According to current legislation, every vehicle owner is required to pay transport tax. Payment and accrual regulations are approved by local authorities, since such a tax relates to regional fees. Regardless of the amount of the accrued payment, the main thing is to pay the entire amount on time. Debt repayment periods are set individually. You need to find out about them in your inspection. In most cases, this is before December 1st. But the question of paying off debt to the budget without commission is probably on everyone’s mind. And then, just about how this can be done.

What repayment methods are there?

The debt repayment regulation gives the taxpayer the right to pay the debt in different ways:

- online format. You can pay through your taxpayer account on the Federal Tax Service website, through the State Services portal, or in online banking;

- at the cash desk of any bank;

- through self-service terminals;

- using an electronic wallet.

Each of these methods is effective. The main thing is to know the payment details, that is, you need to have the payment details on hand. As a rule, such a receipt comes along with a notification for payment. It is sent either by mail to the driver’s place of registration, or electronically displayed in the taxpayer’s personal account.

In fact, it is very difficult to find a way to pay tax without a commission; usually services and banks charge 1-3% of the amount. The following are options that allow you to transfer payment with a minimum commission, and some without it at all.

Possible ways to pay tax

Individuals must pay tax by December 1 of the year following the reporting period. That is, payments for 2021 are made before December 1, 2021, payments for 2021 are made before December 1, 2021, and so on. Taxpayers have several ways to pay transport tax: in person at the bank, using Internet banking, using electronic money, through specialized websites offering different payment options.

Via bank

Today, the list of banks that do not charge a commission for paying transport tax includes only Sberbank. The title of the most status bank in the Russian Federation, with the largest number of clients, allows it to refuse the benefits that the commission for paying taxes promises. To pay the tax, the taxpayer must come to the bank with a receipt, which, together with a notification of the amount of the fee, is sent by mail from the Federal Tax Service.

Using Internet banking

Most banks operating in the Russian Federation have developed a special system - Internet banking, which allows clients to make payments via the Internet. In order to pay for the TN, you must enter the details from the receipt and your personal data in the appropriate fields. In this case, funds are written off from credit (bank) cards. When paying transport tax, no commission is charged only in the Sberbank-online system.

Using electronic money

There are 3 popular types of electronic wallets in Russia: Yandex. Money", "WebMoney", "Qiwi". Each of them offers payment of transport tax without charging a commission. To pay the tax, you need to register in the system, deposit funds there, select the required payment, enter your data and pay. Funds can be deposited into electronic wallets in different ways: through transfers from bank cards, cash through a terminal, transfers for working on the Internet, etc.

Through specialized sites

You can pay transport tax without commission through the official website of the Federal Tax Service or through the Gosuslugi portal. When paying through Gosuslugi, the user will still be redirected to the official website of the Federal Tax Service, the only thing is that there will be no need for registration. Payment can be made by transferring funds from bank cards or from specified electronic wallets. It should be taken into account that some banks will charge a commission for transferring money from a card to the Federal Tax Service website. The site itself does not charge a commission for making payments. Payment of transport tax from a mobile phone balance is not available.

Method one - through Sberbank

Coming to Sberbank and paying the tax receipt is the easiest thing every taxpayer can do. An ideal option for those who do not know how to use online banking or who simply find it easier to pay a payment through a cash desk.

To make a payment, the following documents are required:

- citizen's passport;

- identification code;

- receipt with notification for payment of transport tax.

The payment algorithm is simple. The client comes to the bank, presents documents and waits for the cashier to carry out the transaction. Upon repayment of the debt, the payer must receive a receipt for payment, which confirms the operation.

There is no additional charge for this payment method. This is the main thing.

Method two - through Sberbank Internet banking

If you are a client of Sberbank and you have a card from this issuer, therefore, you can use a more simplified option - pay the fee through online banking. There are also no fees for online banking. The payment is processed in a few minutes.

