- When changing car license plates, you must inform the insurance company about this and make changes to your current MTPL insurance.

- But there are almost no consequences for failure to fulfill this obligation: no fine, no refusal to pay, no recourse, no increased coefficients.

- And “almost”, because when checking insurance by traffic police inspectors on the road, questions may arise about the validity of compulsory motor liability insurance if the license plate number indicated in the policy and on the car differs.

In 2021, it is quite easy to get denied insurance compensation or regress under OSAGO. It is enough not to comply with a number of conditions for insurance. For example, indicate false information to be included in the policy in certain cases. The license plate number of a car is one of those data that is necessarily recorded in the compulsory motor liability insurance (if available at the time of insurance). But if the numbers have changed during the contract period, do you need to make changes to the policy, pay extra for it, or do you even need to change insurance by purchasing a new one? Let's answer all these and other questions in order!

Do I need to make changes to the MTPL when changing car license plates?

Yes. This obligation is prescribed by the Federal Law on Compulsory Motor Liability Insurance (FZ-40) in paragraph 8 of Article 15, which regulates the procedure for insuring cars under compulsory motor liability insurance:

8. During the period of validity of the compulsory insurance contract, the policyholder is immediately obliged to notify the insurer in writing of changes in the information specified in the application for concluding a compulsory insurance contract.

In particular, this includes the following data:

- if the car numbers have changed, it is necessary to make changes to the compulsory motor liability insurance,

- There is also such an obligation if the owner of the car changes,

- and the last document is the PTS or STS (series and number), depending on what exactly was indicated in the insurance (you can specify both).

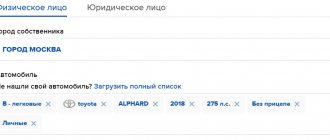

Other information about the car that is included in the policy is the make and model of the car and the VIN number. But in principle they cannot change in the current insurance contract, since if the make and model changes, then it is a different car, and new insurance must be purchased for it, and the VIN number, being an identification number, cannot be changed, otherwise such a car will not be registered with the traffic police, and you will not be able to drive it on the roads, therefore, you will not need a compulsory motor liability insurance policy in principle.

Which is correct?

As we can see from the quotation of paragraph 8 of Article 15 of the Federal Law No. 40, the insurer must be notified in writing about a change in car license plates. This means that you can freely submit a written application about this.

This application must be printed out in 2 copies and submitted both - the second one must be given to you with a note of acceptance with a stamp or seal of the insurance company. If they refuse to do this, then hand over the completed application form for changing license plates to the insurance company for video recording.

But most often in practice, everything looks much simpler - as a result of filing an application, the insurer is obliged to make changes to your policy. This usually happens immediately upon acceptance of the application. They will print a new OSAGO policy with the new changed numbers and give it to you.

If the insurance is electronic

If you purchased an electronic MTPL policy, then, alas, changes to change registration marks will have to be made when visiting the office. For 2021, you cannot inform the insurance company about changes in license plates via the Internet through the company’s official website or by email.

Clause 8 of the Federal Law on Compulsory Motor Liability Insurance clearly prescribes that the application must be submitted in writing, and does not make any distinction between paper and electronic insurance.

How to enter a number into an OSAGO policy

Having a valid MTPL policy is a mandatory requirement for any motor vehicle, so it is extremely important to correctly fulfill all the conditions for its conclusion.

Since the policy is issued directly for the vehicle, it is necessary to correctly fill out the fields of the insurance contract and enter all the data about the car and its owner, including entering the number in the MTPL policy.

Insurance can be issued to the insured without entered license plate numbers, however, in the event of any traffic accident, payment of insurance compensation may be denied to you, since driving with insurance without entering license plate data for more than 3 days is undesirable. Of course, you can defend your case in court, but this is a waste of time and money.

The need to enter the car number in the MTPL is regulated by legislation.

This legislative act regulates all important aspects of concluding and terminating MTPL contracts.

