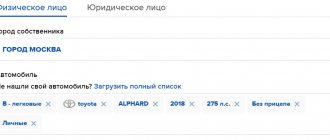

Information about the owner in the contract

When concluding a CASCO agreement, the owner of the car as a driver may not be included in the policy if insurance is purchased for one of the family members or for a person to whom the car was leased or used free of charge.

If the policyholder is not specified in the contract, then he is not considered a person authorized to drive a car (except in cases with a multidrive policy).

We emphasize that we are talking only about CASCO with a limited number of persons who are given the right to drive a car.

If the policyholder is a legal entity. person, then CASCO is issued for any number of drivers. Accordingly, anyone can drive an insured car.

How much does it cost to include a driver without experience on insurance?

According to the Order of the Federal Tax Service No. ММВ-7-14/ dated May 22, 2019, there are 92 subjects in the Russian Federation. Each of them has its own statistics on road accidents. Based on these indicators, regional coefficients used by insurers are approved.

The maximum value in 2021 is Moscow – 2, Kazan – 2, and St. Petersburg – 1.8. One of the lowest values in Simferopol is 0.6. Accordingly, how much insurance costs for a car without experience depends on the region of registration.

In total, the table approved by the regulator has 7 age categories and another 8 based on experience. The maximum value of the coefficient - 1.87 - is approved for drivers under 21 years of age with zero experience, that is, the cost of car insurance in 2021 for the first time will cost them significantly more than their more experienced and senior colleagues.

Already from 22 years of age, the value decreases with an equally low length of service to 1.77. For comparison, young people under 21 years of age with at least 3 years of experience use a coefficient of 1.66. A downward adjustment of 0.99 is used by drivers over 30 years of age with more than 10 years of experience driving vehicles.

The most significant discount awaits those who drive carefully and do not become involved in an accident. This special coefficient (KBM) is assigned to each driver individually and is recalculated every year - from April 1. The value is recorded in the RSA database.

If an unlimited number of drivers are allowed to drive (multidrive), then KBM = 1. The KBM range ranges from 2.45 to 0.5. The starting value for a client applying for compulsory motor liability insurance for the first time in his life is KBM = 1. What it will be like in a year depends on accuracy and compliance with traffic rules. For each year without accidents, a 5% discount is accrued, but with 1 or more accidents it is canceled and the BMR increases up to 2.45.

According to Art. 4 Federal Law No. 40 of April 25, 2002, it is necessary to issue a policy for all vehicles, with the exception of:

- not participating in road traffic;

- capable of reaching a speed of no higher than 20 km/h;

- trailers of personal vehicles of individuals.

All other vehicles for insurers differ in engine power. Each range has its own correction factor, which increases with increasing power value. For example, for engines less than 50 hp. it is equal to 0.6, and for an engine more than 150 hp. – 1.6.

Who can enter the details of the second driver?

Only the policyholder, that is, the one who purchased the CASCO policy, has the right to register the second and other drivers.

But he has the right to issue a power of attorney to another person who will assume the responsibilities of concluding a CASCO agreement and making changes to it.

The power of attorney must be notarized.

It is prohibited to include a second driver in the contract yourself (without notifying the insurance company and drawing up an additional agreement to the CASCO contract).

How much does it cost to add new people to your insurance?

The inclusion of new persons in the policy may increase insurance risks and therefore the insurer has the right to revise the amount of the insurance tariff.

This is done if new persons are young and do not have a driving record, as well as discounts for break-even insurance.

The amount of the surcharge depends on the following factors:

- how many months are left until the insurance period expires;

- number of drivers, their age, driving experience;

- temporary or permanent inclusion of a new driver in the policy.

For calculation, the insurer takes the total cost of CASCO for the year with the required number of drivers. The cost of current single-driver insurance is subtracted from this figure.

The difference is multiplied by the number of days remaining until the end of the insurance period. The resulting figure is divided by the number of days in a year.

On average , the surcharge for a policy for two drivers is usually 5-10% of the contract amount . The less time before the end of the insurance period, the less the additional payment will be.

If there are only a few weeks left before the policy ends, the company may even refuse to add new persons to the insurance.