To carry it out, the subject must perform several simple actions:

- Log in to your account through the mobile application or through the bank’s website in Sberbank Online.

- After logging in, find the “Payments and Transfers” section, in which you must select your region of residence.

- Select the option “Staff Police, taxes”. In this tab, the subject will be given the opportunity to select several directions in which to go to the Federal Tax Service portal. When the subject gets to the portal, here he already needs to select the “Search and pay taxes” option.

- When it opens, you need to fill in the payment details in the field, taking them from the transport tax receipt.

- Then agree to make the payment.

All. At this point, payment will be made in full, of course, if there is a sufficient amount of money in the account.

Instructions on how to find out if tax has been paid (transport, property and land)

When and how to pay taxes

The taxes that we pay for owning a home, land and car are calculated by the tax service without our participation.

The responsible services - the State Traffic Safety Inspectorate and Rosreestr - send tax authorities information about what property we own. Depending on the rates in force in each region, the amount of tax collection is determined. Once a year, tax officials enter these amounts into receipts and send them to all addresses in their huge database. A separate receipt is not issued for each type of tax - the amount for all payments is summarized in one payment document.

The payment must arrive by registered mail. And if you are registered on the Federal Tax Service website and have your own personal account, they will not send you a letter by mail. The amount will appear in your personal account: just go into it to find out how much you have to pay to the state this year.

Notifications of payments in paper and electronic form must be received at least one month before the final payment date. Annual payments must be made to the budget before December 1, that is, you must receive a tax notice before November 1. In your personal account on the Federal Tax Service website, notifications appear earlier, but by mail they arrive a little later.

If the notification did not arrive, you need to figure out why. You will still have to pay the tax, even if the receipt has not arrived. But if the payment is late, it will have to be paid with the amount of penalties or interest and a fine.

How do I know if I have paid taxes?

When it comes to taxes that you need to pay this year for the previous year, you can do it in three ways.

Send a request to “Autonalogues”.

A convenient Internet service that you can use online without registration, at any time. To find out whether the tax has been paid, enter your Taxpayer Identification Number (TIN) and email address into the form. It will take a few seconds to fill out the application, after which you will see the amounts of your unpaid taxes and debts right there on the website. In the same way, you can enter the TIN of your loved ones or friends who cannot use the Internet and get information about their tax payments.

Log in to your personal account on the Federal Tax Service website.

Another convenient online service that requires registration to use. You can gain access to your personal account by writing an application to the tax office of your city, or after registering and confirming your account on the State Services website. On the main page of your personal account, you will see a message stating that you have no unpaid taxes or tax debts if you are clean before the state. If this year you have not yet paid before the budget, you will be shown the amount to be paid and the number of days until the end date.

On the “My Taxes” tab you can find out whether land tax, transport tax and property tax have been paid. Here your payments are listed by category. You can pay the same way - separately transport or land tax or all together in one amount.

Visit the tax office in person.

To do this, you need to make an appointment in advance. You can use online registration: you can choose the date and time of your visit to the tax office, prepare a list of questions of interest. After completing the online application, a coupon will be sent to your email address. You need to print it out and register it in the terminal on the day of your visit to the tax office. If you are 10 minutes late, the coupon will expire, so you need to come to your appointment at the Federal Tax Service in advance.

Is it possible to find out about unpaid taxes on State Services?

On the public services portal you can pay taxes and find out your tax debt. To do this, you must have a verified account. If it is not there, you will not be able to use the service. But even if your account is activated, you will not be able to check for unpaid taxes in the current year for the previous year. Government services do not provide such information. Only tax debts appear here, that is, those payments that were not repaid on time. To obtain information about current taxes, the portal administration recommends visiting the Federal Tax Service website.

How to check if I have paid transport tax for previous years

After December 1, tax officials set aside another 5 days for voluntary payment of tax fees. Didn't have time to add the amount to your budget? It goes into the category of tax debt and then appears in your personal account on the websites of State Services and Nalog.ru. Every day a penalty is charged on this amount, albeit small, but it increases the debt to the state. When the amount of debt exceeds 3,000 rubles, tax authorities sue the debtor.