Thus, in accordance with the provisions of the articles of Section 6 on the early termination of the insurance policy, it should be taken into account that the insurer may invalidate the compulsory motor third party liability insurance contract at any time before the termination of its planned validity period if the license plate number of the motor vehicle is not entered into the compulsory motor liability insurance policy.

Early termination of an insurance policy is based on the fact that the policyholder has provided incorrect or incomplete information about his own vehicle, which is essential for determining the degree of insurance risk by the insurer.

Today, an automated information system for compulsory insurance operates throughout the entire Russian Federation, therefore, in accordance with the provisions of Article 30 of the Federal Law “On Compulsory Civil Liability Insurance of Vehicle Owners,” each car owner is required to enter its number in the MTPL policy within three days from the date of assignment to the car state number. Otherwise, the MTPL policy may be declared invalid.

If the car is just being registered with the State Traffic Safety Inspectorate and the license plate is not included in the MTPL policy, then after the license plate is assigned, the car owner is obliged to inform the insurer about the changes (issuance of license plates) within three days.

In the first case, by personal notification to the insurer. You contact the nearest office of the insurance company, where an employee will enter your license plate number into the MTPL policy and certify the changes with a blue seal. Or they will issue a new policy.

In the second case, using a telephone call, you call the insurance company and notify that license plates have been issued. The insurer's employee enters information into the UAIS OSAGO database, and the owner can enter the number into the policy independently, or you will be notified which office and when to arrive to make changes.

We suggest you read: How to spend DNS reserve bonuses? — DNS bonuses, DNS card bonuses

There is a third way - to enter the number in the electronic OSAGO policy. This is quite easy to do. For most insurance companies, all you need to do is go to your personal account on the website and select “Change policy registration details.” Next, enter the car number in the appropriate field and save. All.

A new electronic MTPL policy with the entered license plates will be sent to you at the email address specified during registration.

What are the consequences if you do not report a change in license plate number?

There is none of them. From the word “absolutely”. Almost not!

This is interesting: Is it possible to fire a disabled person?

Fine

The Administrative Code in force for 2021 provides for financial punishment only in 3 cases:

- if you do not have valid insurance – 800 rubles,

- if you are not included in the current policy - 500 rubles,

- if you forgot it at home - 500 rubles or a warning.

But for failure to include information about changing the state number in the MTPL insurance, no fine is provided.

Refusal to pay

. Or repair, which is the default method of reimbursement in 2021. This also cannot happen under current legislation.

Neither Federal Law-40, nor the Insurance Rules, nor the Civil Code, nor other regulations provide for any consequences if you changed the license plates on your car, but did not make changes to your compulsory motor liability insurance, although this must be done by law.

Regression

Recourse is a demand from the culprit for the amount of insurance compensation to the victim in the presence of certain violations, and it is intended to simplify the receipt of such compensation for the victim from the insurance company, and not from the culprit of the accident.

All grounds for a recourse claim are clearly stated in paragraph 1 of Article 14 of the Federal Law on Compulsory Motor Liability Insurance, and among them there is no such reason as the insurance company ignoring when changing license plates.

The closest thing that can result in a recourse claim is the communication of knowingly false information to the insurer, which resulted in an underestimation of the cost of compulsory motor liability insurance. But in our case this cannot be for two simple reasons:

- the change in license plate did not occur at the conclusion of the contract, but after that during the validity of the MTPL policy,

- the same information, in principle, cannot lead to a reduction in the amount of insurance fees.

Increased OSAGO coefficient

There cannot be an increase in the cost of insurance in the next insurance period due to failure to inform the insurance organization of information about changing the license plate number of the car.

An increasing coefficient is provided for false information when applying for a policy, but not for failure to make changes to the existing contract.

Do I need to change my insurance when changing car license plates?

It is not necessary to replace the MTPL policy with a new one if the registration plates of the vehicle are changed. As in previous cases, the insurance company, upon receiving a corresponding application from the driver, will simply write down the essence of the changes in the “Special notes” field. A situation in which the driver forgot or was unable to tell the insurance company about the change of vehicle license plates cannot serve as a reason for refusal to pay insurance compensation in the event of an accident.