How much does it cost to include a person in CASCO insurance?

To add a new driver to CASCO, you will have to pay a commission set by the insurer. The following factors influence its amount:

- Age and driving experience relative to other people included in the policy. If the new driver has the same age and experience coefficient as the other persons in the contract, then the price changes slightly. But if this is a beginner who has just received his license, then the amount will be several times higher

- The validity period of the insurance at the time of changes. The less time left before the policy expires, the cheaper it will be to register drivers

- The period for which the change will apply. You can register a driver for the period until the end of the policy or for a pre-agreed period of time. In this case the commission will be lower

- Other conditions depending on the policy calculation method. Some insurers may take into account the driver's BMR, the number of insurance claims, whether he has had insurance with the same company in the past, or other parameters

The approximate amount of additional payment for adding a second driver, in most cases, ranges from 5% to 10% of the initial payment. The final value will be calculated at the time the changes are made. Some insurance calculators allow you to calculate the cost of registering a driver after taking out a policy.

Is it possible to enter data via the Internet and how to do it?

Many insurers offer the opportunity to add new drivers through a personal account on their website. To do this, you need to register and enter your contacts.

Basically, online adjustments are subject to e-CASCO, which is currently offered by a limited number of companies.

To add drivers, submit an application.

Scans of documents can also be sent online.

To add you must specify:

- his full name;

- age, driving experience;

- driver's license number;

- CASCO agreement number.

If a regular CASCO insurance was issued, then to add drivers you still need to visit the insurer’s office and bring the original passports and driver’s licenses of the new persons admitted to driving.

Sometimes the company also asks for a copy of the insurance contract and a receipt for payment.

How much does it cost to include a driver in MTPL insurance?

- Car in spring

- Safety

- The car and the law

- Auto reviews

- Let's save!

- Be healthy!

- I'm a teapot!

- Instructions

- Infographics

- How to ride?

- How to park?

- Region codes

- True or not?

- We take care of your car!

- Electric cars

- New car

The basis for calculating the cost of insurance is the basic tariffs approved by the Central Bank. The regulator sets the boundaries of the tariff corridor (maximum and minimum tariff values), which guide all insurers in the country without exception when determining the cost of a compulsory motor liability insurance policy. In this case, the final price of the product (how much insurance costs for a novice driver) is calculated by multiplying the tariff rate by a number of adjustment factors, including taking into account the client’s age and his experience.

The current rules do not provide instructions on how to distinguish a novice driver from an experienced one. Insurers take into account the length of service and age of all persons allowed to drive a vehicle. The highest coefficient is set for drivers aged 16-25 years without driving experience. The price of the policy is also influenced by the KBM, which shows the driver’s accuracy. If in previous years the policyholder has been involved in an accident, then his discount is canceled, so he will pay the same amount for his policy as a newcomer.

Thus, there are indeed many factors that need to be taken into account. Moreover, with each subsequent year the price will change. After all, only the engine power and registration region will remain the same, but the driver’s experience and age will increase, his personal accident statistics will change, the desire to use a trailer or drive in the most difficult winter time will appear or disappear. Finally, nothing prevents you from refusing the services of one insurance company in favor of another, with more favorable rates.

The cost of car insurance in 2021 without experience is calculated using a complex formula. It is based on a single base tariff, which is multiplied by correction factors. The set of applied coefficients determines the final amount in each specific case.

In the table of maximum values of MTPL insurance rates approved by the Central Bank, the amounts fluctuate quite seriously, for example:

| Vehicle type | Highest tariff, rub. | Lowest tariff, rub. |

| Personal car | 5492 | 2476 |

| Commercial bus | 7399 | 3905 |

| Truck up to 16 t | 6064 | 2246 |

Practice shows that in the vast majority of cases, insurers choose the maximum value for a given type of vehicle, using it in subsequent calculations. For this reason, if you want to check this or that calculation proposed for consideration - how much compulsory motor insurance costs for a beginner, it is more correct to immediately take the maximum value in the table as a basis.

Is it necessary to indicate all persons admitted to management?