Claims for unpaid taxes are processed quickly. People often learn that they have not paid transport or land tax from a representative of the FSSP. On the bailiffs website there is a Data Bank of Enforcement Proceedings, where you can view your debts to the budget.

You can also use the “Autonalogues” website. Fill out the application form and review the tax debts for your TIN. Here you can pay debts without commissions and overpayments from a bank card or electronic wallets.

How to find out if tax payment has been completed

If you transferred money to a post office or bank office, do not throw away the payment receipt. When transferring via Internet banking, personal account on the services of the Federal Tax Service and State Services, you must have payment documents in electronic form. Store them for 14 days. It takes approximately this long for the payment to arrive at the Federal Tax Service and be counted in favor of a specific person.

After 2 weeks, check again whether the property or transport tax has been paid in your personal account on the tax office website or on the “Autonalogs” website. If the money is accepted and credited to your tax account, your current tax payment and debt information will disappear.

Payment of transport tax through the Federal Tax Service website

This method can be implemented in two directions:

- the first option is available to absolutely everyone, even those who do not have a registered profile on the Federal Tax Service website.

- the second option is available only to those who have a personal account.

So, regarding the first option. The citizen goes to the website nalog.ru and there selects the category “Payment of tax for individuals.” persons." In it, he finds the transport tax and generates a payment document by entering the payment details. After entering the specified data, the subject has the opportunity to pay the debt using a bank card or Qiwi e-wallet. If none of the options listed above are suitable, then you can simply save the payment slip and take it to the cash desk of any bank.

If the taxpayer has a personal account, then everything is much simpler. You just need to log into your account and select a car in the tax base and the amount of accrued tax. Payment options are similar to the previous direction.

How to pay taxes, fines, state duties without commission and with cashback

There are many different ways to pay taxes and fines, but, of course, we are most interested in how to do this with maximum benefit for ourselves.

To do this, you need to find a service that allows you to make a payment using a bank card without a commission with a normal MCC code , for which cashback is provided. And then you just need to choose a suitable card and pay taxes, fines, and state fees as a regular purchase in an online store.

Before we talk about how to pay traffic fines and taxes, it is worth mentioning when is the best time to do this.

When do you need to pay taxes and traffic fines?

Property, transport, land tax must be paid no later than December 1 of the year following the tax period (according to Article 409 , Article 363 , Article 397 of the Tax Code of the Russian Federation , respectively). Those. taxes for 2021 must be paid no later than December 1, 2021 inclusive.

If you do not pay taxes on time, you will also have to fork out to pay a penalty (1/300 of the key rate of the Central Bank of the Russian Federation for each day of delay). Article 75 of the Tax Code of the Russian Federation tells us this .

In addition, the tax office may additionally impose a fine in the amount of 20-40% of the debt amount ( Article 122 of the Tax Code of the Russian Federation ).

The obligation to pay tax is considered fulfilled on the day of payment on the basis of Article 45 of the Tax Code of the Russian Federation (it does not matter how long the money actually takes to reach the tax account). Therefore, it makes sense to pay property, transport and land taxes as close as possible to the deadline of December 1):

Personal income tax must be paid no later than July 15 of the year following the expired tax period ( Article 228 of the Tax Code of the Russian Federation ).

It is advisable to pay the traffic police fine within 20 days from the date of violation. If you meet this period, you will receive a discount of 50% of the fine amount according to Law No. 437-FZ of December 22, 2014 , which came into force on January 1, 2021.

The 50% discount on traffic police fines, however, does not apply to some serious violations (driving while intoxicated, violating rules that resulted in harm to health, repeatedly running a red light, etc.). If the fine is not paid within 60 days from the date of violation, it will double:

The state fee must be paid immediately. Until you pay, the service (issuance of a passport, change of license, marriage registration, etc.) will not be provided to you.