In judicial practice, there were several decisions in which the court satisfied the applications of drivers who were denied insurance payment due to the fact that the contract and insurance policy indicated different vehicle registration numbers. Despite the fact that the MTPL Rules and the contract provide for the obligation of the policyholder to promptly notify the insurance company of all changes in personal and other data, failure to provide information about changing car license plates to new ones by law does not entail early termination of the contract and its invalidity.

But there is an important subtlety!

And it consists of checking the insurance by traffic police officers on the road.

The fact is that one of the ways to identify the ownership of the policy for a given car is the license plate number indicated in it. And, since you did not make changes to the policy when changing the car’s license plates, it shows registration marks that are different from the current ones. On this basis, the traffic police inspector may issue a fine for lack of insurance in the amount of 800 rubles.

But this, of course, is illegal for one simple reason: the car number is an identifying feature, but not the only one specified in the MTPL policy; There is also a VIN number, which also determines the insurance status of this particular car.

Therefore, a fine for the absence of a policy when the license plates on the insurance and on the car are different is illegal, provided that there is a VIN number on the car body and, as a result, it is possible to prove the identification of the MTPL policy for this car.

The value of the MTPL policy

It has already been said about the importance of the MTPL policy being valid after it is signed, although it can be issued to the policyholder even without filling out information about the car’s license plate number.

Indeed, such a policy can be presented to a representative of the traffic police, it will be accepted and you will avoid a fine, however, in the event of a traffic accident, issues regarding the settlement of losses will be dealt with not by the representative of the traffic police, but by the insurance company that issued the insurance. In this case, if the number is not entered into the MTPL policy, the policyholder may not even count on insurance compensation.

- When driving a vehicle in accordance with the Rules of the Road (SDA);

- When registering a car;

- When damage occurs in the event of a traffic accident.

Communities › DRIVE2 and traffic police › Blog › how to deal with insurance

Not long ago I changed the license plates to the author due to the fact that the car was registered under temporary registration, the temporary registration had ended (and the law came out on October 15 that you can register in any region according to your registration), I went to the traffic police and the car was re-registered, they also told me to change it PTS since it has ended, Dear experts, Attention: the insurance contains the number of the old PTS, the author’s number is not indicated in the insurance. Is it valid or do I need to re-insure the car? THANK YOU.

Tags: pts

Comments 18

The VIN and the owner are the same - you have legally insured your liability for this car and there can be no refusal if something happens. But we have “everything for the people,” so you can change the policy purely for yourself. Remember, making changes is FREE. You pay only if the list of persons admitted to management changes, if their length of service and age are “more expensive” than the current ones. You pay the difference in proportion to the remaining policy period.

I also understand that the twin and the owner are the same, but just give our traffic police a reason to find fault

I changed my policy with the insurance company. Gave 300 rubles.

The car number has changed, which means you need to change your policy. There are two options: 1) You write out a new insurance policy from your insurance company for a year and write an application for the return of the residual value of the old insurance, provide the details and within a month the money is returned to your bank account. 2) you change the policy in connection with the replacement of license plates and, naturally, the new PTS number is already indicated there. At Rosgosstrakh, I returned the residual value of the policy twice within six months in connection with the sale of a car, and both times without any problems. The only thing was that there was a delay with one pole due to its issuance in another region.

This is interesting: The procedure for amending the charter

When to pay extra

And now a few words about how much the procedure for making changes to a vehicle license costs.

You will have to make an additional payment in the following cases:

- When adding a new driver who has higher coefficients compared to the owner of the car or other persons allowed to drive. This situation may arise when we are talking about a car owner under 22 years of age, with less than 3 years of driving experience, or who caused an accident. According to current legislation, when calculating the insurance premium, it is necessary to focus on the driver with the highest coefficients.

- When changing the registration address of the car owner, if a higher territorial coefficient is provided in this city/region. And if the value of the coefficient decreases, the driver must return the amount of the difference.

- In case of extension of the policy period.

We invite you to read: Is it necessary to insure life when insuring a car under compulsory motor insurance in 2021 and is it legal?