It is necessary to enter all persons who operate the machine . If this is not done, then difficulties may arise with payment if the accident is caused by a person who is not allowed to drive.

Most likely, the insurer will pay compensation at the request of the insured, but then turn to the culprit of the accident with a recourse claim, demanding compensation for losses.

Insurance company refusal to pay

The absence in the policy of an indication of the driver who was driving the car at the time of the accident does not relieve the insurance company from the obligation to pay compensation.

This is stated in paragraph 34 of the Resolution of the Plenum of the Supreme Court dated June 27, 2013 No. 20 “On the application by courts of legislation on voluntary insurance of citizens’ property.”

If, despite judicial practice, a refusal to pay occurs, the client has the right to go to court and appeal this decision.

You can first send a claim to the insurer with a request to eliminate the violations and make a payment.

Right to recourse

The insurer is not obliged, but has the right to file a recourse claim against the culprit of the accident. The insurance company does not have the right to demand compensation from someone who is not at fault for the accident and who is simply not included in the policy.

But, if a driver who is not included in the insurance is found to be at fault, this is the basis for the insurance company to receive back the paid insurance amount through subrogation.

Any court decision on the insurer's claim can be appealed to the appellate and cassation instances.

Example of subrogation

Let’s say the car was driven by driver Ivanov, an 18-year-old son, who was not included in CASCO due to the high cost of the policy. They only registered his father with a good accident-free record, believing that they would receive the payment in any case.

The young man committed an accident and was the culprit. The amount of damage was estimated at 300 thousand rubles.

The father collected all the documents and submitted an application for compensation.

Within a month, the insurer reviewed the application and paid for repairs at the service station in the required amount.

A couple of months later, driver Ivanov received a copy of the insurance company’s recourse claim and an invitation to court.

Since all the evidence of his guilt was presented, Ivanov will be forced to compensate the insurance company for the cost of repairs (240 thousand rubles).

How and how much does it cost to include in driver insurance?

Often there is a need to include a foreign citizen in compulsory motor liability insurance. It is important to take into account that when making a calculation, information about the registration number is entered, which was issued at the place of his permanent residence. As a result, age, length of service and the size of the discount for emergency or careful driving are also taken into account.

It is important to consider that foreigners can also earn a discount, since after registration of a motor vehicle license, the information is registered in the RSA database. To calculate the surcharge, the formulas that were described earlier in the article are used.

Previously, there was an opinion among drivers that several drivers were included in the policy completely free of charge. It is worth noting that this arose as a result of the fact that insurers added changes on the reverse side, in the “Special Conditions” section and did not request a certificate of BMR in relation to each admitted road user.

Everything changed with the introduction of a unified RSA database. Once it was created, managers were given access to request information. For convenience, specialized programs were also created that automatically determined additional payments based on specified parameters.

It turns out that you can enter a driver for free only if the coefficients under his conditions are the same, or higher, with those that were used when calculating the original compulsory motor liability insurance. If we talk about the total number of insured people, then their number should not exceed 5 people. If necessary, you can always exclude someone and add another insured person.

In order to insure an additional traffic participant, a minimum package of documents will be required. You should prepare:

- policyholder's passport

- OSAGO policy

- in/from a new traffic participant

If you remotely change the clauses of the contract, then it is enough to prepare only the data of the new driver.

Procedure

Each driver can make additions in person at the office or through an agent. With the introduction of an electronic product, this opportunity is available online.

To make additions remotely you will need:

- log in to your personal account

- select "make change"

- indicate all the details of the new insured citizen

- request recalculation

- make an additional payment if necessary

- get a new e-OSAGO including additions

When visiting the office in person, you must present all documents and wait 5-10 minutes while an employee checks the information and generates a recalculation.

Insurer statistics show that drivers with little experience become the source of almost half of all accidents and emergency situations on the road. The lack of practical skills and stress resistance affects. Therefore, for beginners, significant increases in compulsory motor liability insurance are included in the cost of insurance.

Of course, any insurance company is interested in break-even clients. However, they do not have the right to refuse to issue compulsory insurance to a person without experience. It is also illegal to try to sell additional insurance. Although if the driver is not confident in his skills, it would not hurt him to insure, for example, life and health. But this is a voluntary choice of any policyholder: both those who have just received a license and those with experience.