How to pay taxes through State Services without commission and with cashback

Paying taxes using the State Services and the taxpayer’s personal account on the website nalog.ru is very simple and convenient. I highly recommend everyone to access these services.

There are several levels of accounts on the State Services portal: simplified, standard and confirmed. To fully use all portal services, you will need to create a verified account. To do this, you need to contact the nearest service center (branches of the Federal State Unitary Enterprise "Russian Post", MFC, Pension Fund of Russia, etc.). I confirmed my account on State Services with the Pension Fund, the procedure took 5 minutes.

2000 rub. for “100 days without %” from Alfa-Bank with a free year, 1000 rubles. for Tinkoff Black, 500 rub. for “Alpha Card”, 500 rubles. for Moskarta from MKB, 2000 rubles. for an Opencard credit card, up to 25,000 rubles. for a Tinkoff brokerage account, 8,000 rubles. for Citi Select, “110 days without interest” from Raiffeisenbank with free service and cashing out the credit limit.

Save the Money! recommends:

You can log into the taxpayer’s personal account using an account on the State Services portal (you will need an account confirmed by personally contacting the service center of the Unified Identification and Authentication System (USIA)). You can also obtain your login and password from any tax office.

The taxpayer’s personal account displays up-to-date information on all taxes (data is loaded within 2-3 days after the first login), there you can check the correctness of the accrual, clarify data on taxable objects, fill out an application for benefits, fill out the 3-NDFL declaration (declaration on personal income tax):

Now you don’t have to worry that letters of happiness will not arrive on time due to the fault of the Russian Post, all the necessary information is available online.

So, go to the taxpayer’s personal account on the website nalog.ru and click on the “Accrued” tab:

A tab opens showing the amounts of taxes that need to be paid:

Next, click on the “Pay charges” button and select “Online payment”, having first ticked the tax that we are going to pay (in this example, property tax 660 rubles):

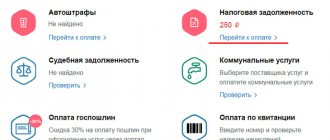

Then the service offers to choose a method of paying our tax. In order to be able to pay taxes using a card from any bank, you need to select “Government Services”:

After this we get to the State portal:

We choose to pay by bank card (you can also pay without commission using the WebMoney system):

We indicate the details of the card with which we want to make a payment and click on the “Next” button:

The system informs us that the payment will be made without commission using Gazprombank. Click “Pay”:

The flagometer determines the MCC code of this operation as 9311 – “Tax payments”:

After payment, State Services informs us that the payment has been accepted, and here you can print the payment slip. That's all, the tax has been paid:

Before paying taxes using this method, all that remains is to choose a card where MCC 9311 offers some goodies. This MCC code will not lead to departure from the grace period (if you pay by credit card).

UPD: 11/10/2020 Cashback for 9311 is now given:

● “Universal” from “ATB” – 5% in cash when choosing your favorite “Auto” category.

● “EVERYTHING AT A TIME” debit card from “Raif” - 2-3% (depending on which certificate you save points for), is no longer issued to new clients. The “ALL AT ONCE” credit card will turn into a pumpkin after November 30, 2020.

● Citibank debit cards – 1-5% (depending on the target certificate); Citi Select credit card - 3% cashback (obtained when exchanging selects for the corresponding certificate), Cash Back from "City" - 1%.

● UNO card from Neiva Bank – 3% points.

● “Alpha Card with benefits” 1.5-2%, depending on turnover. Alfa Travel debit and credit card - 2-3% miles, Alfa Travel Premium debit card - from 3 to 5% miles, depending on the level of spending, Alfa Travel Premium credit card - 5% (no longer issued), Yandex.Plus and Beeline from Alfa-Bank - 1%.

● For the MTS Smart Money (no longer issued to new clients), MCC 9311 is counted towards the required turnover to receive a discount on communications (equivalent to 3-5 cashback), MTS Money Weekend , MTS Cashback - 1%.

