costs are recognized in the reporting period in which the insurance premiums were paid.

Thus, accounting and tax accounting of expenses for civil liability insurance will coincide if in tax accounting expenses are recognized evenly over the term of the contract. When accounting and tax accounting of these expenses do not coincide, the organization will need to show taxable temporary differences ( PBU 18/02 ), which arise because expenses reduce profit in tax accounting immediately and in full, and in accounting - in parts and gradually. And this will lead to the emergence of a deferred tax liability equal to the product of the amount of the temporary difference and the income tax rate.

As already mentioned, under certain circumstances, each party has the right to cancel the contract for free use by notifying the other one month in advance. If such a situation occurs before the expiration of the insurance contract, then the organization that received the car and incurred (according to the terms of the contract) insurance costs may have questions regarding accounting and tax accounting of unwritten insurance premiums.

In such cases, the following must be kept in mind.

In accounting, the balance of account 97 should be written off as non-operating expenses using entry D 91/2-K 97.

For tax purposes, the remaining part of the insurance premium cannot be accepted in the future when calculating the tax base for profit, since these expenses cannot be considered economically justified and aimed at generating income (clause 1 of Article 252 of the Tax Code ). Thus, unless otherwise provided by the gratuitous use agreement, unwritten insurance premiums must be taken into account at the expense of the taxpayer’s own funds.

Taking into account the above, we recommend that when concluding a contract for free use, provide for the possibility of reimbursement of part of the insurance premium, if the need arises.

[1] Guidelines for accounting of fixed assets, approved by order of the Ministry of Finance of Russia dated July 20, 1998 No. 33n.

[2] Accounting Regulations 5/01 “Accounting for inventories”, approved. By order of the Ministry of Finance of the Russian Federation dated June 9, 2001 N 44n

[3] Methodological guidelines for accounting of industrial production, approved. by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n

[4] Federal Law of November 21, 1996 N 129-FZ “On Accounting”

[5] Guidance document R3112194-0366-03 “Consumption standards for fuels and lubricants in road transport,” approved. Ministry of Transport of the Russian Federation 04.29.03.

[6] Unified forms of primary accounting documentation (approved by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7)

[7] Accounting Regulations 10/99 “Expenses of the Organization”, approved. By order of the Ministry of Finance of the Russian Federation dated May 6, 1999 No. 33n.

[8] Regulations on accounting and financial reporting in the Russian Federation, approved. By Order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n

[9] PBU 18/02 “Accounting for income tax expenses”, approved. by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n.

[10] Federal Law of April 25, 2002 No. 40-FZ “On compulsory insurance of civil liability of vehicle owners

[11] Code of the Russian Federation on Administrative Offenses dated December 30, 2001 No. 195-FZ