The insurance period for a year or period, other terms of the contract, the rules for its execution for drivers without and with experience are no different. The only difference for beginners is the price of OSAGO. The policy can be purchased both at the company’s office and online. Contact us and we will help you get insurance without leaving your home.

It is important for novice drivers to remember that insurance for a new car must be obtained within 10 days from the date of signing the purchase and sale agreement. In this case, the field with the license plate number remains empty. The numbers will have to be entered later, after registration. Presentation of a diagnostic card for a car from a showroom without mileage is not required. Do you want to find out how much OSAGO costs for beginners in 2021 and buy insurance from a reliable company without additional costs? services - use the esago service.

Policy Multidrive without restrictions

Multidrive is a CASCO insurance with an unlimited number of drivers allowed to drive the vehicle.

At the time of an accident, it may not be the policyholder who is driving, but any person, and at the same time, the owner of the multidrive can count on payment in full.

Claim for damages by the culprit

Subrogation means the transfer to the insurer of the right to demand compensation from the person responsible for the accident (Article 965 of the Civil Code of the Russian Federation).

If the driver who caused the accident was not included in the multidrive policy, then the insurer has the right to send him a letter demanding that he pay the amount of damage voluntarily.

If this is not done within the agreed time frame, a lawsuit will follow.

The policyholder is obliged to transfer to the company all documents and evidence necessary for going to court (this is provided for in the Insurance Rules).

In case of refusal, the insurer is released from paying the insurance compensation in full or in the relevant part and has the right to return the excess amount of compensation paid.

The right to demand compensation from the guilty party arises after full payment for the insured event has occurred.

Are there any restrictions?

Drivers over the age of 23 who have a driver's license (usually more than two years) can be included in the CASCO policy.

Drivers included in the policy must drive the vehicle legally.

Required documents

To add an additional person to the current MTPL insurance policy, the following documents will be required:

- Valid insurance policy.

- Technical passport (a document that contains information about vehicle registration).

- New driver's passport (identity document).

- Driver's license of the person whose data is included in the insurance policy.

- Application from the owner of the vehicle, in which he contacts the insurance company with a request to enter information about the new driver. The application is in the form of a form, filled out personally by the owner of the vehicle, without corrections or errors.

- A certificate issued by the State Traffic Safety Inspectorate confirming the absence of involvement in an accident within the period specified by law.

Important! The presence of two persons is required - the owner and the new driver. If someone does not have this opportunity, their participation should be through a representative. He must have a power of attorney, which is duly certified by a notary.

Procedure for entering data

The process of entering information about an additional driver takes place directly at the office of the insurance company that issued the current insurance policy. The completed application by the vehicle owner is subject to verification by company employees. When the application is reviewed and a positive decision is made, the following documents are issued:

- An insurance document that contains new information added.

- A document confirming payment of the cost for entering new data.

- A reminder for drivers about the civil liability insurance procedure.

- Bank, which is filled out in case of involvement in an accident (two copies).

Attention! The procedure does not involve payment for the services of insurance company employees. Requirements to pay for the actions of the insurance company can be regarded as grounds for contacting supervisory services with a complaint.

What to choose?

New drivers can easily be included in an already issued CASCO agreement . To do this, you need to come to the office with documents and make changes to the policy or submit all the data in your personal account on the insurer’s website.

In some cases, you will have to pay extra for this service. The amount of the surcharge depends on how much time is left before the expiration date of CASCO, as well as on other factors.

If you have unlimited multidrive insurance, then you don’t need to arrange anything - anyone who has the legal right to do so can get behind the wheel of a car.

How to include another driver in your insurance?

To add an additional driver to your policy, you usually need to provide the following information to the insurance company:

- Full name of the new driver;

- Date of Birth;

- Driving experience;

- Driver's license.

The reason for making changes to CASCO may be other circumstances, for example, a change of name and replacement of documents, loss of a passport or driver’s license, change of owner of a car. In this case, it will also be necessary to make changes to the insurance contract based on supporting documents provided to the insurance company.