Renewal of insurance for another car

After purchasing a car, the owner must register it within 10 days and issue a compulsory motor liability insurance policy. To buy a new car, you often have to sell your old one. Then the question arises of what to do with the still valid MTPL policy. Is it possible to renew existing insurance for a new car, and what actions are possible, we will consider below.

By law, car liability insurance is mandatory for every driver. The absence of a policy, according to the Code of Administrative Violations, faces a fine of 800 rubles. However, its cost is high, so drivers want to save money and get a new one at the lowest cost. There are several ways to do this.

How to avoid difficulties

- Make sure the policy and the agreement are up to date;

- Examine the agreement for violation of conditions;

- Contact a company representative in advance and consult on the issue that has arisen;

- After consultation and data verification, you can begin correcting the document.

The driver retains the right to contact the vehicle insurance company to make changes to the documents when replacing them, issuing a duplicate, or when changing any information.

Is it possible to simply transfer the insurance to another car?

Unfortunately, you cannot do this yourself without breaking the law. When preparing a contract, information not only about the owner, but all the main technical parameters of the vehicle are entered into the database and document. They also influence the size of the insurance premium. Therefore, it is impossible to simply transfer data from one policy to another.

However, there is a way to return unspent money on the old policy by investing it in the registration of a new one.

To do this, you need to write an application for termination of the contract in connection with the official sale of the car. Bring documents from the traffic police about deregistration, from the tax authorities, an agreement and an act on the transaction, that is, the sale. The insurance company will cancel the policy by returning funds for the unused period. Moreover, if such a clause was separately specified in the agreement, the company can recover its losses by deducting compensation for early termination (usually up to 20%).

How to renew insurance for another car

There is another way to resolve the issue with the least losses. The insurance from the old vehicle is transferred to the new one. This is rarely done, only in agreement with the insurer. Both cars must be serviced by the same insurance company. If the company agrees, all you have to do is write an application, attaching the following documents:

- passport;

- driver license;

- PTS;

- document confirming passing the technical inspection;

- previous insurance contract.

The insurance company will make changes to the current MTPL policy and calculate the difference you will pay. As a result, you will be able to get insurance for less than when concluding a new contract, and you will be able to drive without breaking the law.

What does the information specified in the policy not be up to date entail?

When replacing an expired license, the driver's interest is important. It is for this reason that he is personally responsible for the relevance of the data reflected in the policy.

In the opposite situation, there are always negative consequences:

- The emergence of a conflict situation with the traffic police. Despite having a policy with up-to-date information, the patrol may invalidate the document if there are inconsistencies. According to the identified violation, in accordance with Art. 12.37 of the Code of Administrative Offenses, which provides for a warning or a fine of up to five thousand in national currency. A stationary post has the right to demand a vehicle stop to check documentation;

- Damage from road users. If unforeseen circumstances arise and a discrepancy in the policy is identified, the company will refuse compensation for damage. In particular, the agreement provides for the waiver of obligations of the insurance company if it is revealed that there is incorrect information specified in the policy with up-to-date information on the owner and the vehicle.

- Causing damage is an extreme case in which a driver with an out-of-date policy may find himself. Reimbursement of the main amount of compensation is carried out in accordance with CASCO, but not all cases are classified as insurance and the insurance organization of the damaged motorist has the right to refuse to compensate for the costs of vehicle restoration work.

The company responsible for the incident may also act based on the discrepancy between the data specified in the policy. Victims of the incident have only one way out - going to court. Compensation for damage caused is collected from the culprit.

As an exception to such developments, it is important to have a compulsory motor liability insurance policy with up-to-date information. Thus, when receiving new documentation, the driver needs to amend the policy, EB.

What are the consequences of inaction?

In accordance with clause 8 of Article 15 of the Federal Law “On Compulsory Motor Liability Insurance”, in the event of any changes in personal data, the policyholder must notify the insurance company.

At the pace of modern life, a person does not always have the opportunity to do the necessary things to correct a document. And some, due to ignorance, do not understand exactly how to make changes to the electronic OSAGO policy.