● Tinkoff All Airlines - 2% miles; other Tinkoff Bank cards ( Tinkoff Black , Yandex.Plus , Drive , etc.) – 1%.

● “Benefit” , “Benefit Travel” from Home Credit (Khomyak is allergic to Yandex.Money), MKB cards – 1%.

● You can use credit cards without cashback, but with a long grace period (for example, “110 days without %” from Raiffeisenbank , “Card of Opportunities” from VTB , “Dobro” from OTP Bank , “I Want More” from "UBRIR" ). During the grace period, your own funds can be deposited, the income during this time will be approximately 1.5-2%.

If you have not yet gained access to State Services, but you have a personal taxpayer account, then when choosing a payment method, you can choose not “State. There, too, you will be able to pay taxes without commission with a card from any bank (if you pay with a Tinkoff Black card by logging into Internet banking, you will not receive cashback):

MSS of this operation is also 9311:

When using the Tinkoff Bank service, I would still recommend checking the MCC transactions with a flagometer , in case Tinkoff one day decides to pay taxes by topping up its virtual card with a bad MCC .

UPD: 11/22/2018 Quite recently, it became possible to pay taxes directly from the taxpayer’s personal account, without the need to switch to State Services or Tinkoff, the MCC code is also issued 9311:

In the taxpayer’s personal account, you can change the tax amount (for example, to make payments using several cards):

UPD: 11/25/2020 Some services allow you to pay for different services with one payment (“locomotive”), but the MCC code may surprise you. So, if you pay taxes and utilities at the same time in the “Rent+” application, then the MCC of the transaction will be 4900 (“Utilities”).

And for this MCC code “Universal” from “ATB” with the “Family” option will give 10% cashback, “Vostochny” credit cards with the “Heat” option - 5%.

How to pay taxes through Yandex.Money without commission and with cashback

In order to pay taxes on the Yandex.Money ( UPD: 11/10/2020 the service was renamed to YuMoney, but all functionality remained the same), you will need to indicate the TIN or receipt index. This service is convenient to use when you need to pay taxes for someone else (from December 30, 2021, you can officially pay taxes for third parties):

The document index (universal UIN accrual identifier) can be found on the payment slip that arrived by mail, or you can view it in the taxpayer’s personal account:

With this payment method, MCC 9311 is also issued (cashback for taxes through YaD can be obtained using the cards discussed above, except for cards from Home Credit; Khomyak does not like the Yandex.Money service ):

To expand the available payment limits, you will need to upgrade your wallet status (to registered and identified). You can read more about Yandex.Money limits here .

With the help of YaD, you can also pay contributions to the Pension Fund, compulsory medical insurance, and individual entrepreneur taxes without commission using MCC 9311. However, it is worth remembering that the bank can block the current account of an individual entrepreneur if you do not pay taxes on it. So it’s better to make part of the payments to the budget from your current account:

UPD: 11/10/2020 Previously, there were reports that when paying taxes through Yandex.Money and State Services, MCC 9399 was received instead of 9311, but recently MCC 9311 has been consistently issued.

UPD: 11/22/2018 The Yandex.Money service money page .yandex.ru/loyalty by clicking on the “I want to start” button). The monthly point limit is 2000.

UPD: 11/28/2018 If you joined the Yandex.Money point cashback program before the 15th of last month and did not make a turnover of at least 1000 rubles last month, then there will be only 0.5% cashback (in the month of joining there will be 1% ).

If you pay taxes in the Yandex.Money service with an unlinked card, you will not receive an additional 1% cashback from your e-wallet. The easiest way is to link the card to the YaD when topping up your mobile phone (at least for 5 rubles), and you will need to check the “Save in wallet” box. If you link a credit card directly to your wallet, you can run into being kicked out of Grace and a commission, just like for withdrawing cash.

UPD: 11/13/2020

How to pay taxes through MTS Money with additional cashback

You can also pay taxes without commission and with additional cashback through the MTS Money service.

This is done from the “Payment by unique accrual identifier (UIN)” section, where you will additionally need to enter the taxpayer’s INN, MCC transaction 9311.

As a result, when you use a card that gives a reward for MCC 9311 to pay, you will receive cashback from the card issuing bank + an additional 1% cashback with points under the MTS Cashback program.

When paying taxes through the “Federal Tax Service” menu, a commission of 15 rubles is provided. plus 0.7% of the payment amount, so there is no need to go there.

How to pay state duty with a discount and cashback

It is most profitable to pay the state fee for obtaining a passport of a citizen of the Russian Federation, issuing or replacing a driver’s license, registering a vehicle, marriage (divorce), obtaining a foreign passport, and registering an individual entrepreneur through State Services. When paying these state fees by card on this portal, you are entitled to a 30% discount:

To receive a discount, you need to submit an application through State Services, wait until the department issues an invoice, and select a non-cash payment method:

The MCC for this transaction is 9399, so there will also be cashback for paying with a suitable bank card. You can pay state fees with a 30% discount on the State Services portal until January 1, 2021.

UPD: 11/10/2020 The discount on paying state fees through State Services has been extended until 2021.

How to pay a traffic police fine with a discount and cashback

You can also pay traffic police fines with a bank card through the State Services portal and Yandex.Money (MSS 9222 or 9311), but for this service the services want a commission of 1%, at least 30 rubles. In principle, cashback for this MCC can cover it.

However, you can pay traffic police fines with MCC 9222 or MCC 9311 without any commission at all on the Tinkoff Bank website . On the Tinkoff Bank website you can pre-check for fines by registration certificate number and driver’s license number.

Until June 23, 2021, you can pay fines without commission using MIR cards on the State Services portal, details here .

Conclusion

As you can see, paying taxes, fines, and state duties with a card without commission and with cashback is quite simple. Sometimes the amount of tax turns out to be quite decent and any opportunity to receive a small compensation will not be superfluous:

In addition, by paying for these services online you will save time.

I hope my article was useful to you; write about any clarifications and additions in the comments.

You can follow updates in this and other articles on the Telegram channel: @hranidengi Channel mirror in TamTam: tt.me/hranidengi .

Subscribe in Telegram Subscribe in TamTam

Subscribe to stay updated on all changes :)

comments powered by HyperComments

Redeem through the State Services portal

This option is available only to authorized users.

After logging into your personal account, you need to follow these recommendations:

- Find the item “Authorities”;

- In this menu, select the “Federal Tax Service” item;

- Find the direction “Free information”;

- Select the “Get Services” section.

The system will automatically start searching for unpaid mandatory fees, including transport payments. If the system finds a debt, it will offer to pay off such debt immediately. This can be done directly online through the system. You need a bank card or e-wallet.

How to pay existing tax debts?

- If, using any of the available services, it turns out that there is still a debt. Then you can pay for it on the Yandex service page. Money according to the receipt number (respectively, if you have one).

- If you don’t have a receipt, then you should go straight to your personal account of the Federal Tax Service. Complete simple registration. After it, a person will have his own virtual office. Subsequently, taxes that must be paid will appear in it. To pay, you don’t always need to print out a receipt and go to the bank with it. You can transfer tax payments using a bank card.

Online payment of transport tax using a Tinkoff card

Having a Tinkoff card, a taxpayer can pay the debt using online banking. This is available either through the website or through the mobile application.

Payment through the Tinkoff Bank website

You just need to log in to the bank’s website and then find the “Pay tax debt” tab. In the window presented, you must enter the transport tax notification number. Then just click the pay button and make the payment.

Repayment of transport tax through a mobile application

The subject logs into the mobile application and finds the section dedicated to payment. After this, you need to find the “Government Services” tab, where you select the interface of the Federal Tax Service. Then everything is the same: the client simply enters the tax notification number and makes the payment.