If you do not report the change of telephone number to the Investigative Committee, this will not entail dire consequences. But if you do not make adjustments when changing documents, place of residence, full name, then you can find yourself in a very unpleasant situation.

For example, when checking documents, a traffic police officer will ask a lot of questions about why the information in the insurance form does not correspond to the data in your documents. The law enforcement officer has every right to invalidate the policy and issue a resolution on violation of administrative liability.

This is not the most critical situation; everything becomes more complicated when a traffic accident occurs. No insurance company will agree to compensate for damage under e-OSAGO in which the data does not correspond to reality. Therefore, it is important to change the data in the electronic auto liability policy in a timely manner. Changing the data in the electronic policy in a timely manner will save a lot of time and money in the future.

This is interesting: Step-by-step instructions for concluding a partnership agreement with a taxi

Purpose of the OSAGO policy

Compulsory motor third party liability insurance for owners of motor vehicles was introduced throughout Russia on July 1, 2003.

The purpose of MTPL car insurance is to create financial guarantees for road users who have become victims of a traffic accident. The culprit of the accident, at the expense of insurance, compensates for damage to the property and health of third parties who unwittingly became participants in the accident. An MTPL policy is issued for a specific vehicle and can assign to it a certain number of persons allowed to drive it, or provide for an indefinite number of drivers. Currently, you can apply for an auto liability policy in person by visiting an insurance company, or use online services.

In what cases are changes necessary?

Amendments to the electronic OSAGO must be made in the event of a change in any data entered into the unified RSA database. Namely this:

- replacement of VU;

- the need to use the vehicle outside the period of use specified in the insurance form;

- replacement of PTS;

- replacement of the state registration plate;

- change of owner of the vehicle;

- change of place of residence, full name.

In addition, when transferring control of the vehicle to a temporary driver, you must also change your insurance.

When can't you make changes?

It is not allowed to make the following adjustments to e-OSAGO:

1. You cannot change the vehicle in the electronic insurance form.

2. Policyholder - a new individual will not be entered into the form.

3. The insurance period cannot be corrected.

In all of the above cases, you must first terminate the insurance contract and re-enter it. Such changes are not made to the policy.

How to correct the data?

Starting from paragraph 11 of Ch. 1 of the MTPL Rules, the policyholder has the right to make changes through his personal account on the insurer’s website. This occurs by sending an electronic application to the Investigative Committee, which remains under consideration for 2 business days; after this time, the client receives a response.

This may be an updated policy form in electronic form or a reasoned refusal to make amendments remotely. Then the policyholder needs to contact the office in person and receive a reissued OSAGO policy in paper form.

If it is not technically possible to perform the necessary actions through the personal account on the insurer’s website, then you will also have to go to the nearest branch of the insurance company. An outsider can perform these manipulations on behalf of the owner on the basis of a power of attorney issued by a notary.

Required documents

In order to make a change, you must contact the company or branch with which the agreement has been concluded with a written request indicating the reason for the amendment.

In addition, the applicant’s application will require a package of documents:

- Insurance policy held by the driver;

- Driver's document (license);

- Other documents regulated by agreement.

The company retains the right to put forward its own conditions for making additions, including confirmation of other information.

Required documents:

- PTS;

- Lease agreement, purchase and sale agreement, power of attorney to drive the vehicle.

After the application is approved, the company makes amendments. The process takes several days. During this period, it is recommended to avoid traveling by vehicle.

Required actions and documents

When visiting an insurance company in order to change your e-MTPL, you must take all updated documents with you. An insurance company employee will make the appropriate changes to the PCA database, and they will immediately be reflected in the policy:

1. Changing a driver's license requires submitting an updated document and passport, and writing an application. That's all you need to do to make changes. In the future, make sure that when calculating the cost of insurance, the previous VU number on which the KBM is listed is displayed.

2. In order to register a new driver, you must bring his driver’s license and your passport. You may have to pay an additional insurance premium.

3. If you decide to extend the period of use of the vehicle, you should contact the insurance company before the end of the period prescribed earlier.