Options for accessing your personal account

In 2021, there are 3 ways to log into a taxpayer’s personal account.

Login and password

To obtain a login and password, you need to visit the tax office. It doesn't matter which tax office you go to. You will need a passport of a citizen of the Russian Federation and a certificate of assignment of a TIN with you. If you go to the tax office at your place of registration, you don’t have to take the TIN with you.

Please note that in 2021, you do not need to fill out an application . All documents will be completed on the spot.

I recommend not visiting the tax office in January, April, July and October. Especially in the last week of each of these months. It is at this time that legal entities file documents en masse, which is why there are long lines at the tax office. The rest of the time the service is quite fast.

When contacting the tax office, you must say that you want to receive a login and password to access the taxpayer’s personal account. After this, the employee will print out a registration card form, which will indicate the taxpayer’s primary password.

Please note that the password for your personal account must be changed within a month . Otherwise, the primary password will be blocked and you will have to go to the tax office again to get a new one.

Qualified electronic signature

If you have a qualified electronic signature issued by a certification center accredited by the Ministry of Telecom and Mass Communications of Russia, then you can use it to enter your personal account.

If there is no signature, then there is no point in obtaining it for the sake of access to the taxpayer’s personal account. It’s easier to use method No. 1 discussed above and get a login and password from the tax office.

State services portal account

In 2021, the Government Services portal has many useful features for drivers. Among other things, it allows you to get a 30 percent discount when paying government fees. Therefore, many drivers have already acquired an account with State Services.

Using your State Services account, you can also log into your personal account on the tax website.

Repayment through Alfa Bank

You need to download the Alfa-Click mobile application or make a payment via Internet banking on the financial institution’s website.

To pay the transport tax debt, taking into account the accrued penalty, you need to:

- Select the “Translations” section;

- Find the “Payment of taxes” tab;

- Choose in favor of whom the payment will be made - in favor of the budget.

After completing the algorithm, all that remains is to enter the payment details specified in the transport tax notification.

Through the Sberbank Online service

To pay, you only need to have a computer with an Internet connection. Payment can be made at any time of the day by choosing one of the following methods:

- by document index (UIN) - relevant if you have a payment receipt;

- according to arbitrary details.

Login to Internet banking is carried out using a login and password, followed by confirmation with a one-time code from SMS.

By document index or UIN

The document index (in the receipt coincides with the UIN) is a unique digital combination consisting of 20 or 25 characters. It is formed by the tax authority, in accordance with the Federal Tax Service of Russia “On the procedure for indicating the UIN when filling out orders for the transfer of funds to pay fees to the budget system of the Russian Federation,” and applies only to transactions performed by individuals. When transferring tax amounts by legal entities and individual entrepreneurs, this detail is not created.

The identifier simplifies the accounting of funds and helps systematize information about incoming payments. The UIN is required for regulatory authorities. The taxpayer simply uses the identifier to facilitate financial transactions (the system automatically finds the document details when specifying its UIN). You can find it out using the Federal Tax Service service or find it on the receipt (the digital combination is indicated at the beginning).

There are no lists and tables containing all UINs of a particular organization. Each payment has its own unique combination of symbols.

Step-by-step instructions for paying transport tax by document index (UIN) through Sberbank Online:

- Log in to your personal account using your personal data.

- In the “Transfers and Payments” section, select “Taxes, work patents”.

- Click “Search and pay taxes to the Federal Tax Service.” The website states that the operation is only possible with a bank card.

- Choose . Specify the card from which the amount will be debited.

Next, all you have to do is enter your UIN and confirm your actions. The status of the completed operation will be displayed on the website.

In case of delay, you can select the subsection “Search for overdue taxes by TIN”. Enter your taxpayer identification number, which will display the amount due. All that remains is to confirm the operation.

You can connect to auto-payment, which will allow you to automatically make payments on time. To activate this function, you need to follow the appropriate link in your personal menu and carry out the operation. After confirmation, indicate the frequency and date.

By arbitrary details

If the UIN is not known, you can pay transport tax through Sberbank Online without a receipt using arbitrary details. Actions are performed in the same “Transfers and Payments” section. But at the stage of selecting a service, you need to click on the line “Federal Tax Service (Payment according to arbitrary details)”.

Then indicate the card for debiting the amount of money and enter the following details:

- Recipient's BIC (bank identification code, is a combination of numbers);

- account number (numeric code identifying its owner);

- KBK (budget classification code);

- Recipient's TIN (digital code that streamlines the accounting of taxpayers in the Russian Federation).

The table shows the BCC that must be indicated when paying transport tax in 2021 in each individual case (data taken from).

| Type of payment | KBK | |

| For legal entities | For individuals | |

| Payment amounts (recalculations, debt) | 182 1 0600 110 | 182 1 0600 110 |

| Penalties on the corresponding payment | 182 1 0600 110 | 182 1 0600 110 |

| Interest on qualifying payments | 182 1 0600 110 | 182 1 0600 110 |

| Amounts of penalties (fines) | 182 1 0600 110 | 182 1 0600 110 |

Another payment method is from the “Government Services” section, which is located in the quick menu of the Sberbank Online service. Payment is made according to the UIN on the receipt.

Use of electronic money

The easiest option to carry out the transaction using payment systems is Yandex. Money. The payer can not only make a payment, but also check the debt for all taxes. The client is authorized. Then he finds the “Goods and Services” tab, in the subsection of which he opens the “Taxes” tab. That's all. If a subject has an accrued and unpaid fee, he will see it and will have the opportunity to make a payment.

The main thing to remember: to check the debt, the system will ask for an identification code.

How to pay debt online?

It is not necessary to know the Taxpayer Identification Number (TIN) to pay taxes. If you have a receipt, you can make payment for them using:

- payment system Yandex.Money (described above);

- bank card;

- self-service terminals;

- ATMs;

- cell phone stores.

Please note that you will have to pay an additional fee. It does not exceed 1% of the amount, but is at least 30 rubles.

To make payments online, it is recommended to use a virtual card.

An email receipt will be sent directly to the email address provided. If you pay for it using Yandex.Money, it will be saved in the “Payment History” tab. The Federal Tax Service processes the payment within about half a month.

Payment of transport tax without a receipt

The absence of a payment receipt complicates the transaction. It is impossible to carry it out if the taxpayer does not know where the money should be sent. If suddenly a payment is received using the wrong details, the entity will still be considered a debtor. Therefore, it is better not to take risks and not perform the operation at your own discretion.

Let us remind you that the receipt along with the notification is sent to the post office or to the taxpayer’s personal account. If the paper was never delivered, then you need to personally contact the Federal Tax Service or the State Services portal.

Remember: the absence of a receipt does not relieve you from the obligation to pay the transport tax debt. If payment is not received on time, penalties and interest will be assessed. And these are additional costs.

Details for paying transport tax by individuals in 2021

The notification sent by the tax office contains all the necessary details for making the payment. If for some reason there is no receipt and the payment document is filled out independently, it must contain the following mandatory details:

- Information about the payer (TIN, KPP, full name, registration address).

- Details of the tax authority (recipient's name, TIN, KPP, OKTMO, recipient's bank, BIC and current account number).

- KBK payment . This is an important detail that contains 20 numbers. The BCC differs for individuals and legal entities. There are also separate codes for paying penalties and fines. If you enter the code incorrectly, problems with crediting funds may occur.

- UIN is an identification number assigned by the tax office to track taxes going to the budget. You can only obtain a number from the tax office, in person or through the Federal Tax Service’s electronic service. When paying transport fees at Sberbank, indicating the UIN is not required. If payment is made through other banks, the transport tax UIN in the payment order must be reflected in field 22.