4. When changing your registration, it is enough to provide your passport and write an application.

5. After changing the vehicle passport, do not be lazy to change the policy, because it displays this information. You must provide a new vehicle title and owner's passport.

6. When you receive new license plates for your car, you should also update your insurance form. Take with you the vehicle registration certificate and passport, write an application to change the license plate on the insurance form.

7. If you decide to take a different last name, then first take care of changing all the documents, and only then contact the insurance company with a full package of corrected documents.

8. It is possible to indicate the new owner of the vehicle in the insurance. To do this, you need the presence of the policyholder, a passport of a citizen of the Russian Federation, the driver's license of the new and old owner, a document that confirms ownership of the vehicle.

9. If necessary, you can change the type of insurance to unlimited, then the cost of insurance will increase.

In each case, it is necessary to write a statement on behalf of the owner of the car, which will be accepted and certified by an insurance company employee. The client will receive a standard paper policy form, number and validity period, which will remain the same.

What changes should be made to the current policy?

The answer to the question of whether it is possible to make changes to the insurance policy is contained in paragraph 8 of Article No. 15 of the Federal Law on Compulsory Motor Liability Insurance.

Specific deadlines are not specified in the document, but the insurer must be notified immediately after new data becomes available. According to the requirements of paragraph 9 of this article, the insurance company, after receiving new information from the client, is obliged to make the necessary changes to the current policy, and also update information about it in the RSA electronic database within 5 working days.

When understanding the question of whether it is necessary to make changes to the current motor insurance, it should be noted that the insurer must be informed about the change only in those data that are directly related to the operation of the car. Therefore, if you indicated one mobile phone number in your application, and after some time you changed it, you do not need to inform the insurance company about this event, since this will not affect compensation payments in any way.

A motorist may need to visit the office of his insurance company when replacing a driver’s license due to a change in personal data (for example, when changing a surname after legal marriage), expiration of the document’s validity period (which is currently 10 years) or restoration after loss. The current policy must include a new license number and personal information not only of the owner of the vehicle, but also of all persons allowed to drive it.

New driver

The need to add a driver arises when we are talking about a policy with a limited number of people allowed to drive a car. This procedure is carried out only on the basis of a personal written application from the owner of the vehicle. Making an entry allows the new driver to legally drive the car entrusted to him. In this case, the traffic police officers will not have any claims, and the driver’s civil liability will be insured.

New license plate

The license plate number of the car, issued upon its initial registration with the State Traffic Safety Inspectorate, can be changed at the initiative of the owner. Regardless of the cause of this event, it must be reported to your insurance company immediately.

The minimum period for which compulsory motor liability insurance is issued is 3 months. If the owner of the car intends to continue using it, it is necessary to submit an application to the insurer and extend the validity period of the document by paying an additional amount. This must be done before the insurance period expires.

When registering a motor vehicle license, the policy indicates the number of the car’s registration certificate with the traffic police, and if it is not available, the registration number of the vehicle registration certificate. Any of these documents can be replaced due to damage or loss, which must be notified to the insurance company.

When calculating the insurance premium, the place of official residence (registration) of the car owner is taken into account due to the need to apply the territorial coefficient (CT). Therefore, when moving to another city or region, you need to take care of making changes to your auto insurance policy.

We invite you to read: Are daily allowances in excess of the norm subject to personal income tax and insurance premiums in 2021?

A valid MTPL policy must contain only reliable information about the insured, the car and drivers allowed to drive.

All obligations to pay compensation for damage caused pass to the culprit who did not notify his insurer in a timely manner.

If a car is driven by a citizen whose data is not included in the policy with a limited range of drivers, from a legal point of view it turns out that he is driving without having a valid policy. Any traffic police inspector has the right to impose a fine of 500 rubles on the violator based on Article No. 12.3, clause 2 of the Code of Administrative Offenses of the Russian Federation. And if the driver causes an accident, the insurance company has every legal basis not to compensate for the damage caused.

The following data in the insurance policy cannot be changed:

- make, model and year of manufacture of the car;

- VIN code and body/chassis number;

- owner of the vehicle.